10 Reasons Why You Are Not a Millionaire

There seems to be an impression that the only reason people can’t be millionaires is because they don’t work hard enough. The truth is, hard work has nothing to do with being a millionaire. This is not to say you don’t have to work hard. You do it. However, you also need to avoid many pitfalls and wrong financial decisions, which ultimately are the real reasons why most people can’t build wealth. The truth is, you don’t have to have a huge salary to get over a million dollars in assets, but you have to make good financial decisions (and avoid bad decisions).

It is important to note that one issue may not be what separates you from your millionaire status, but a combination of several actions and decisions you make. And, yes, there are exceptions to the rules, but there are some people who have won the lottery – are you really going to be a retirement bet on winning the lottery? Here are 10 reasons why you are not a millionaire at the moment, and this is most likely the reason for this:

You are trying to satisfy other people’s expectations

There is nothing that can achieve financial goals faster than trying to achieve others’ expectations rather than one’s own. This is more common in trying to “keep up with Jones.” The simple fact is that if you want to live like a millionaire before you have the resources of an actual millionaire, you are unlikely to be a millionaire. Instead, you just add a lot of debt and waste money to impress those who may not be impressed. Trying to keep up with Jones when your salary doesn’t compete with Jones is an affirmative way to undermine the opportunity to build wealth.

You have children

This may not be the most popular item on why you are not a millionaire list, but the truth is that kids are expensive. If you have built some wealth and plan to include your child in your budget, the expenses associated with your child can be reduced to some extent, but this is usually not the case for many couples.

In fact, according to the 2000 Census Bureau, the average net worth of families under the age of 18 is $534,400. By comparison, the average net worth of families with one or more children under the age of 18 is only $381,400.

Having a baby when you are young and you have limited income can greatly affect your ability to build wealth. This is because children often increase housing, food and education costs. Complex interests are so important to creating wealth, and its cornerstone is that the sooner you start saving and investing, the better. In this case, it is inevitable that all the extra money ends up in the care of the children, rather than investing in creating wealth.

You spend more than you do, and you don’t invest

There is no secret, and there is certainly nothing magical when it comes to the basics of personal finance. To maintain financial status, You need to spend less money than you earn. If you haven’t done this simple thing, it doesn’t matter how much money you make, and you always find yourself not having enough money to make a living.

It goes a step further than that. Spending more than the expenses you earn is not enough to build wealth by itself. You must also actively save and invest a portion of all the money you earn. In fact, you can save much more than your ROI. This is important for two reasons:

First, you can control the amount of investment, but you cannot control the amount of income you receive.

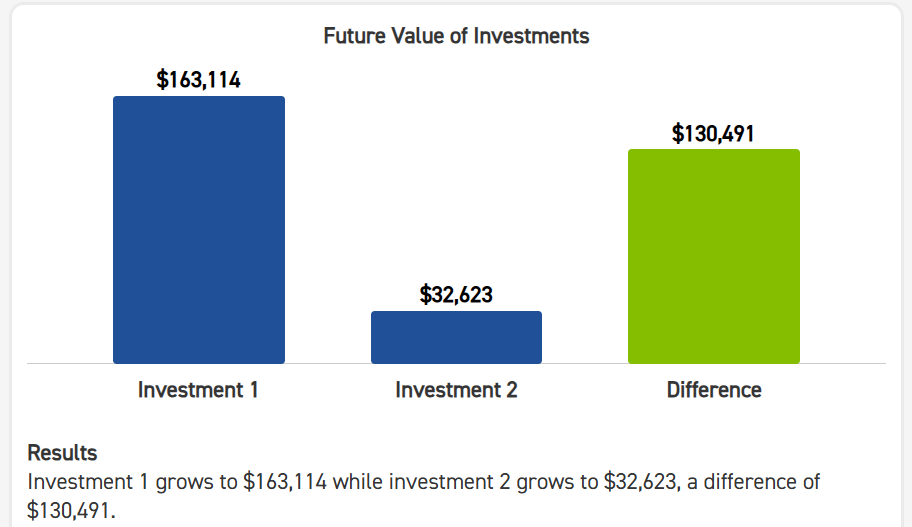

Secondly, everything equals the greater the amount you can invest, the greater the value of your investment. For example, if you compare two investment options. One investor invested $10,000 and another invested $2,000. Both of them earn a 7% return and hold a 40-year investment. At the end of 40 years, their investment differences were very dramatic.

A good rule of thumb is: try investing at least 20% of each payment you receive and investing it in long-term savings and investments.

