How to know which type is correct

This is a scenario: the holiday is approaching and the customer’s haste to send your warehouse into speeding. Similarly, local construction companies need materials to complete the upcoming work without planning. In either case, these businesses do not have enough cash flow to meet growing demand and capitalize on their revenue potential. A possible solution? Short-term financing.

This type of financing is useful for businesses that require a quick cash injection without the disadvantage of long-term benefits. Short-term funds is an excellent option to pay new or unforeseen fees, while working capital covers other operating costs.

In this article, we will look at different types of short-term financing, their pros and cons, how they differ from long-term loans, and how businesses are eligible for such funds.

Table of contents

What is short-term financing?

Short-term financing is a commercial loan or Credit limit Structured to make payments much earlier than traditional long-term loans – usually between six and 18 months. Usually, you will find short-term loan options for banks, credit unions, or private credit lenders.

Once the loan is approved, the business will receive a one-time deposit into its bank account. Payment frequency and amount will be pre-arranged as part of the loan terms. These short-term loans may attract cash to be wanted to quickly pour into equipment, more inventory or Emergency new employee.

Short-term financing types

Businesses can choose from a variety of types of short-term loans. The financing options you need will vary depending on your specific circumstances, such as the purpose of the loan and how satisfied you are with the repayment terms. Here are the three most common examples of short-term financing:

Credit limit

one Credit limit Working is much like a credit card. The lender opens the line of credit and you can access it anytime. Like any type of revolving debt, you can withdraw your credit line and only pay interest on your usage fees. This financing option may make sense for disciplined business owners who want to control their business debt.

Cash flow financing

With cash flow financing, companies can use future sales to quickly and easily acquire capital. This alternative form of financing is usually unsecured – meaning you do not need to place unpaid invoices, equipment or property on Collateral. You also have a strict monthly payment schedule, as you can make payments based on daily sales and adjust to suit your business’ performance.

Term loan

This is what term loans are – the loan is expected to be repaid within a certain period of time. Small Business Loans Usually runs between six and 18 months, while long-term loans (e.g. Small Business Promotion (SBA) Loans – Usually lasts three to ten years. The purpose of the loan will help you determine the best repayment terms. For example, large equipment loans are often long-term solutions.

