Construction Industry Trends (November 2024)

Our monthly construction industry trends report combines the latest industry data with internal survey results from National Business Capital’s award-winning team. We have accumulated extensive experience in the construction industry since 2007 and we are pleased to share these findings and expand upon them through our unique expertise.

Our goal is to provide business leaders and decision-makers with the necessary information and data to make informed decisions in their business activities. This month, we’ll look to 2025 and discuss the impact of proposed legislation on the construction industry.

Prepare for the impact of proposed tariffs on raw materials

Last month, President-elect Donald Trump won the presidential election, paving the way for his second term. While his victory injects confidence into markets, many companies are bracing for the impact of his proposed tariffs on their profits.

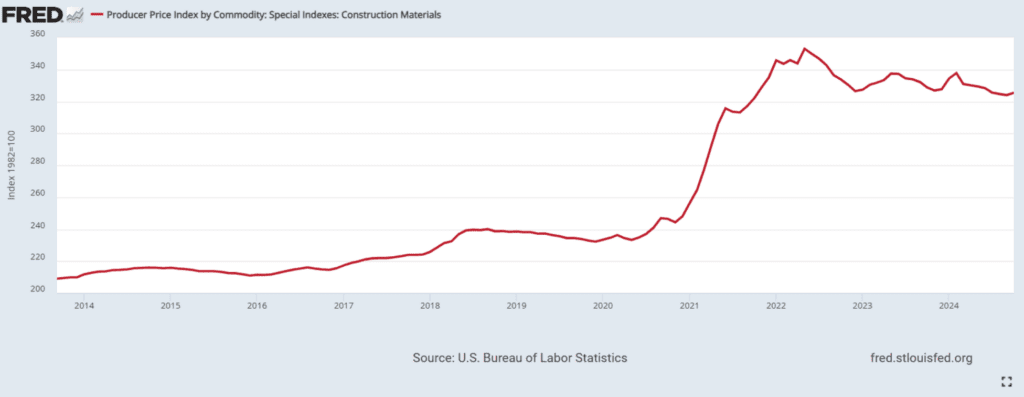

Lumbar spine prices (2014 – 2024)

Source: Fred St. Louis

November 2024 – For homebuilders, the proposed tariffs would further increase already rising softwood lumber prices. Apart from raw materials, the scheme will also increase the cost of other home-related items such as air conditioners, garage doors, dustbins, etc. and potential costs.

The chart above shows producer price index (PPI) trends for all building materials from 2014 to 2024. change. However, the tariff plan proposed by our new president may reverse this trend by increasing the cost of imports.

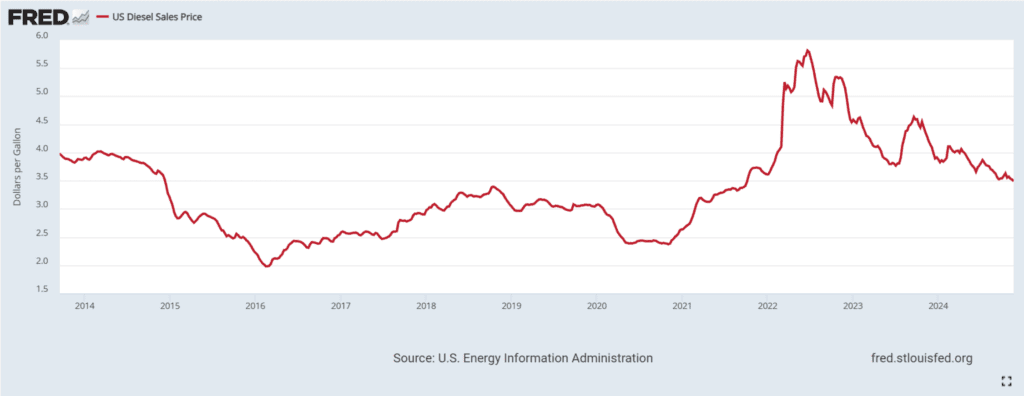

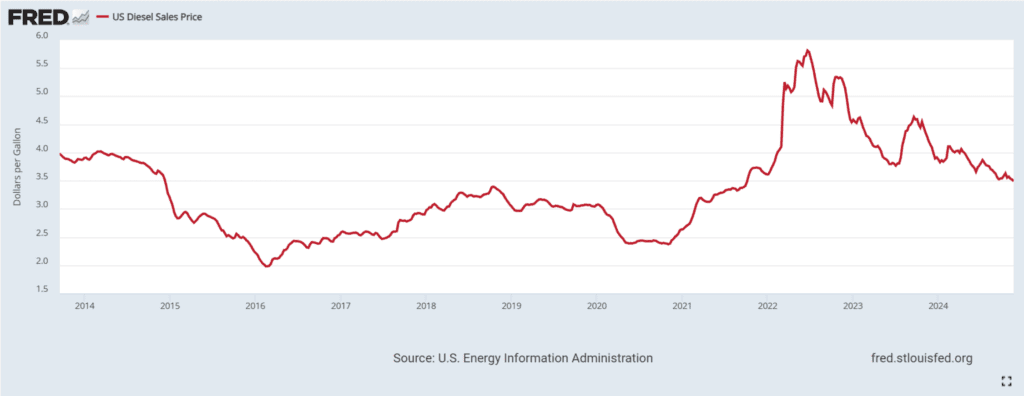

Diesel prices (2014 – 2024)

Source: Fred St. Louis

November 2024 – Another key price to monitor is fuel. According to Statista, the United States has imported $164.9 billion in fuel so far in 2024.

