Do older people understand health care risks? – Retirement Research Center

Misunderstandings about the need and cost of long-term care have attracted attention.

Families close to retirement face various risks to their financial security. They may have a longer lifespan than planned and exhaust resources. They may experience unexpectedly high inflation; or they may receive unusually poor returns on their investments. It also appears that families will face the risk of paying large amounts of medical and long-term care costs. My colleagues and I just completed a study based on a new survey to determine how much older people understand the risks they are facing.

Our focus is mainly on the costs associated with long-term care. Of course, medical risks are highly uncertain and can be expensive, but most of the risks are insured by Medicare (and Medicaid for those eligible for both programs).

By contrast, long-term care risks are not well insured. Of all adults in the U.S., only 3% or 15% of the age group over 65 have long-term care insurance, and Medicaid, a public insurance program for low-income individuals, is not a realistic option for most middle-income families.

However, among 65-year-olds, 80% require long-term care for the rest of their lives (see Table 1). Although the intensity and duration of these long-term care needs vary widely, about 40% of people need high-intensity care for more than one year.

Given the widespread demand and lack of insurance, family members often provide most of the care time for those with low and moderate demand and supplement their efforts with paid caregivers as demand increases. However, the cost for a paid limited company is high – in 2023, the median annual cost of a private room in a nursing home is $116,800, $75,500 for a home health assistant, and $64,200 for assisted living facilities.

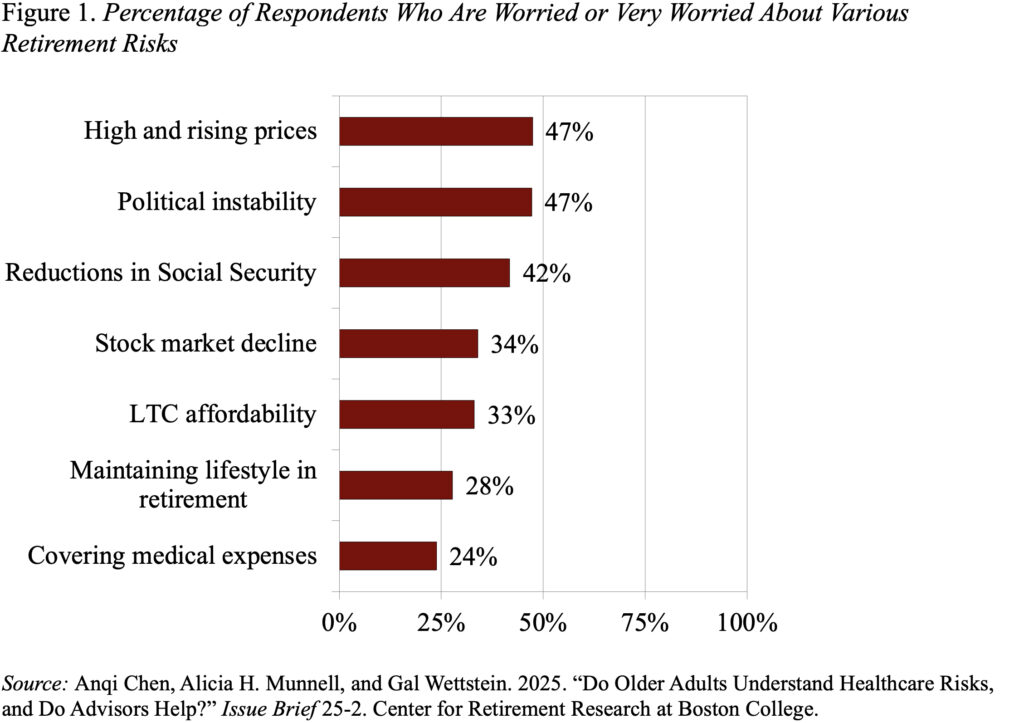

To view families’ perceptions of health care risks, Greenwald Research interviewed 508 people aged 48-78 online with at least $100,000 in investable assets in July 2024. The results show that medical and long-term care needs are low, with the list of concerns among most respondents (see Figure 1) – consistent with other studies.