You don’t pay first

One of the most fundamental steps you can take is to make sure you invest money in yourself, which is to pay before you make it. If your goal is to save 20% of your income, you will need to pay 20% of your expenses before paying any other bills or expenses from your salary. If you try to pay after paying all the other fees, you will be inadequate every now and then (if not always) at the end of the month and can’t save as you wish. Pay first, you can promise that creating wealth is an important part of your overall plan, rather than what you hope to achieve after everything else.

Your house is too big

Some people think buying a big house is a good investment. While this can be the case, buying a home is more affordable than you can afford is a great way to ensure you can’t create real wealth. The problem is that when you buy a large one, your home costs more. A large house will mean bigger taxes, more expensive maintenance, buying more stuff to fill the house, higher insurance costs and more than what you buy a home that really suits your needs . The real way to build wealth is to buy a home that suits your needs and budget and get all the savings from not buying large homes and investing in and creating wealth.

You’re changing things too early

Just because you purchased a new version of the gadget you bought a year or two ago doesn’t mean you need to buy that new gadget. If you are the kind of person who keeps replacing products that still have a lifespan to buy the so-called newest and greatest gadgets, then you will most likely have a hard time building the type of wealth you need.

Usually, wealthy buy high-quality items that have a long lifespan. This reduces the cost of these items in the long run. Instead, those who strive to become millionaires are more likely to regularly upgrade expensive consumer electronics. Here is an example of the iPhone 15, a commonly upgraded consumer gadget.

You keep falling into scarcity

Scarcity comes in many forms – including financial shortage, time shortage, food shortage or willpower shortage.

In all cases, scarcity consumes the brain’s limited bandwidth, leaving you with little else to solve anything else. Scarcity also creates a sense of urgency, often forcing you to focus on direct issues. This means that long-term planning can be rear-seated while meeting immediate needs. Scarcity can also increase stress, make you less and less and less time you spend on your children and family. As

Scarcity, especially chronic scarcity, can reduce your ability to build wealth. This is because long-term planning, relationship building and stress relief are needed to make good investment decisions effectively and solve real income generation and employment challenges.

For more information on this, consider reading the excellent Richhabits.net – it has many great articles on financial stress neurology.

You cannot take care of your health

Nothing can waste your wealth faster than getting sick. While you may not be able to control all aspects of your health, there are some steps you can take to make sure you are as healthy as possible. Eat right, exercise, take precautions, do annual checkups and take care of medical issues before it can be really serious, which allows you to live a healthier life. The better you take care of her health, the more you will have the opportunity to create and stay rich as you get older.

You’re divorced

Just as marriage can be a wonderful way to help build wealth, divorce often has the exact opposite effect. In fact, divorce is one of the best ways to destroy your wealth so far. This is not to say that you should stay married for financial reasons only, but it is important to know that divorce is often a huge expeller of wealth and divorce will hinder the best plan for being a millionaire.

You have one or more bad habits

What is bad habits that can take money away from you without giving more rewards. These classics are smoking, gambling and drinking, but bad habits are also easy to drink coffee every day or three sodas you drink every day. It doesn’t even have to buy something. Laziness and sitting in front of TV for five hours rather than trying to make yourself better is also a bad habit of creating wealth. Depending on the number of bad habits you have and how much they continue to spend, those habits alone can prevent you from becoming a millionaire.

Reason for reward:

You don’t educate yourself

Research on the rich often shows that high net worth individuals spend consistent time learning job-related skills. According to writer Tom Corley, the rich spend at least 30 minutes a day in career-related reading. This allows them to improve their skills and make them more effective in converting time into currency, improving market earnings, or running a business (here).

You don’t exercise

Rich jobs are very long. They work an average of 50 hours a week. To maintain this rate, the rich usually have at least aerobic exercise every day. This may include jogging, jumping rope, walking or cycling. Exercise can cause your brain neurons to grow and produce glucose. Glucose is the brain fuel, the smarter it becomes. So when people exercise more, they tend to do more (according to Harvard).

Wrap this – You can still do this even if you don’t have money right now

Getting rich is not easy – but it works. Even if you are not rich right now, you should be able to become rich if you develop good habits, save and invest, live frugally and avoid crashing into any financial land mines (such as divorce or buying a home that is too big). Warn in advance, becoming rich takes years of work, but feasible and highly rewarding. .

For more interesting save suggestions reading, consider the following:

A conversation with a thief, or a place to hide money in your home

This is a sign of a fake

Ten changes you can lose weight and save money

(Photo courtesy of Enkhtuvshin)