Invest in monopoly to make profits and wins: Resistance is futile

Twenty years ago, I learned an important lesson: If you can’t beat them, join them. And, if you can’t find monopoly jobs, you might as well invest in them!

Adopt what happened on September 1, 2025. I received an email from Apple saying my Apple TV+ monthly subscription has risen from $9.99 to $12.99. My first reaction was trouble. Who wants to pay an extra $3 per month for the same show? Everything should be free, such as my weekly newsletter to help readers achieve financial freedom as soon as possible!

But as a shareholder, I was sucked. Given Apple’s millions of subscribers, the huge profitability price has risen by 30%. Then there is the price increase of its latest laptops. This is the pricing power that can only be obtained when building an ecosystem of similar monopoly.

The only logical thing I could think of after that email? Buy more Apple stocks.

For reference, monopoly is a market structure in which a single company or entity dominates the supply of a particular product or service, thus giving it important power to set prices, control distributions, and limit competition. Because entry barriers are high, such as patents, exclusive resources, government regulations, or economies of scale, monopolists can maintain excess profits and pricing flexibility over time.

Cash hoards and large ecosystems

Traditionally, Apple’s shares are sold after selling new products after their annual event. The hype has never fully adapted to Wall Street’s lofty expectations, and the 2025 showcase is no different. But I’ve realized something: Apple doesn’t need to innovate with our ideas, and launches widgets that change the world every year. Just moving the camera lens 1 mm is good enough.

True “innovation” is Apple’s ability Lock customers and charge. The 30% commission on the App Store is a perfect example. If you are a developer and want your app to succeed, you have no choice but to enter Apple’s ecosystem. Apple knows this. iPhone, Mac, iPad, airpods, watches – all of these hardware products are classified into a sticky recurring revenue. Once you enter, you won’t leave.

That’s why Apple will only continue to rule. As an investor, betting on Apple is betting on super normal profits.

Google’s monopoly looks good, too

Then there is Google, another Monopoly Sword Saint. Google Pays Apple $2 billion per year Just to be the default search engine in Safari. Imagine it. How does any other search engine compete when Google buys pole locations on the world’s most valuable and popular devices?

Google still commands 90% of the global search market, and this dominance remains unshakable despite the increase in AI LLMS. To my frustration, Google now elevates publisher content and displays it in its AI overview, which makes it harder for publishers to capture valuable search traffic.

In September 2025, Google exempted the worst judgment in its landmark antitrust case. Judge Amit Mehta ruled that although Google cannot enter into an exclusive agreement with the company, it can still pay partners like Apple to distribute its services. Translation: Google can continue to send tens of billions of dollars to Apple, and Apple can continue to cash checks.

This is a win-win situation for both companies and their shareholders. For Judge Mehta and his family, it might even be a victory.

How many companies can compete at this level?

There are only a few companies in the world who have financial firepower to play a role at this level.

In theory, the only company that can compete is Microsoft, and no one cares. If Microsoft ever decided to use bananas and bid for Google, we might see Apple’s annual salary increase to the $3 billion range. This is more than the annual GDP of some small countries.

From an investor’s perspective, you take root for these bidding wars. As long as Apple remains the gatekeeper of the world’s most coveted user base, it will be paid.

As history has shown, regulators and courts rarely break down this entrenched dominance. When you have enough scale, money and influence, you can Bending politics and policies is good for you.

Strategically, Google should spend more on politicians, rather than lobbying $200,000 to $30 million a year to protect its monopoly and gain a further foundation.

The winner continues to win

This dynamic is not limited to companies. The same is true for personal finance.

Think about the wealthy people in 2010 $10 million in investable assets. If that person just farmed it all into the S&P 500 and reinvested the dividend, they would be around $57 million todayassuming the S&P 500 is closed 10% in 2025. They have become a semi-human monopoly – an advantage that can be purchased, provides multi-generational wealth and ensures that most people can only dream of.

Now, compared to those who bought too many homes in 2006 and were redeemed and declared bankruptcy in 2010. Instead of complicating millions of people, they earned negative net worth and a credit rating for seven years. They’re like small competitors trying to capture market share from Apple or Google. The gap only widened over time. The main strategy is to sell it to Apple or Google one day instead of competing with it.

Just like companies, individuals who already have resources tend to keep improving their lead. The snowball effect is real.

Human monopoly

That’s why I believe investors should focus more on companies like monopolies and oligopolies. If the government does not intend to stop them – history shows that it is rarely done, then you may benefit too.

Openai and HumanFor example, they are two emerging giants in the AI big language model. Although both are now private, their oligarchical structures have been formed with Camel and Gemini.

In consumer products, Coca-Cola and Pepsi Dominate global soft drinks in a classic double monopoly. If you believe that despite the health risks, the world is constantly drinking sugary drinks, these stocks make a lot of sense.

In payment, Visa and Mastercard Form another deeply rooted oligopoly. If you think consumers will keep spending more than themselves and pay double-digit interest rates on revolving credit, owning these companies is a reasonable option.