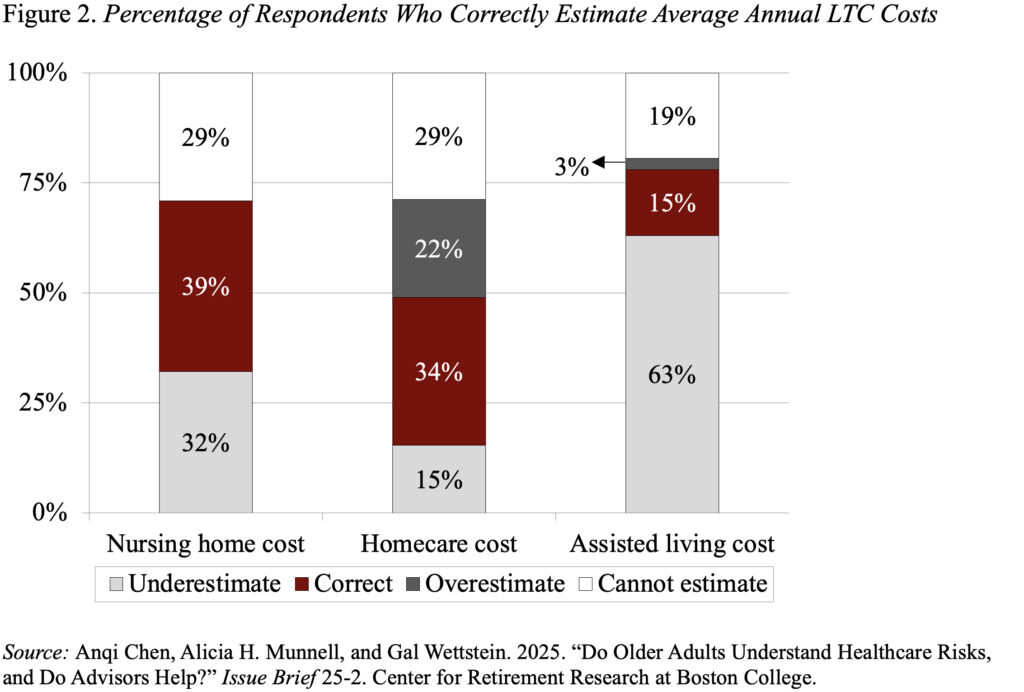

Furthermore, only 39% of elderly families were able to correctly estimate the cost of nursing homes, 34% of home care services, and only 15% of assisted living facilities (see Figure 2).

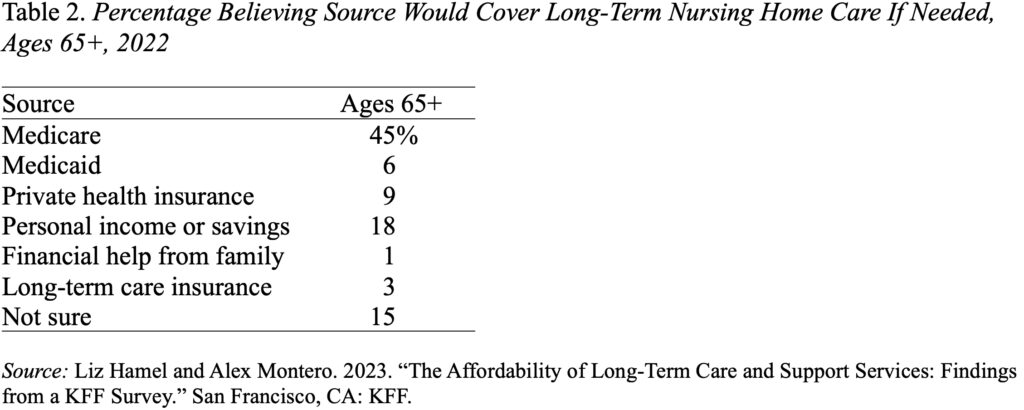

One of the reasons families have such a big misunderstanding of risks and long-term care costs is that after the investigation, many people mistakenly believe that Medicare covers LTC. The latest example from KKF shows that 45% of respondents over 65 think Medicare will pay for LTC, while another 9% think their fees will be paid by private health insurance (see Table 2).

Underestimate health care risks, especially the risks of long-term care needs – there are real costs. Families won’t buy long-term care insurance for this event, nor will they save upfront. Instead, they left alone with insufficient resources to deal with a very demanding, complex and expensive challenge.

Source link