The end of the commercial real estate recession is finally here

Commercial real estate (CRE) investors have been in trouble amid a brutal recession since 2022. As inflation increases and the upper limit interest rate increases, asset value increases and mortgage interest rates become higher and higher. The crying of the rally became simple: “Survival until 2025.”

Now we are in the second half of 2025, and it seems that the worst is finally over. The commercial real estate recession seems to be over and opportunities explode again.

I believe the next three years will be better than the previous one in CRE. And if I’m wrong, I’ll just lose money or earn less time than expected. This is the price we pay as risky asset investors.

A few tough years for commercial real estate

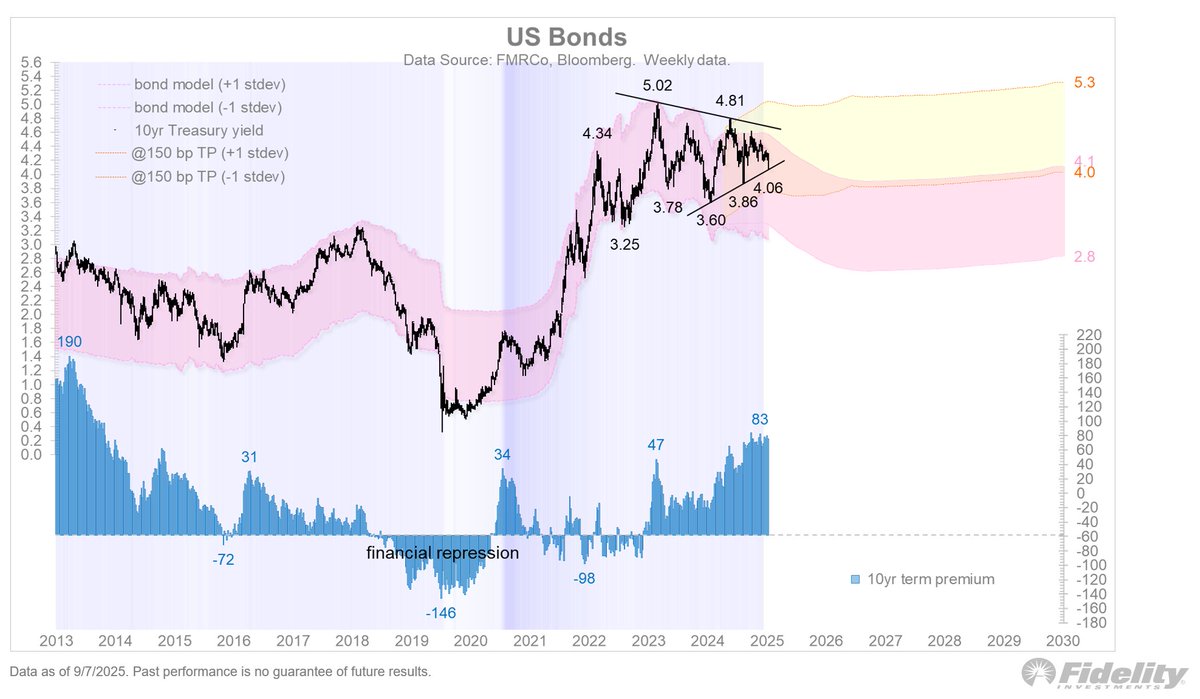

In 2022, when the Fed begins its most radical hiking cycle in decades, CRE is one of the earliest casualties. Property value is very sensitive to borrowing costs because most transactions are financed. With the 10-year treasury yield rising from about 1.5% pre-pandemic (below 0.6%) to about 5% of the 2023 Peak, the upper limit rate is nowhere to be found, but it can rise.

Meanwhile, the demand for office space is trapped in hybrid and remote work. Apartment developers are facing rising construction costs and rising rental growth rates. Industry was once the darling of CRE, cooling as supply chains freeze and then normalized.

As financing costs rise and NOI growth unifies, CRE investors have to cut it. Headlines about default, extensions and “extend and pretend” loans dominate the space.

Signs that the commercial real estate recession is coming to an end

Fast forward to today and the landscape looks very different. That’s why I believe we’re at the end of Cre Acre downurn:

1. Inflation has normalized

Inflation has dropped from 9% heat in mid-2022 to below 3% today. Lower inflation gives Fed security to give policy and investors more confidence in underwriting long-term transactions. Price stability is oxygen from commercial real estate, and it is finally back.

2. 10-year yield decline

The 10-year Treasury drives most mortgage rates and has dropped to about 4% from its peak. A 100-barrel drop is meaningful for leveraged investors. A 1% reduction in borrowing costs can be converted to 10%+ higher property values using common cap rate math.

