Secured and Unsecured Credit Lines: Business Overview

A line of credit is a loan that gives you the flexibility to borrow money. This is a versatile financial tool that can be protected or unsecured. So, what is the difference between unsecured and secured credit options? In short, a secured line of credit is backed by collateral, while an unsecured line of credit is not.

Secured and unsecured credit lines are two comparative methods of borrowing, each with its own advantages, requirements and potential risks. We will list the differences, guide you through the process of choosing between the two, and cover alternatives, all of which enable you to choose for your best choice. Business financing need.

Key Points

- A secured credit line is backed by collateral.

- The unsecured credit line is not supported by the mortgage.

- The interest rate for secured credits is lower, the borrowing limit is larger, while the unsecured credits have quick setup and more flexibility to use.

What is a guaranteed credit limit?

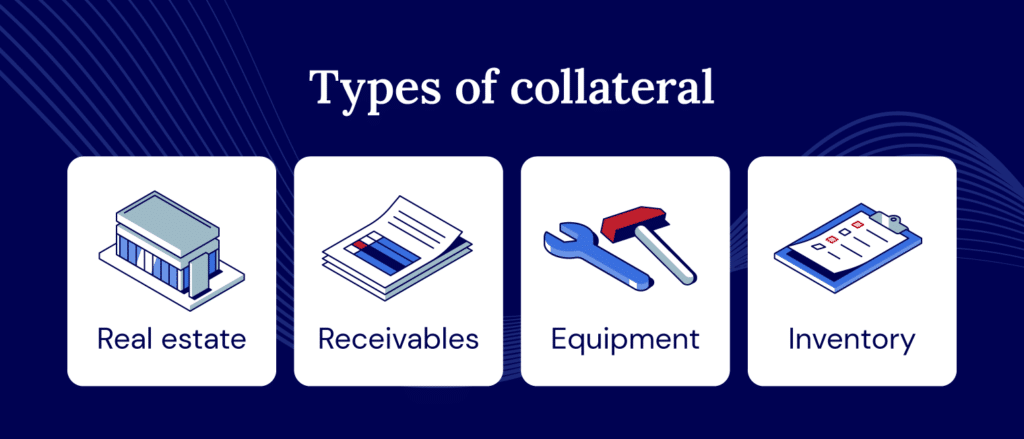

one Guaranteed credit limit It is a flexible lending arrangement. If the loan does not repay the loan, the company can obtain a certain limit of funds. For businesses, a secured line of credit relies on collateral such as real estate, equipment, inventory, accounts receivable or other valuable assets to support the loan. If the borrower defaults, the lender can claim collateral to recover its losses.

Lenders prefer secured credit lines because they are less risky. This leads to lower interest rates and larger borrowing limits for borrowers.

An example of secured credit is when a construction company uses its equipment as collateral to ensure that the construction company defaults, and the lender can then ask for the equipment that has outstanding debts to be sold and recovered.

| Professionals with guaranteed credit limits | Secured credit line defect |

| • Reduce interest rates As lender risk is reduced • Higher credit limit And get more funds • Easier to be approvedeven with a lower credit score than the star |

• Risk of asset loss If you can’t pay your debt •Some have Limitations on how to use funds • Settings can be complicated There are other paperwork |

What is an unsecured line of credit?

On the other hand, unsecured credit lines do not require any collateral. Lenders provide loans based solely on the borrower’s credibility, financial performance and cash flow.

While this removes the risk of losing assets, unsecured lines of credit often have a stricter eligibility process and higher interest rates to compensate for the increased risk of lenders.

Banks rarely offer unsecured financing, but private credit lenders do so. Private credit allows borrowers to acquire capital without accompanying coverage, while providing a faster, relationship-centric process.

An example of an unsecured credit line is a restaurant that has been approved with strong credit history and cash flow. The restaurant uses funds to hire other employees to participate in large special events. No collateral is involved.

| Unsecured Credit Patentee Line | Unsecured credit line defect |

| • No mortgage requiredso if you can’t repay, you won’t risk losing your assets • How do you use funds? • Quick Setupbecause there is no need to establish an accompanying ownership |

• Higher interest rates As lenders are at higher risk • Lower credit limit/Get less capital • Strong credit is Required Because it’s difficult to approve without a mortgage |

What is the difference between secured and unsecured credit?

