Poor Millionaires vs. Rich Millionaires: Liquidity is the Difference

one poor millionaire It sounds contradictory, but they exist. About 6% of American households are millionaires, but many of them still don’t feel rich.

one poor millionaire A person who is worth more than $1 million but does not have access to most of their wealth. In other words, their net worth is extremely illiquid. Layoffs, a bear market, or job losses can quickly put them in jeopardy.

In contrast, a rich millionaire They are also worth over $1 million, but can easily capitalize on their wealth. They are liquid and resistant to financial shocks. Not only are they financially rich, but they are also spiritually richer. Thoughts of financial ruin rarely cross their minds.

Key Liquidity Killer for Millionaires

The main culprit for illiquidity is principal residence. It’s great to have a beautiful home, especially when you work from home or retire. You just have to be careful about owning too many houses.

If you want to feel comfortable, try to keep your primary residence at the following levels 30% of your net worth. if you want feel richleaving it below 20%. This way, at least 80% of your net worth can be liquid or semi-liquid assets.

But in reality, maintaining 70% to 80% liquidity is difficult and unnecessary. Millionaires often invest in rental properties, private real estate funds, venture capital, venture debt, and other illiquid alternatives. Ten millionaires and above also typically own significant private business equity, another illiquid asset class.

That’s why there are at least Liquid assets represent 20% of your net worth— just like stocks and bonds — very valuable. You’ll sleep better knowing you never have to sell illiquid assets at low prices and there’s always dry powder to buy on the dip when the market panics.

Suggested income and net worth chart before buying a home

Below is a handy home buying chart I put together based on income and net worth minimums. Ideally, you should have both a suggested income and a suggested net worth relative to your target home price. If not, you need at least one of the following combinations to continue:

- Recommended income + minimum net worth, or

- Recommended net worth + minimum income

Otherwise, you may feel financially strained.

My experience with liquidity after accumulating wealth for over 26 years

My advice comes from real life experience, from having nothing in 1999 to being financially independent today.

Since 2003, every time I purchase a home, I have documented how each home makes me feel. My latest home purchase in 2023 was another test of my 20%–30% rule. It was an all-cash deal, equal to about 23% of my net worth.

I felt uncomfortable the moment we closed – house rich, cash poor – hoping nothing bad would happen to our finances next year. It’s a horrible feeling that I can’t wait to get rid of.

I even wrote about the post-purchase living wage, which pissed some people off. But I was just being honest about how I felt. Out of this uncomfortable position, I decided to increase my liquidity by negotiating more online business development deals and taking on a part-time consulting role at a seed-stage fintech startup. Unfortunately, I could only last four months.

This experience once again strengthened my belief: to feel truly wealthy and secure, Keep your primary residence to no more than 20% of your net worth. Even though I was free of anxiety, I never wanted to feel that way again.

Thanks to the bull market and continued savings, my house now accounts for about 19% of my net worth, and I feel great. To make matters even more intense, I am selling my old primary residence in early 2025 after renting it for a year. Converting illiquid real estate equity into public stocks, Treasury bonds, and open-end venture funds that provide quarterly liquidity feels great.

As much as I favor a single-family home with a view of San Francisco’s West Side, the peace of mind that comes with mobility trumps all else.