3. Fed Hub

After more than nine months of stability, the Federal Reserve cuts again. Although the Fed cannot directly control the long-term mortgage rate, short-term cuts usually filter. Psychological changes are also important: Investors now believe that the tightening cycle is indeed behind us.

4. The trouble reached its peak

We have seen forced sellers, loan extensions and price cuts. Many weak hands have rushed out. Once the signs of pain, distress sales start to attract opportunity capital. Historically, this transition marked the bottom of the real estate cycle.

5. Capital is returning

After two years of sidelines, capital is back. Institutional investors are insufficient real estate relative to their long-term goals. Home offices, private equity and platforms Fundraising Funds are being actively raised and redistributed to the CRE. Liquidity creates price stability.

Opportunities for CRE

Not all CREs are equal. While the office may suffer damage for years, other property types look convincing:

- Multifamily: Rental growth slowed down but did not collapse. Since 2022, there may be supply supply in the next three years due to the small supply of new buildings, and rental pressures are rising.

- Industrial: Even from the crazy pandemic, warehousing and logistics are still long-term winners.

- retail: “Retail Apocalypse” is exaggerated. A well-located grocery store anchoring center is being executed, and experience retail has endurance.

- major: Data centers, senior housing and healthcare offices continue to attract niche capital. With the AI boom, data centers may see the most CRE investment capital.

As a capital allocator, I am attracted by relative value. Stocks Today’s stock trading today has a forward return of about 23 times, while many CRE assets are still priced as if the price is permanent at the 2023 level. This is a disconnect worthy of attention.

Don’t confuse commercial real estate with your home

One important difference: Commercial real estate is different from buying your primary residence. CRE investors are very concerned about yields, cap interest rates and financing. On the other hand, home buyers are more focused on lifestyle and practicality.

For example, I bought a new house and didn’t maximize financial returns, but because I wanted more land and outdoor space so that my kids were still young. The return on investment for peace of mind and childhood memory is immeasurable.

Commercial real estate, by contrast, is about numbers. It’s about cash flow, leverage and exit multiples. Yes, emotions spread, but the market is even more ruthless.

Risk still exists in CRE

Let’s be clear: convening the end of a recession does not mean that the blue sky will last forever. Risks still exist:

- Too many offices: Many CBD office towers are functionally outdated and may never be restored.

- Debt matures: The wall of loans will still be due in 2026-2027, and the market can be tested again.

- Policy risks: Tax changes, zoning laws or other unexpected inflation outbreaks may lead to progress.

- Global uncertainty: Geopolitical tensions and slower growth abroad may exude demand for CRE.

But the cycle does not end with all the risks disappearing. When the balance of risk and rewards shifts, favoring investors willing to look forward, they end up.

Why I’m optimistic about Cre

About 40% of my net worth is in real estate, about 10% of which is in commercial properties. So, I personally feel this frustration.

But when I shrink, I see the echoes of the past cycle:

- Panic sales, then opportunity to buy.

- The rate peaks and starts to drop.

- The institution returns from defense to offense.

I recently recorded a podcast with Ben Miller FundraisingHe is optimistic about CRE over the next three years. His point, coupled with the improved macro background, led me to believe we have turned the corner.

CRE: From Survival to Prosperity

For three years, the spell has been “Survival until 2025.” OK, we’re here. CRE investors who hold it may end up being rewarded. Inflation is lower, interest rates are lower, capital is returning, and new opportunities are emerging.

The end of a commercial real estate recession does not mean easy money or straight rebounds. Unlike stocks that move like speedboats, real estate moves more like super robots – it takes time to turn. Patience remains crucial. Still, the trend has changed, and it’s a moment to reposition the portfolio to be attractive valuations and prepare for the next upgrade.

The key is to stay selective, maintain a long-term mindset, and align each investment with your goals. For me, commercial real estate is still a smaller but still meaningful part of diversified net worth.

If you’ve been waiting for the sidelines, it might be time to wade. Because in investment, when the waters are calm, the best opportunities rarely appear – they appear when the cycles quietly turn.

Reader, do you think the CRE market has finally turned? Why or why not? At this stage of the cycle, where do you see the most compelling opportunities for commercial real estate?

Invest in a diversified way

If you want to get commercial real estate, take a look Fundraising. Founded in 2012, the fundraising company now manages over $3 billion for more than 380,000 investors. Their focus is on residential-oriented commercial real estate in low-cost markets – assets tend to be more resilient than offices or retail. Throughout the economic downturn, fundraising continues to deploy capital to capture lower valuations. Now, as the CRE cycles change, they are in a good position and can benefit from the rebound.

The minimum investment is only $10, and over time, the average cost is easier than USD. I personally put six figures into the fundraising CRE products and I appreciate their long-term approach to working with myself. The fundraiser has also been a long-time sponsor of Financial Samurai, which tells our shared investment philosophy.