Since diesel is a significant part of the industry’s workload, it is important to monitor this trend. Higher overhead and sudden changes in overhead can limit profitability, especially on larger jobs. Construction companies need to consider how potential increases in fuel costs will affect their profit margins during the project pricing stage. For those of you working on this, talking to your accounting team is a must.

How are companies responding?

Seeing the changes coming, many construction companies have taken the initiative to purchase the materials needed for 2025. New supplier relationships.

However, this strategy has its limitations. Material suppliers that receive large orders may increase prices, which may erode cost savings from proactive ordering. Large orders may help prevent price increases from individual suppliers.

Another challenge with proactively ordering materials is the ability to obtain funds quickly. Companies with senior lines of credit that don’t support larger material orders may ask their lenders for an over-advance payment. However, as more companies follow suit, the ability of lenders to provide excess advances becomes more difficult.

Francois Bouville, Director of Institutional Partnerships at National Business Capital, wrote an article on this topic, explaining how National Business Capital’s subordinated debt has become a key resource for these companies. Read the full article on LinkedIn here.

One thing to note is that it is unclear how quickly our government will implement these tariffs and which countries will be affected by the more significant tariffs. For example, a HousingWire article discusses how Trump has vowed to impose 20% tariffs on Mexico unless progress is made on border challenges. It’s unclear whether this will become a reality, nor are we sure whether the implementation of these new tariffs will expand over time or take full effect immediately. Still, monitoring is important for construction companies.

Companies starting new jobs will have the opportunity to adjust their pricing models to suit their material costs. However, those working on projects may need to take different actions, whether by obtaining funding to cover higher material costs or talking to decision makers to adjust contract pricing. This is especially true for construction companies that specialize in government work.

Other related trends and news

- Construction worker non-fatal injury rate drops to lowest in 10 years – An article in Construction Dive explains that since 2011, non-fatal injury rates in the private and public industries have steadily declined to their lowest point in more than a decade. This is good news, not only on a humane level but also considering the high cost of insurance for employers.

- Residential construction spending contracts up 7.3% year to date – Residential construction spending fell $17.7B, a 7.3% annual decrease, according to a ConstructConnect report. The decrease in spending was mainly due to a deeper decline in multifamily housing starts, which are down 24% year-to-date.

- Rate cut has positive impact on construction project abandonment and delays – The Federal Reserve’s recent interest rate cut of 25 basis points has undoubtedly boosted industrial confidence, but the impact on the private sector is more obvious. According to an article published on Construction Dive, shelved projects fell by 56%, while abandoned private projects dropped by 21.7%.

- Power infrastructure bottlenecks may slow data center progress – As more data centers enter the final stages of construction, connecting these facilities to the grid becomes a greater challenge. According to the ForeignPolicy.com article, the power consumption of these data centers greatly exceeds standards, and many infrastructure engineers refuse to connect them to the grid due to the danger of power outages. This sentiment may slow the construction of new data centers in the near future in favor of power infrastructure projects.

- Manufacturing construction, office tower construction, accommodation and commercial development drive private sector spending – An article in Construction Today discusses the biggest drivers of private and public construction spending. In the public sector, road and street construction, public safety, waste management and water supply are the areas where the largest expenditures are made.

National Business Capital Building Review (November 2024)

Each month we provide a unique perspective on the short to medium term outlook for the construction industry. Our insights come from a combination of existing industry statistics, internal data, and the overall sentiment of the construction clients we work with on a daily basis.

- Manufacturing capital increased by 83% – Various measures in manufacturing create demand for capital. Their demand can be seen through National Business Capital’s financing data, which shows that manufacturing financing has increased by 83% since October. Many companies are using our funds to purchase material orders ahead of upcoming tariff changes, while others are investing in equipment to increase operational efficiency. It’s encouraging to see the industry taking action and we’re eager to see what the future holds.

- Roofing contractors increase after severe weather in South (40%) – Roofing contractors have taken on a higher workload since Hurricanes Helen and Milton changed life for many on the East Coast. Their assistance with recovery efforts created a need for working capital, which our team worked closely with them to provide. Overall, we’ve seen a 40% increase in roofing contractor customers and expect more to come in the near term.