As you can see, guaranteed and unsecured business quotas vary in terms of mortgage requirements, interest rates, credit limits, approval difficulties, etc. Let’s arrange these differences side by side:

| The basis of comparison | Guaranteed credit limit | Unsecured Credit Line |

| Mortgage requirements | Collateral is required to be used as a guarantee for the credit line. | No mortgage is required. |

| interest rate | The rates are usually lower. | The rates are usually higher. |

| Credit limit | Higher lending restrictions are easier to negotiate. | Lower lending restrictions |

| Difficulty in approval | It is easier to get approval if you have assets of significant value that can be used as collateral. | Getting approval can be more difficult, especially for those with less credibility. |

| Use funds | You may be limited to specific purposes only (e.g., a line of credit guaranteed by the device, or you may need to use inventory for operating expenses or asset purchases). | There are usually no restrictions on the use of funds. |

| Borrower’s Risk | If the borrower defaults, they may lose the assets used as collateral. | Breach of contract can lead to litigation, salary entry and credit score losses. |

Now that you know the key differences, let’s discuss how to choose the right option for your business.

How to choose between secured and unsecured credit lines

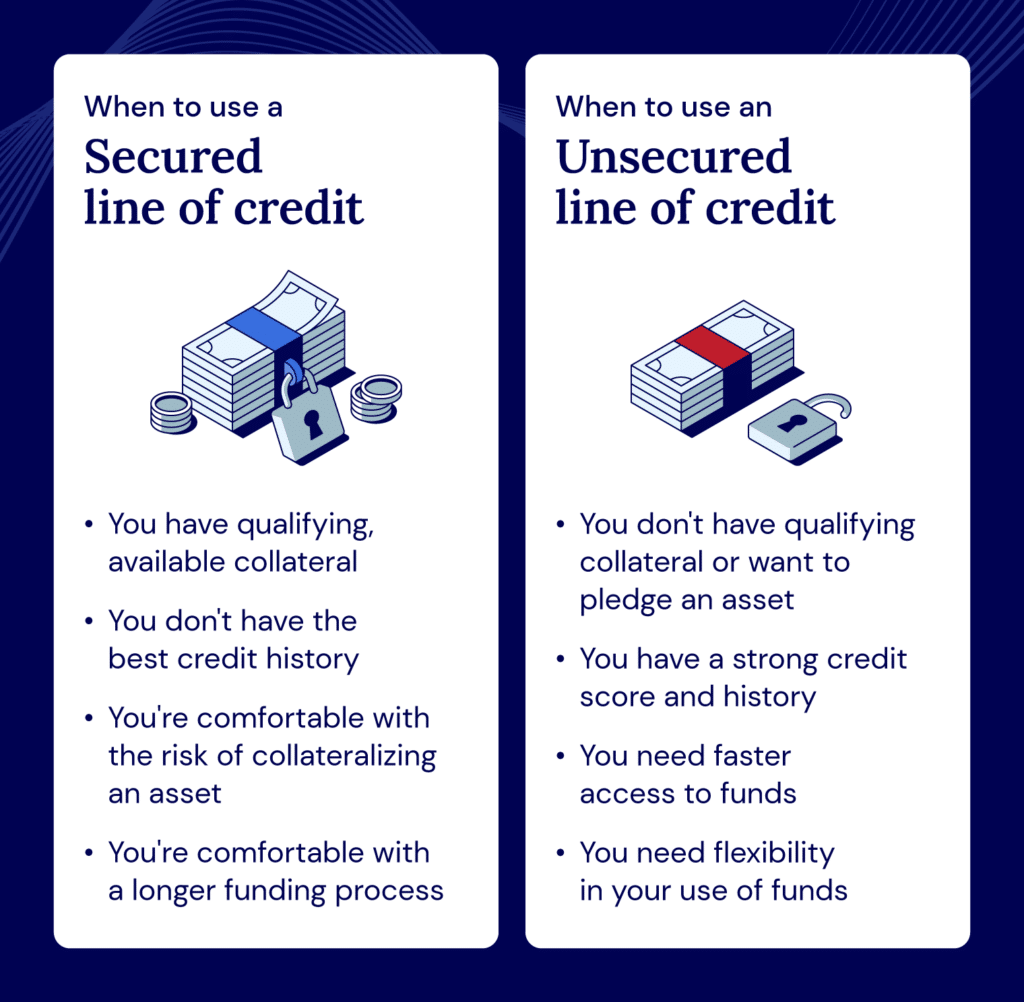

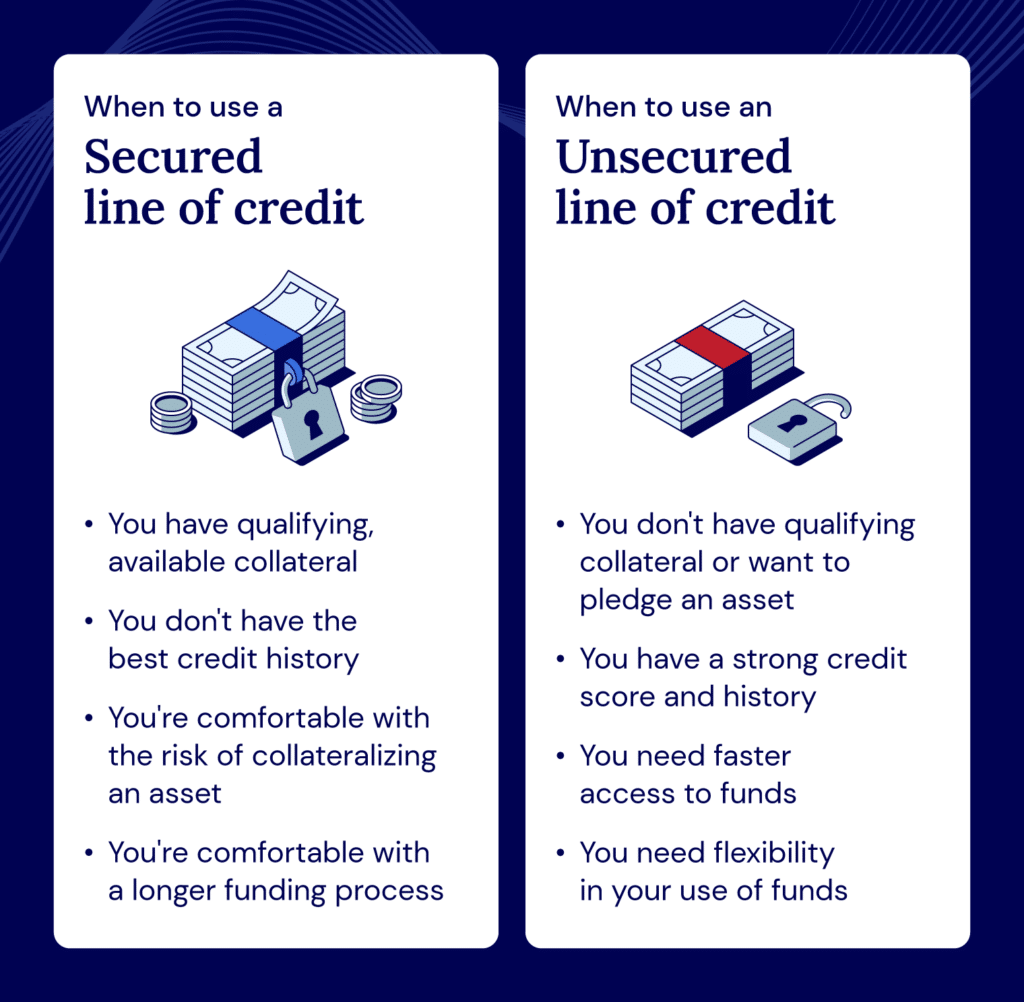

So, which credit type is right for your business? To decide, you need to consider the ability to provide collateral, credit scores, the amount of capital required to borrow, the interest rate provided, and the timeline requirements.

Consider the inclusion availability and risk tolerance

A secured line of credit may be a better choice for businesses with asset guarantees and willing to take risks. If you don’t have these assets or want to lose one, unsecured credit may be the best.

Pay attention to credit information and qualification requirements

Lenders may have more flexibility in credit scores because they are backed by collateral, so their credit limit may have more flexibility. As unsecured credit lines are higher than secured credit lines, lenders are more selective about their loans. Therefore, you usually need to have a strong credit history to qualify for an unsecured credit line.

