Small Business Loan Installment Or Spin?

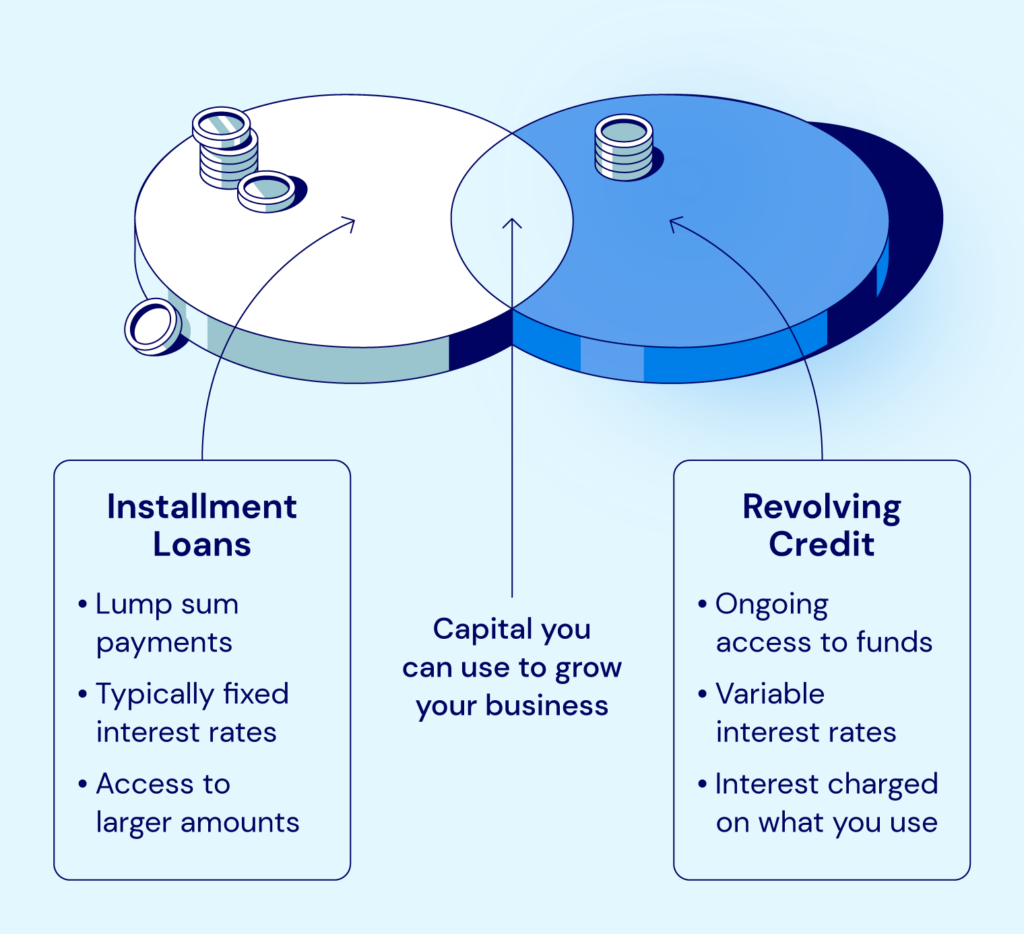

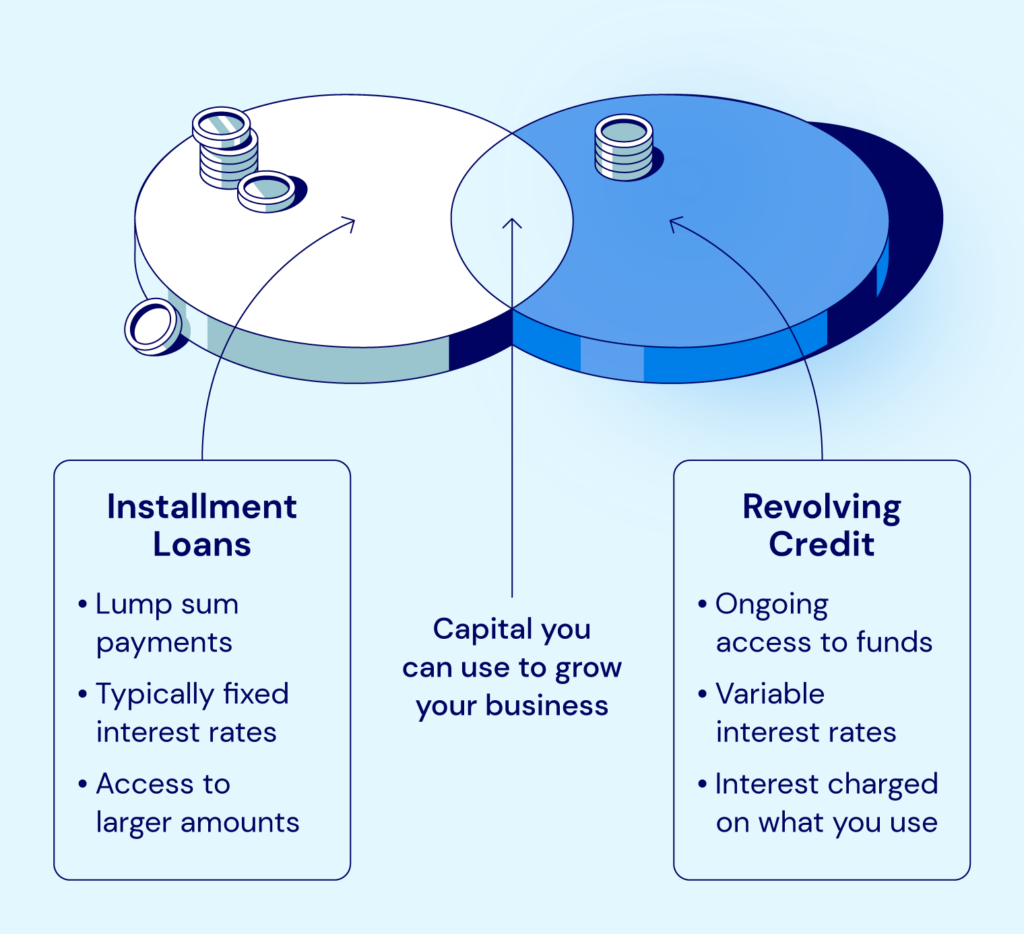

Small business loans are designed to help you get the funds you need to start or run a business. Provide funding options, e.g. Working Capital Loansyou will get capital at an affordable interest rate. When you explore your options, you may encounter two types of loans: installments and revolving credit. So, is a small business loan an installment or a revolving debt? The answer depends on the terms of your loan.

Let’s look at the differences between installment loans and revolving credit, and when each debt should be used to fund your business.

Table of contents

What is an installment loan?

Most people think of small business loans as installment loans. When you approve and accept this Loan Typeloan sends you a one-time payment. You then pay the loan for installments, as well as any interest paid in the loan until you pay the loan in full.

Pros and cons of installment loans for small businesses

Installment loans offer several different advantages, but are not the ideal solution for every business or every situation. Here are some of the pros and cons of using these loans.

| Installment Loan Professionals | Installment Loan |

|

|

What is circular credit?

Rotate Credit limit It is a loan that can be obtained from more than once. Rather than getting a one-time payment, your lender approves you to borrow the maximum amount called a line of credit. You can borrow capital into this limit, and as long as you pay it off, you can borrow it indefinitely.

This allows you to purchase equipment without applying for another loan, increase inventory and pay other fees.

remember Requirements for rotating credit line It may vary from lender to lender. It is best to compare quotes from multiple lenders to find the one that suits your needs.

Pros and cons of revolving credit

Here are some advantages and disadvantages Business Rotating Credit Line You should be aware of it.

| Rotary Credit Expert | Disadvantages of revolving credit |

|

|

Installment Loans vs. Revolving Credit: Major Differences

Since both installment loans and rotating business lines of credit can help you get capital in different ways, choosing the right tool for your needs can make everything different. To do this, you need to understand the key differences between installment loans and revolving credit.

| Installment Loan | Rotating Credit | |

| Types of interest | Fixed or variable depending on the loan | Variable interest rates are based on current market rates |

| How lenders allocate funds | One-time payment | Funds available as needed |

| Loan limit | Pre-available fixed amount | The maximum limit can be used repeatedly by business owners |

| Update | Can be based on the lender or may not be recoverable | Usually, as long as the borrower currently pays, the visa can usually be renewed. |