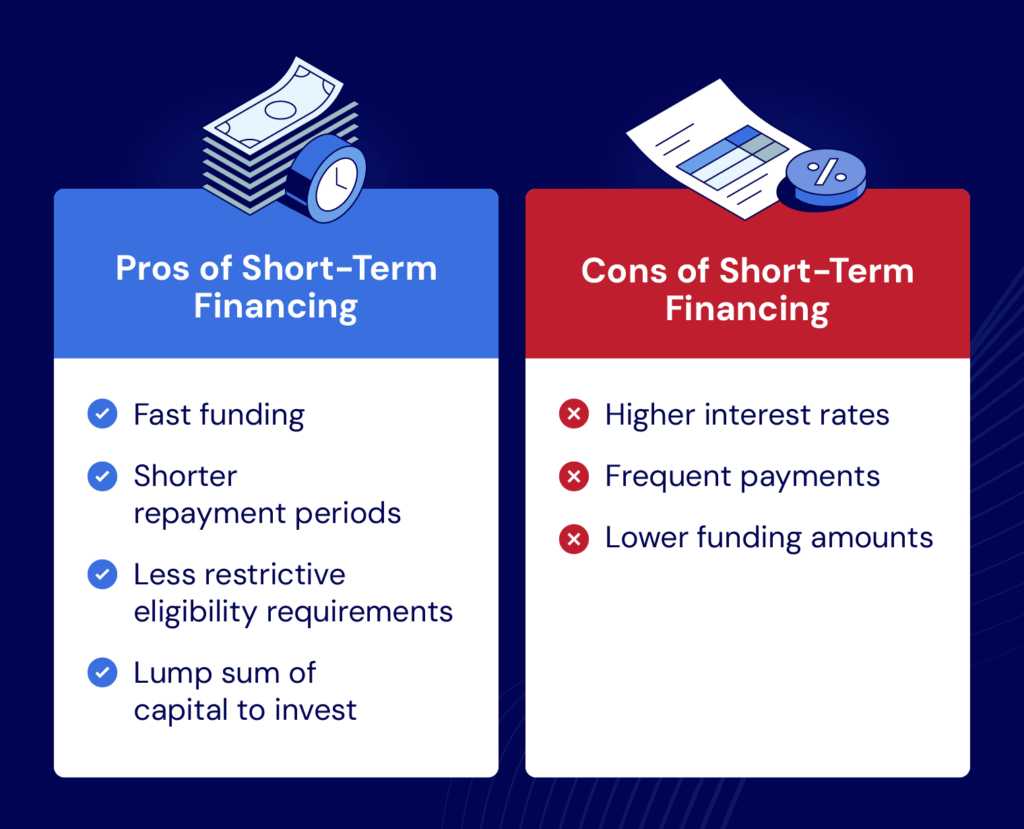

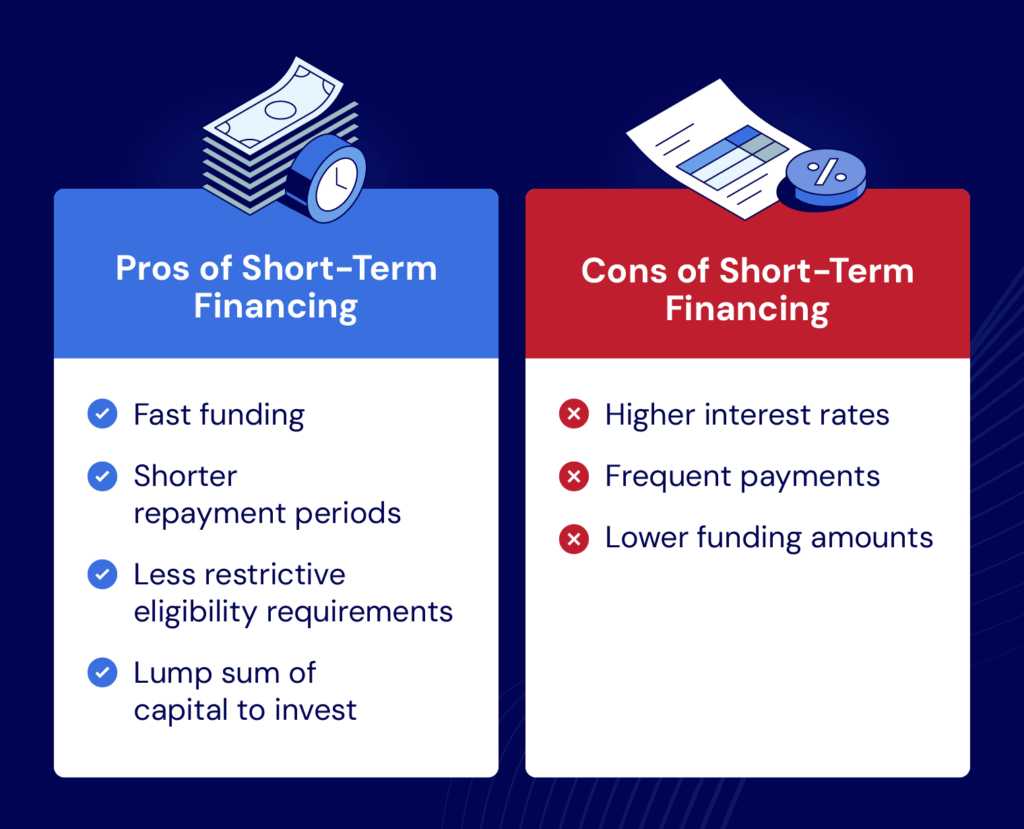

Advantages and disadvantages of short-term financing

Any type of loan will have a share of its pros and cons – short-term financing is no different. Let’s look at some of the advantages and disadvantages of this type of financing.

Advantages

There are many benefits for short-term financing because it has many benefits. Some of these advantages include:

- Quick Funding: Some lenders can deposit funds into your account within 24 hours.

- Shorter repayment period: The term is usually between six and 18 months.

- Less restrictive eligibility requirements: These loans come with shorter terms and lower balances, making them easier to qualify.

shortcoming

Despite several benefits, short-term financing is not without its shortcomings. Some examples include:

- Higher interest rates: Short-term financing may carry higher interest rates, regulations vary by country, and lenders’ rules vary.

- Regular payment: The payment schedule between you and the lender is scheduled, but short-term loans usually require payments more frequently than traditional financing options.

- Lower amount of funds: This type of financing is ideal for a quick influx of cash, but it doesn’t make sense for businesses with larger budgets and more complex financing needs.

Differences between short-term and long-term loans

As you would expect, short-term and Long-term loans There are many differences. This is what you can expect from everyone.

| Short term loans | Long-term loans | |

| Term length | 6-18 months | 2 to 10 years |

| interest rate | Variable/high | Variable/low |

| Amount | Lower (depending on business qualification) | Higher (depending on business qualification) |

| qualified | Less restrictions | More restrictive |

How to Qualify for Short-term Loans

The amount of repayment for short-term loans is quite consistent, but the factors that qualify for this financing choice may vary widely based on the lender. That is, many loan providers will look for similar markers to determine funding and maturity before approving financing. Some qualification requirements include:

- Business and personal credit scores: Like any loan, the lender will see Credit Score Determine the reliability of the business when repaying the money.

- Business time: If your business has been in operation for a while, you will have a better chance of loan approval because it illustrates the viability of your company. Most lenders will require you to be in business for at least six months to qualify.

- Annual income: This gives lenders the best idea of your business performance, and in most lenders you will need annual income to support repayments. Some lenders may also require collateral – e.g. Inventory financing.

Start growing your business now

At National Commercial Capital, we have many loan options that can help your business in the short or long term. Our expert business financial advisors want to chat with you, answer questions, and guide you through every step of the loan process. Apply now Find the best short-term financing options for your business.