Here is an overview of how the eligibility requirements differ:

| Guaranteed credit limit | Unsecured Credit Line |

| Evaluation of assets: The lender will evaluate the value of the assets you can use as collateral. | Credit Score Check: The lender will thoroughly check your credit score, which usually has to be good or excellent. |

| Credit history comments: Lenders will review your credit history, although their credit scores may be more flexible as they are backed by collateral. | Income Verification: To prove that you can repay the loan, you must provide proof of income (e.g., payroll, tax return, or bank statement). |

| Financial Review: The lender will review your financial statements (including reviews of income, existing debt and overall financial health) to assess your ability to repay your loan. | Financial Health Review: The lender will review your existing debt, financial position and sometimes business plans. |

| Approval and Terms: If approved, the lender will establish terms of the credit line, including the credit line, interest rate and repayment schedule. | Approval and Terms: If approved, the lender will provide you with terms of the credit line, including the credit line, interest rate and repayment schedule. |

Remember that the eligibility process for secured and unsecured credit lines depends heavily on the lender’s requirements.

Assess your funding amount and timeline requirements

Unsecured lines of credit may be better for businesses that need to get funds quickly but have a small credit line and are willing to pay higher interest fees.

On the other hand, the best credit line is probably the best if you need more. It also usually has longer repayment terms.

All in all, a secured line of credit may be more appropriate if you can offer collateral and require a loan with higher interest rates. If you have a high credit score, need funds quickly, and don’t want to take risks, an unsafe credit line may be more appropriate.

Alternatives to commercial lines of credit

As a business owner, it is important to consider all financing options. Here are some alternatives to business credit lines to consider:

- Cash flow financing: Cash flow financing is a short-term financing that involves loans backed by your business’s expected cash flow.

- Term Loan: With a term loan, you can pre-borrow an agreed repayment schedule and specific loan terms.

- Invoice factoring: Invoice factoring is a type of accounts receivable financing where you sell excellent invoices to third parties. This allows your business to raise funds ahead of time.

- Equipment Financing: Equipment financing allows businesses to purchase equipment without paying the full cost. You can use it to buy equipment like machinery, vehicles, and office furniture.

- SBA Funding: The Small Business Administration guarantees SBA loans. You can use this type of loan for a variety of goals, such as purchasing equipment and scaling.

Deeply studying all options will help you make the most educated choices in your specific financial situation and business needs.

Find the flexible funds you need for national commercial capital

The trade-off of secured versus unsecured lines of credit depends heavily on your personal business. Although secured credit lines usually have lower interest rates and higher borrowing limits, they do take the risk of losing the collateral you promised in the event of default. On the other hand, unsecured lines of credit may be obtained faster, without collateral, but usually have higher interest rates and stricter credit requirements.

If choosing the right financing option is still overwhelming, then we can help with our national commercial capital. Our expert business consultants are here to answer your questions and guide you to find everything you need to find the best financing options for your business.

Whether you need inventory financing or other financing options, we are here to drive your business. We offer a variety of credit options to help your company take the next important step. Fill in your online application to begin.

Frequently Asked Questions

The lottery period is when a company can obtain funds from its credit line. After the end, the company must begin repaying the outstanding balance and cannot raise additional funds.

The repayment terms tell you exactly when and how to repay the borrowed funds. They may decide on repayment periods, minimum payments, and so on.

If you default, there are risks associated with the guaranteed and unsecured credit lines.

With a secured line of credit, the main risk is that if you are unable to repay the amount you borrowed, you may lose the assets of the collateral you promised. This could be property, equipment or other valuable assets.

With unsecured credit lines, the risk is that if you fail to repay, it may damage the credit score. This may make it more challenging to gain credibility in the future. Additionally, if you do not repay, the lender may take legal action.

Real estate, equipment, commercial inventory or other high-value assets are often used as collateral for secured credit lines. The type of asset accepted as collateral may vary depending on the lender’s policy.

If you default on a secured line of credit, the lender has the right to grab the assets you use as collateral to recover the debt. If it is an unsecured line of credit, the lender can report a default to the credit bureau, which will negatively affect your credit score. They may also sue you for recovering their funds.