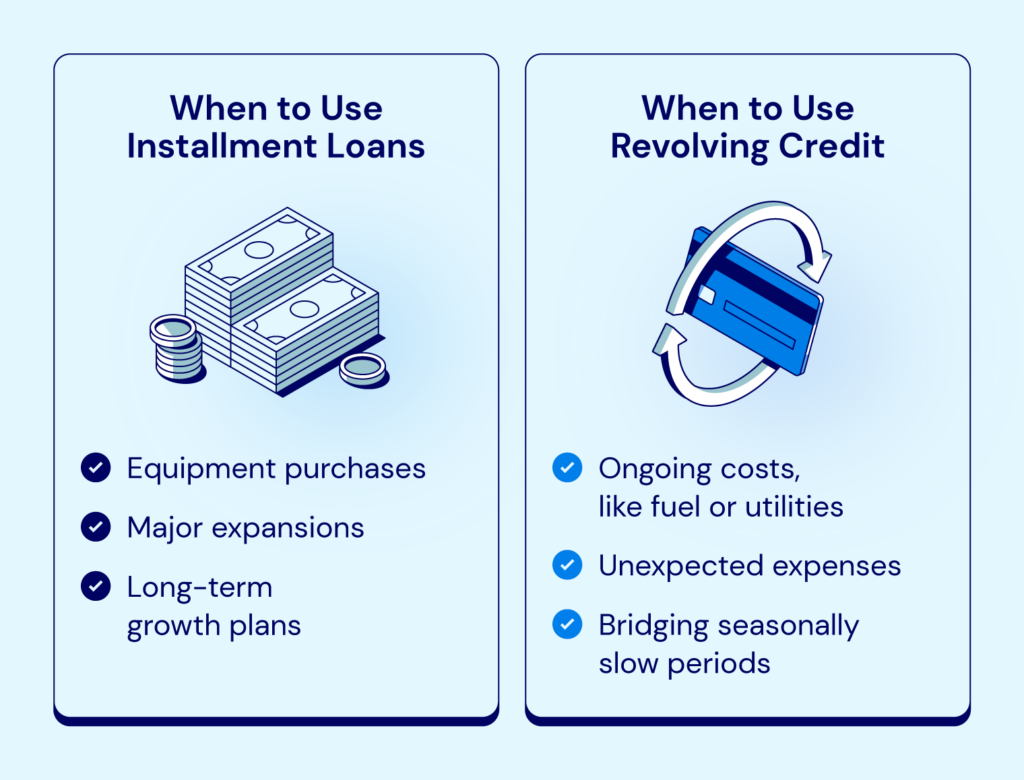

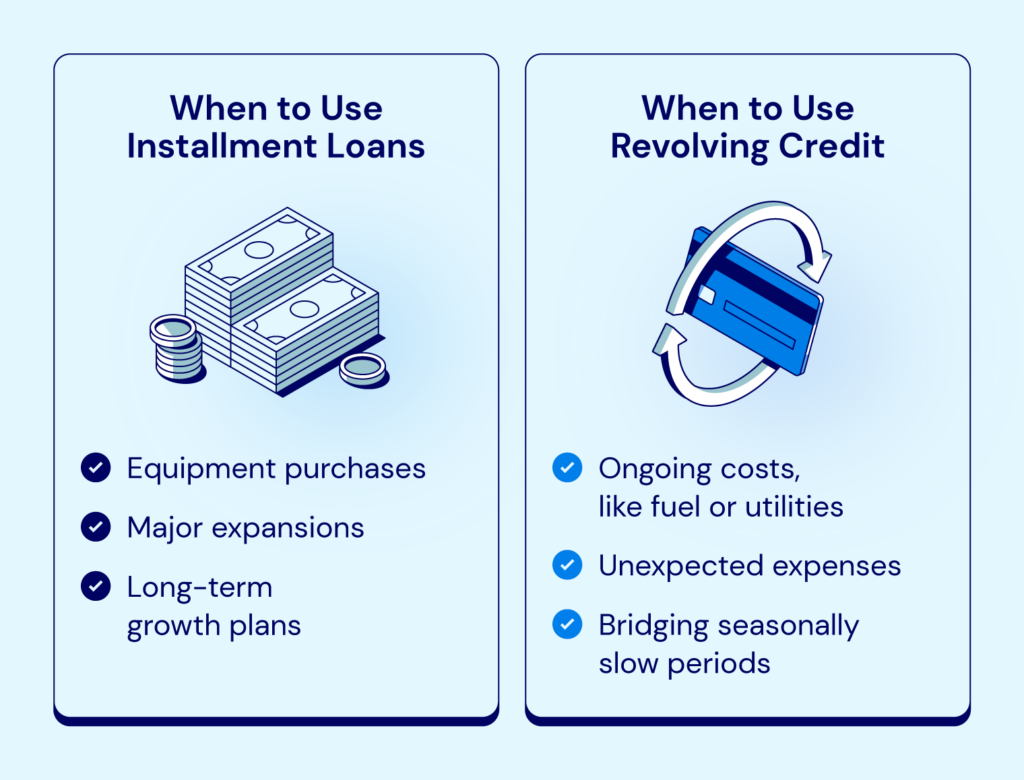

When to use installments or revolving credit

While both installment loans and rotating credit lines can help you grow your business, they may have different use cases. Installment loans are ideal when you need to pay upfront. This may include:

- Procurement equipment

- Larger inventory purchases may not immediately generate ROI

- Reshape existing offices

These loans provide you with predictable monthly payments and allow you to break the expense of borrowing capital for longer periods of time, which may reduce the stress on your budget.

Rotating credit can be a good option for business owners who need flexibility. You might want Use credit limit arrive:

- Pay fees during slow seasons.

- Access capital on a rolling basis, rather than getting funds upfront.

- Create a Emergency Fund Hedging against unpredictable profits.

Remember that many business owners choose to use a combination of installment loans and revolving credit. Before you decide, consider the amount you need to pay, how often you need to get capital at once, and what you can afford.