Liquidity by millionaire level

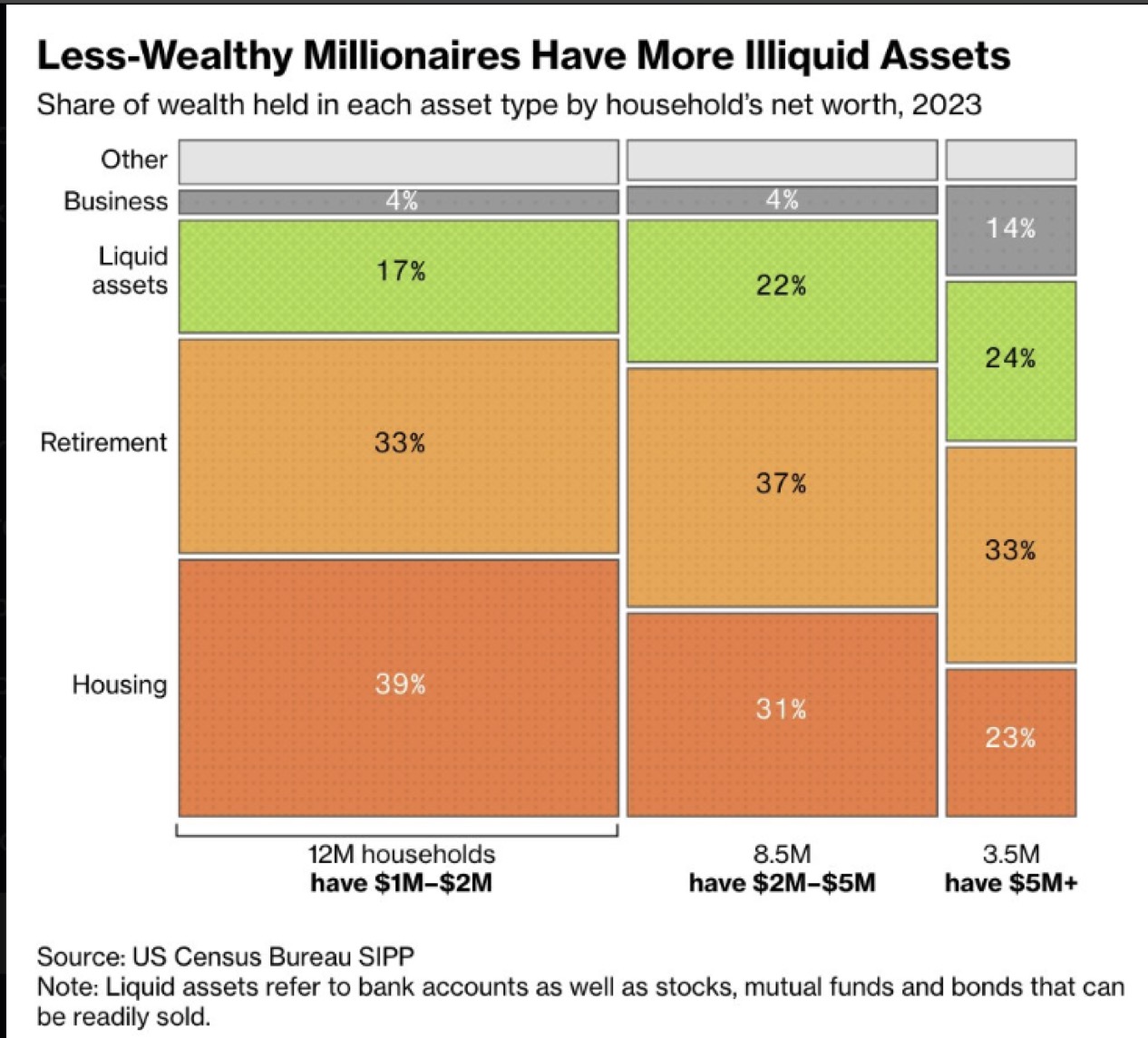

According to the latest data from the U.S. Census Bureau, millionaire mobility varies widely.

for ~12 million households Have a net worth of $1 million to $2 million and have an enterprising spirit 39% Wealth is tied to housing. No wonder so many “poor millionaires” say they don’t feel rich or feel like they’re just treading water. Due to inflation, a millionaire today would need over $3 million to match the purchasing power of a millionaire in the 1990s.

At the same time, for ~3.5 million households Only those with a net worth over $5 million twenty three% Located at their primary residence. About 33% comes from retirement accounts, 24% from liquid assets, 14% from business interests and the remainder from miscellaneous assets. Much better.

