What is a bridge loan? Gap in financial status of funding

Companies sometimes need immediate cash to achieve important goals forward They can seek more permanent funds to fund their projects or businesses. Bridge loans can help with this – but what is a bridge loan?

These loans are dedicated loans designed to bridge the gaps before long-term financing solutions.

Company can use it Bridge loan financing To get capital between gaps between lender relationships, start a company for the first time or keep the company fluent while waiting for investors’ cash to pour in.

Any individual or company that needs it Short term loans The definition of bridge loans should be understood, as this type of loan may be exactly what they want.

This guide will explain what bridge loans are, this type of financing, which types of businesses can benefit from bridge loans, the pros and cons of using these temporary loans, and how to decide if a bridge loan is right for your company.

Table of contents

Bridge loan definition

Bridge loans are short-term financing options that meet instant needs.

Businesses may need short-term funds to bridge the gap or exploit opportunities. That’s where the bridge loan comes in.

There are many different types of commercial bridge loans that can meet the different needs a company may have. One is an equipment bridge loan, used to purchase important equipment that a company needs to make money. Other types include Building bridge loan And more.

The terms of most loans last six to 18 months and may be charged fees, including fees paid by the borrower and export fees.

Unfortunately, these types of loans may be much more expensive than stable long-term financing. But high interest rates and high fees may be worth paying if there is no time to get more permanent funds or temporary obstacles to obtaining long-term loans.

How does bridge loan work?

There are many situations when it is impossible to get permanent financing immediately. For example, a business might want to buy equipment and use it as Collateral For credit lines, the equipment may be expensive or require repair. Naturally, this can also lead to unexpected expenses.

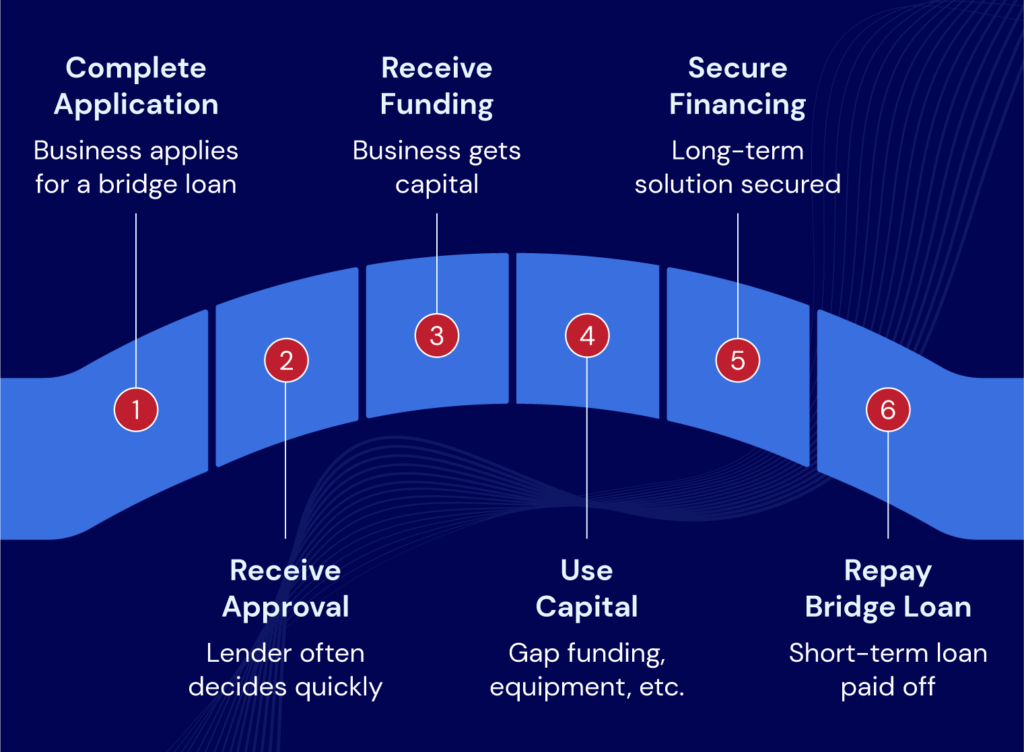

Bridge loans can solve this problem by providing temporary funding until permanent financing is passed. generally:

- If the company meets the lender’s bridge loan requirements, the business will apply for a loan and be approved promptly.

- The company can choose from different types of loans, including interest-only bridge loans, to reduce costs, as bridge loans usually have higher interest rates and fees.

- The company takes the necessary steps to ensure permanent financing.

- Once long-term financing is obtained, the company pays for bridge loans.

There are some great bridge loan risks, including the risk that the borrower will eventually fail to obtain the expected permanent financing to be paid off.

However, despite the risks, if a company has short-term funding needs (such as a merger or expansion plan) and cannot obtain any other means, you may need to rely on such loans.

Which businesses benefit from bridge loans?

Many different businesses can benefit from bridge loans, including:

- Companies involved in the M&A process Funds are required to make a merger or acquisition.

- Companies with cyclical cash flow Therefore, they have the ability to fund operations until they can collect payments from customers.

Many businesses rely on this type of short-term funding, but any business that needs a quick influx of capital and plans to pay it off within a few months may want to research these loans.

Bridge Loans and Traditional Loans

In addition to asking what bridge loans are, it is also important to understand how these loans differ from traditional loan types.

Here are some of the biggest differences:

- Loan requirements: Qualifying for a bridge loan is usually easier than getting more traditional loans, as bridge loan lenders may have easier loan approval requirements, especially when confirming future long-term financing.

- speed: Lenders can quickly fund these short-term loans, as the goal is to get cash immediately.

- Loan return period: The repayment period of bridge loans is usually short and the borrower needs to pay the loan in full within a few months.

- Loan Cost: Bridge loans are often much higher, including higher initiation fees and interest rates. That’s because if permanent financing fails, these loans usually bring significant risks of default.

Bridge loans are just one of many options. If you need short-term financing for a specific purpose, such as paying for inventory until it is sold, Accounts receivable financing Probably your best choice.

Pros and cons of bridge loans

This kind of loan has its pros and cons. These are some of the biggest benefits and disadvantages.

| Bridge Loan Professionals | Disadvantages of Bridge Loans |

|

|

How to Eligible for a Bridge Loan

The process of eligible short-term funding may vary depending on the lender and loan type. For example, lenders typically offer bridge loans to borrowers that meet the following requirements:

- Good credit: Borrowers usually need a good one Business credit scoreusually defined as 680 or higher. This is a necessary condition to show that they are responsible for the debt payment.

- Financial statements: Any company that wants to obtain short-term funds must provide certain financial statements, including profit and loss statements, cash flow forecasts, and balance sheets.

- Project feasibility. When loan funds are used for a specific project, such as buying new heavy machinery, the lender will want to know if your business plan is feasible.

- Past experience: Borrowers should demonstrate past experience in bridge loans. This requirement helps prevent inexperienced business owners from borrowing and surrounding their minds.

Borrowers should check with lenders to determine which specific documents or requirements they must meet to maximize approval opportunities.

Explore financing options using national commercial capital

Bridge loans are an important source of funds, providing companies with opportunities that they didn’t have as financing issues can hinder them.

Companies that require short-term funds should contact state commercial capital to explore options for obtaining flexible bridge loans.

Whether you are in the construction industry, waiting for an acquisition and needing operating capital, or having other urgent needs for funds you expect to repay quickly, state commercial capital can help provide affordable, efficient lending solutions, and a team of expert business consultants to meet your needs. Apply now To obtain a bridge loan to start your project.