Compare and get loan options to help your small business

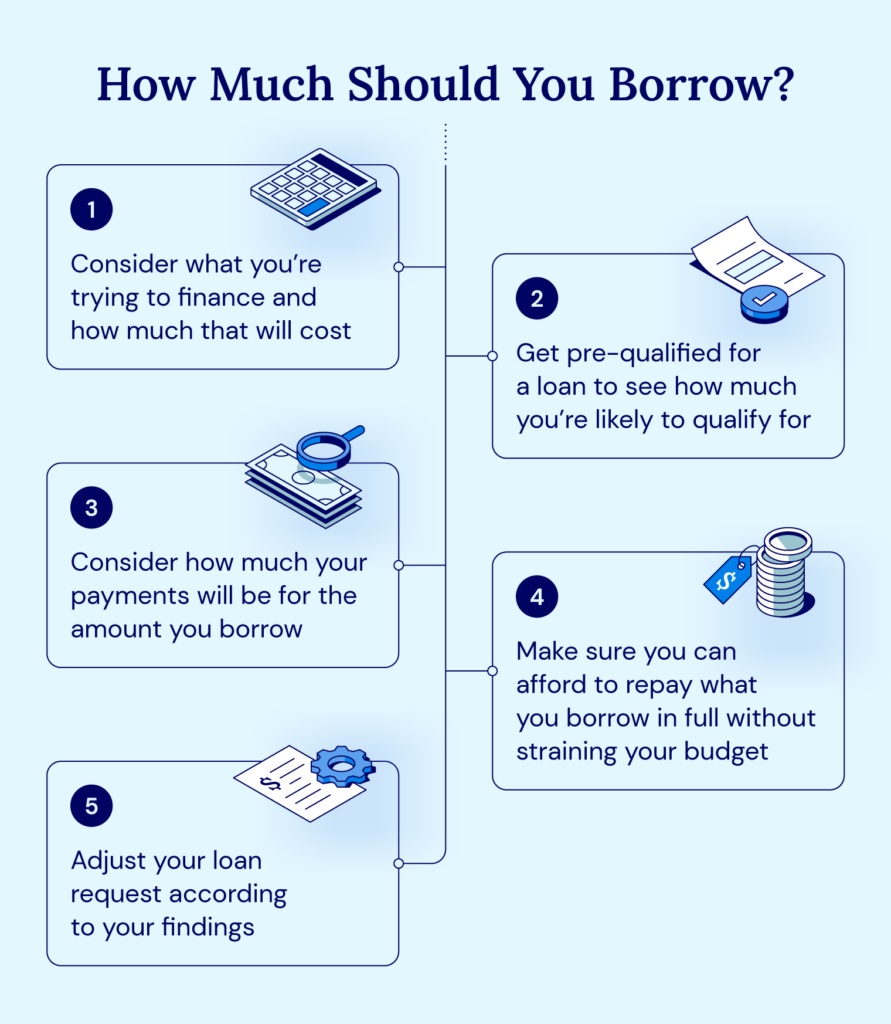

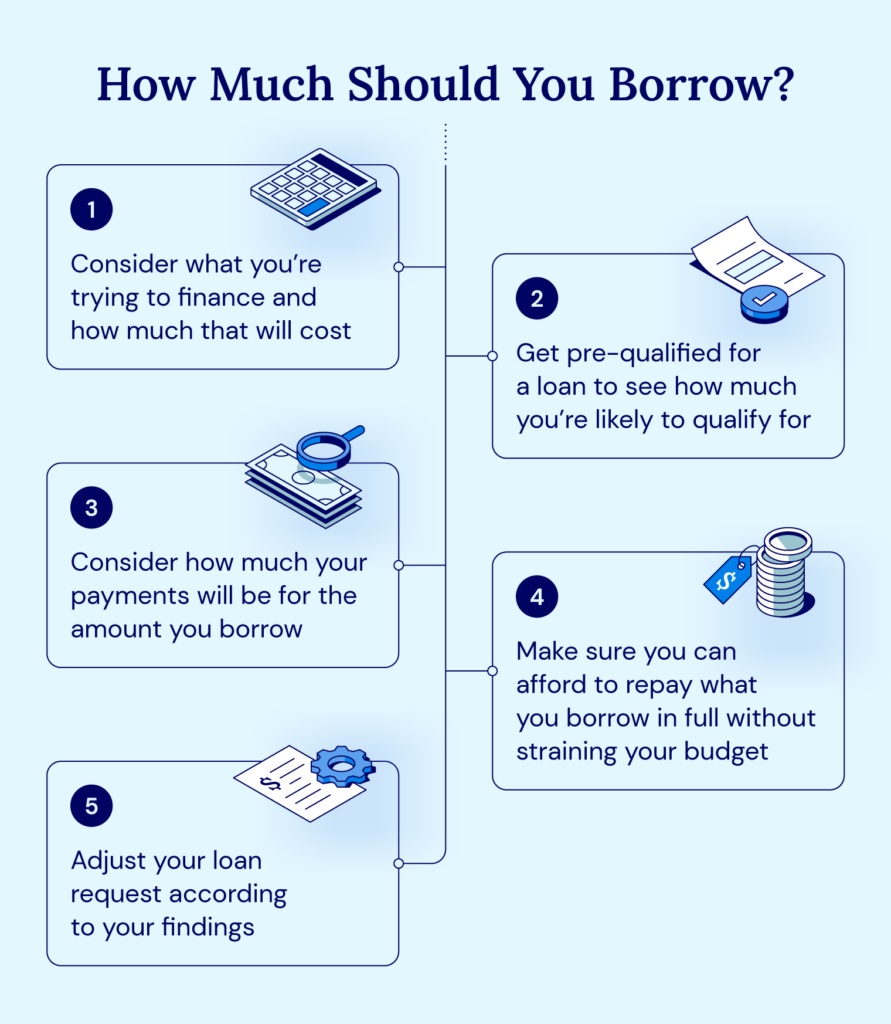

Understanding whether small business loans are installments or revolving debt is just the starting point. You still need to select a lender and apply for a loan or business line of credit that supports your business goals.

National Commercial Capital will be here to help you find the right financing options that suit your needs, whether you are considering installments or revolving credit.

If you are ready to grow your business and want to explore your options, our team will be here to help. Apply now and talk to an experienced business financial advisor to learn more about the loans and credit lines you may be eligible for.