According to the Financial Samurai survey, $5 million is ideal Retirement net worth is a close second at $10 million. Once you feel wealthy enough, you’ll be willing to take action, usually by quitting a less-than-ideal job to pursue something more fulfilling.

I’m pleased to see that the 23% housing figure among these “rich millionaires” is consistent with my 20% guideline. I believe that for households with more than $10 million in assets, housing represents a lower percentage of net worth—perhaps less than 20%.

I’ve written before about what it’s like to hit various millionaire milestones – $1 million, $5 million, $10 million, and $20 million-plus. I will say this with confidence: Once you have over $10 million and your house is 20%, you will Feel Rich, even in expensive cities like San Francisco or New York.

For example, let’s say you own a home worth $2 million with a mortgage, but have $4 million in a taxable brokerage account, $1 million in Treasury debt, $2.5 million in an IRA, and $500,000 in cash. There is no doubt in my mind that you will feel rich.

Housing builds base wealth, everything else makes you richer

Census Bureau data reinforce a key fact: Housing is the basis for wealth accumulation.

Due to chronic supply shortages, population growth, inflation, leverage, forced savings and government incentives, owning a primary residence is a smart hedge against inflation. You may not build wealth the fastest, but after ten years of homeownership, you may see significant equity gains.

The combination of paying off your mortgage and enjoying long-term appreciation is a powerful force. Of course, you will have more opportunities than others to purchase your primary residence. However, in the long run, you want neutral housing.

Temporary rental is possible, but long-term rental is not allowed (more than 7 years)

Some renters say they “save and invest the difference,” but a few actually do that all the time. Decades of discipline are hard. In a way, having a mortgage on your home protects you from yourself, forcing you to automatically save and build wealth.

If everyone had perfect self-discipline, we would all be in peak financial shape with four-pack abs. Yet, despite knowing the health risks, more than 60% of Americans are overweight.

I’m helping manage one of my relative’s investments for free. She is in her 50s and has been renting in New York City for more than 30 years. Sadly, she is now under pressure to move because her income cannot keep up with rising rents in the city.

I feel uncomfortable financial pressure through her and it really sucks. If she had bought a house ten or twenty years ago, her life would be much easier today.

Once housing takes up a small enough share, the cycle repeats

Once you have achieved “neutral” real estate investing with your primary residence, you can actively invest in other asset classes. Your foundation has been laid. From there, other asset classes can help you grow your wealth. Over time, as these other investments grow, your primary residence will naturally become a smaller percentage of your total net worth.

Ironically, once your home falls below 10% of your net worthyou may think Too frugal. By that time, your passive and active income may far exceed your expenses.

So don’t be afraid to upgrade your lifestyle. Buy a home worth up to 20% of your equity, or even add another 30% if you choose. Enjoy the fruits of your discipline, then lower the ratio and feel another huge sense of accomplishment.

Housing builds your foundation, but mobility builds your freedom. Rich millionaires are not only own wealth they can use When it matters most.

So, readers, are you a rich millionaire or a poor millionaire? How much of your net worth is tied to illiquid assets and readily available cash or investments? In your opinion, what is the ideal level of mobility to truly feel wealthy and free?

Tips for creating more wealth

If you’re interested in investing in real estate without a mortgage, consider checking out Fund rises. The platform has more than $3 billion in assets under management, with a focus on residential and commercial real estate in the Sun Belt. As interest rates gradually decline and new construction is limited starting in 2022, I expect there will be upward pressure on rents over the next few years, an environment that can support stronger passive income.

I have personally invested over $500,000 in Fundrise funds and they have been Financial Samurai Because our investment philosophy is the same.

Pick up a copy of the USA Today national bestseller, Millionaire Milestones: Easily Reach Seven Figures. I’ve drawn on more than 30 years of financial experience to help you build more wealth and get out of your shell faster.

For more granular personal finance content, join over 60,000 others and sign up Free Financial Samurai Newsletter and Post via email. My goal is to help you achieve financial freedom sooner than later.