Will SBA EIDL loans be forgiven?

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans. Extensive forgiveness involves a variety of challenges. Our new administration is unlikely to take the same stance on debt relief as the previous administration, which suggests these outstanding loans may never receive the same treatment as PPP loans.

Five years have passed since the rapid onset of the COVID-19 pandemic. Businesses have rebounded and markets have largely adjusted to the “new normal” in which we live, but some lingering effects of those historic days still haunt some businesses.

As stay-at-home orders were implemented and supply chains collapsed, many small businesses took advantage of the SBA’s Economic Injury Disaster Loan (EIDL) program to stay afloat. SBA EIDL loans have provided a lifeline to businesses during this time, but that lifeline has become a heavy burden for some members of the small business community.

The EIDL program was extended from 2020 to 2022 to $380 billion. The lifeline that saved businesses is now burdening them, and many are wondering whether our new government will forgive this debt, like PPP debt.

However, there is no word yet on whether our new administration plans to forgive them. Our CEO discusses this topic and his stance on whether forgiveness is possible.

“Loans like this are rare; if a business can’t make these terms work, the problem may not be the loan. More likely, it points to other underlying management issues.

National Business Capital CEO Joseph Camberato speaks in the Business Journal.

Challenges with EIDL loan forgiveness

The broad forgiveness of EIDL loans poses a challenge to government, particularly the Small Business Administration, and to ordinary taxpayers. With the balance so high, broad forgiveness would seriously harm the Small Business Administration’s finances and ultimately wipe out a large amount of taxpayer money. They will effectively write off $300 billion, including $50 billion in accrued interest.

Imagine if your company had an outstanding balance of the same amount as a supplier. If they write that money off, that’s a $300 billion loss, which could plummet your finances. Losses of this amount could cause the SBA’s operations to cease in the next few years.

The SBA attempted to sell its EIDL portfolio in September 2021 and June 2022, but ultimately determined that a sale would not be in the government’s best interest. Their position remains today, but the rationale has changed: Selling the portfolio would be too expensive for the SBA to move forward.

“Forgiving these loans is unfair to taxpayers, who should not be footing the bill for businesses that haven’t adapted yet. We need to look at how these businesses are operating and not waive loans that were designed to give them a chance to succeed. Canberato continues.

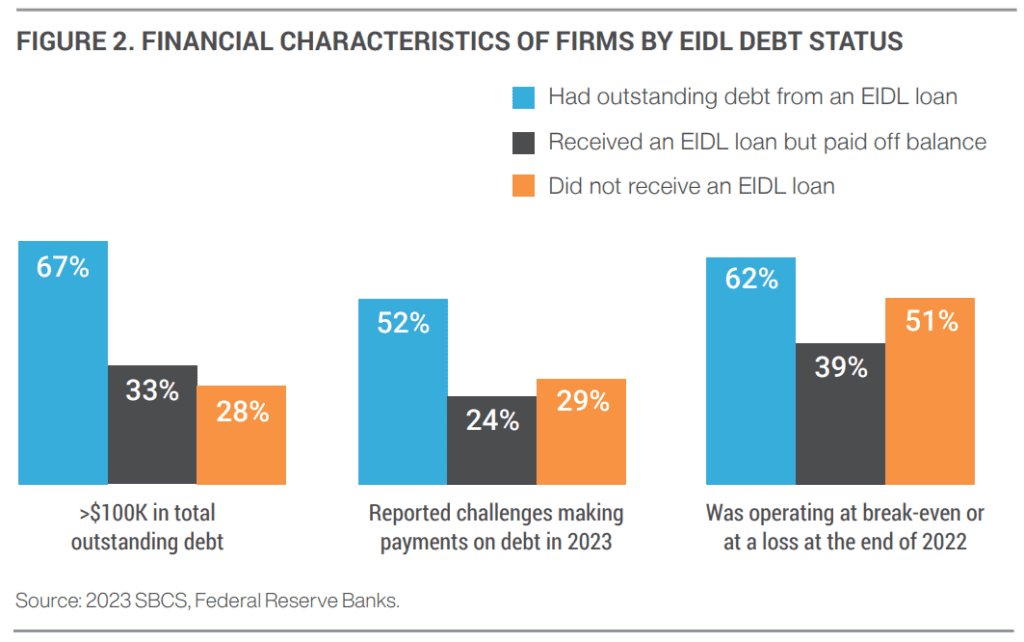

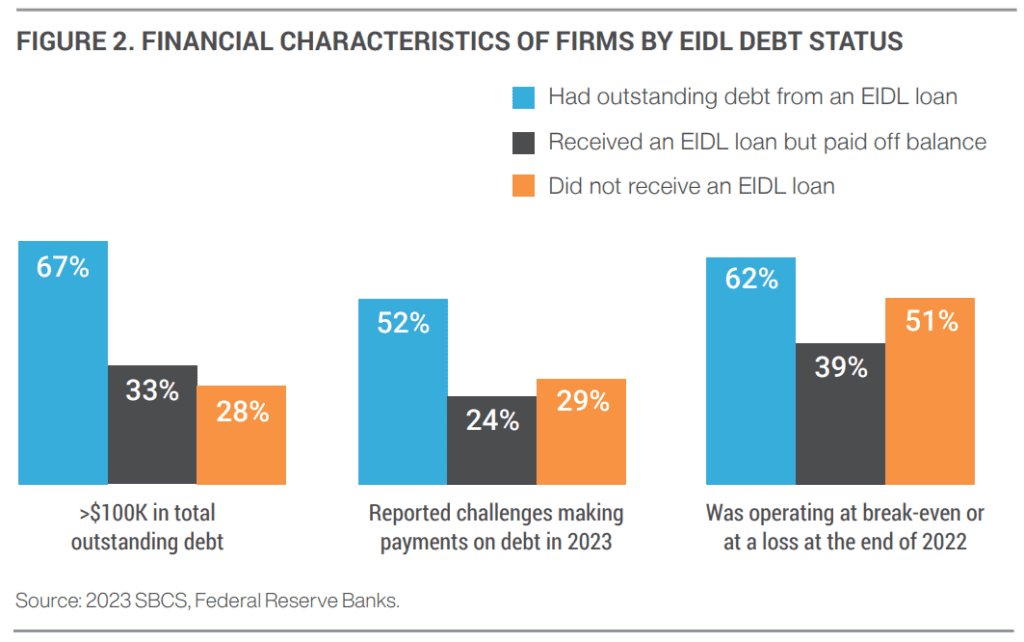

His position is not unfounded. Many companies with EIDL loan debt have historically faced financial challenges in their businesses, as shown in the Federal Reserve’s Small Business Chart below.

5 strategies for companies with EIDL loan debt

Companies with EIDL loan debt can use some of the following strategies to improve their financial health:

- Assess your financial situation: Examine your current cash flow to determine how much money you can realistically allocate to loan repayments.

- Communicate with the SBA: Businesses overwhelmed by SBA debt can contact the Small Business Administration on their own and explore repayment assistance options. While there’s no guarantee you’ll qualify for an available program, it’s always a good idea to get in touch and ask. It is recommended to do this as early as possible, as waiting until the debt becomes unmanageable will reduce your negotiating power.

- increase income: If you are currently paying too much, increasing revenue through expanded distribution, new products/services, or other strategies can make large payments more manageable. It could be as simple as raising the price a little, but you’ll never know unless you dig into the numbers and do your due diligence.

- Seek financial guidance: Consult with a business financial advisor, CPA or turnaround specialist to learn more about available resources and possible strategies.

- Explore grants and relief programs: Examine local, state and private sector funding opportunities.