Today’s young workers may not have the housing wealth of today’s retirees – Center for Retirement Research

Without home ownership, it’s difficult to save money.

When thinking about the future of Social Security, one question should be whether future cohorts will have assets comparable to those retiring today. Today, the major component of a typical retirement home’s investment portfolio is their home. In fact, a home is the primary asset of most families. But today’s higher home prices and high interest rates have put home ownership out of reach for many young families.

Historically, families purchased homes at an early age by making a large down payment. They then build equity in their home by paying off their mortgage and enjoying capital gains while they work. Although they may have downsized to a larger home and may have taken on additional debt as their family has grown, their goal is to be mortgage-free in retirement (see Table 1). While most families cannot tap into their home equity to pay for daily living expenses, they view their home as insurance for long-term care needs and as a way to leave a legacy for their children.

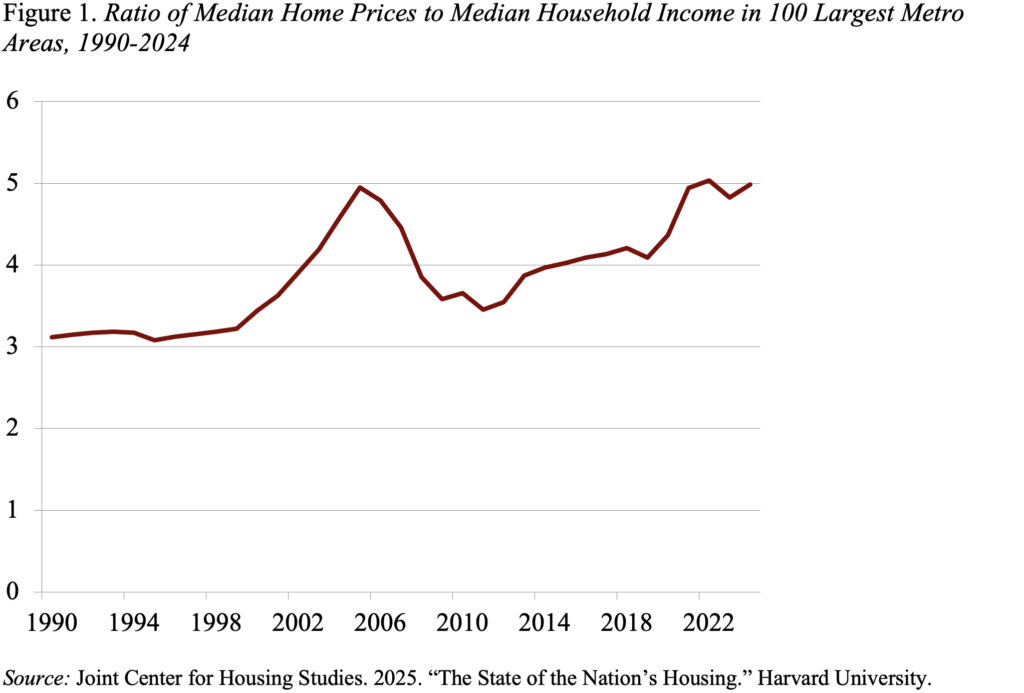

However, with today’s high mortgage rates and high housing prices, many young people don’t know how to own a home. 30-year mortgage rates have fallen slightly from 6.8% in the second quarter of 2025 to 6.2% currently, but home buying levels remain at 30-year lows. The real culprit is house prices, with the median house price currently being five times the median household income (see Figure 1).

In U.S. dollar terms, the median home cost in 2024 is $412,500, which means potential homeowners will need $26,800 in cash to cover closing costs and a 3.5% down payment. (With a 20% down payment, the required cash increases to $95,000.) Using a standard debt-to-income affordability ratio of 31% and assuming a 3.5% down payment, new homeowners must earn at least $100,000 in half of the 100 major metro areas. Additionally, new owners will face steep increases in insurance premiums and property taxes.

The high prices reflect a severe shortage of available homes. Many homeowners who were lucky enough to get mortgages when interest rates were 2% were reluctant to sell, and natural disasters like hurricanes and fires reduced supply. Additionally, investors in the rental market have been buying up large numbers of single-family homes, crowding out would-be homeowners with cash and quick closing times. In the future, as the “2 percent” fade away, the baby boomer generation dies out, or builders decide to build more housing, a number of factors could free up supply — although one estimate suggests the new tariffs will add $12,800 to $25,000 to the cost of building a new single-family home.

Meanwhile, many young people — often already saddled with student debt — will end up renting. Of course, if they just invest their savings without holding stocks in stocks and bonds, they could end up with a lot of assets in retirement. But this hypothesis reminds me of the advice I got from my colleagues when I left the Boston Fed at age 50 – collect your benefits now – they said – and you can invest better than the boring guys running our pension plans. There are two flaws with this approach, firstly my investing skills have never been very good, and secondly – and more relevant to the renting story – I spent my pension money eating out at good restaurants – without depositing them into the account!

One of the beautiful things about owning a home is that it serves as an automatic savings mechanism—an attribute that may not be available to future retiree groups. This model would make them more reliant—not less—on Social Security.

Source link