The pattern is obvious: these deeply entrenched players can grow bigger and more profitable, while regulators look at it in another way. Politicians often own their shares in a monopoly they should regulate.

Then why not?

Adapt or perish

Of course, it can always be ruined. As more people rely on AI-generated answers, Openai and Anthropic have taken a bite from Google’s search business. This is another reason why I decided to go Invest in Openai and humans As a hedge.

But destruction does not eliminate the monopoly dynamic, but only changes it. Today’s upstarts are the deep-rooted winners tomorrow. Currently, Apple, Google, Microsoft, Coca-Cola, Pepsi, Visa and Mastercard are still under solid control.

Company adapts. Investors must, too. The alternative is irrelevant.

My future investment philosophy

For ordinary people, investing in low-cost S&P 500 ETFs is still the easiest and most effective wealth-building strategy. But if you are reading Financial Samurai, you may be more concerned about money than most people. As a result, you are willing to think strategically about how to tilt your odds.

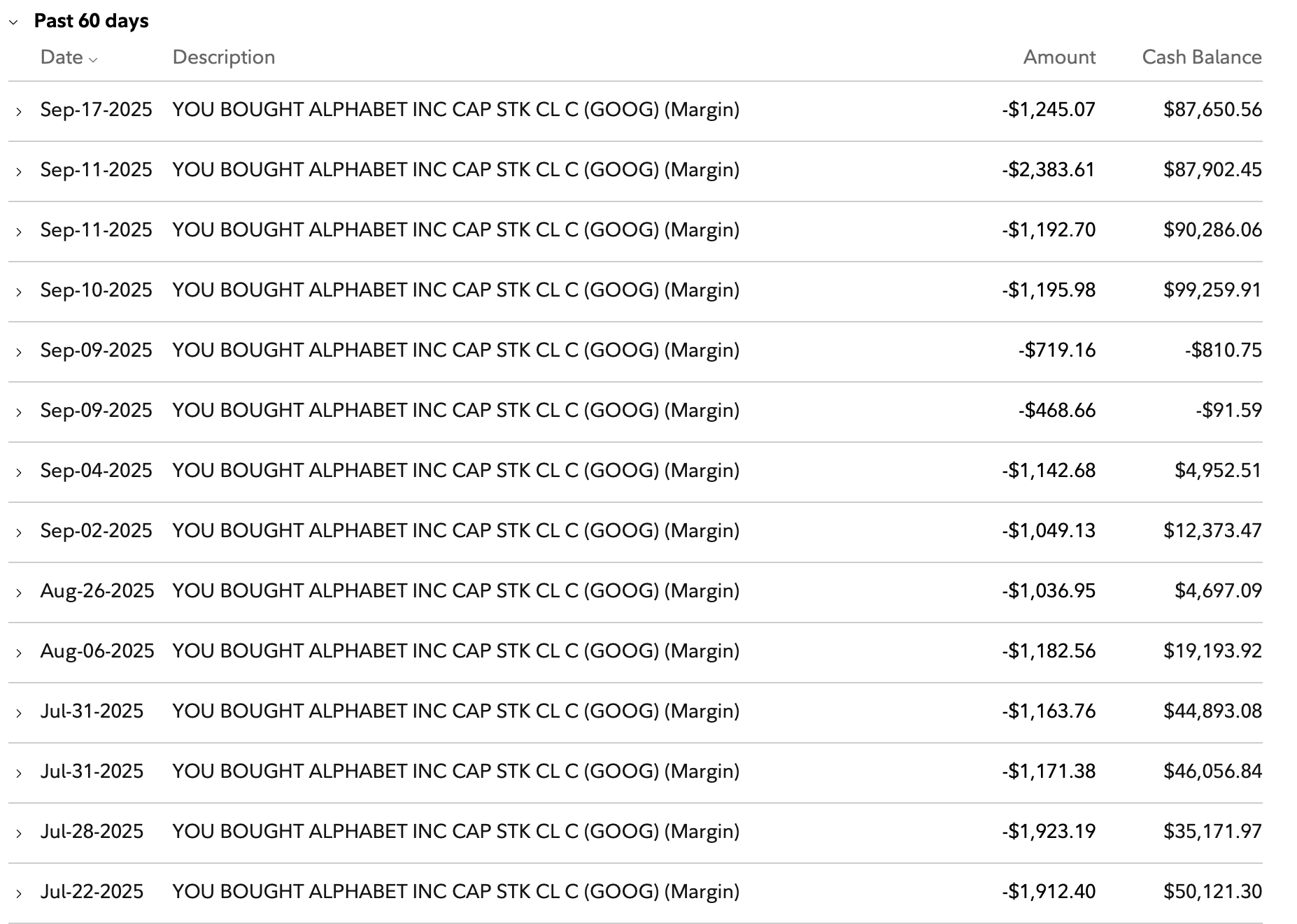

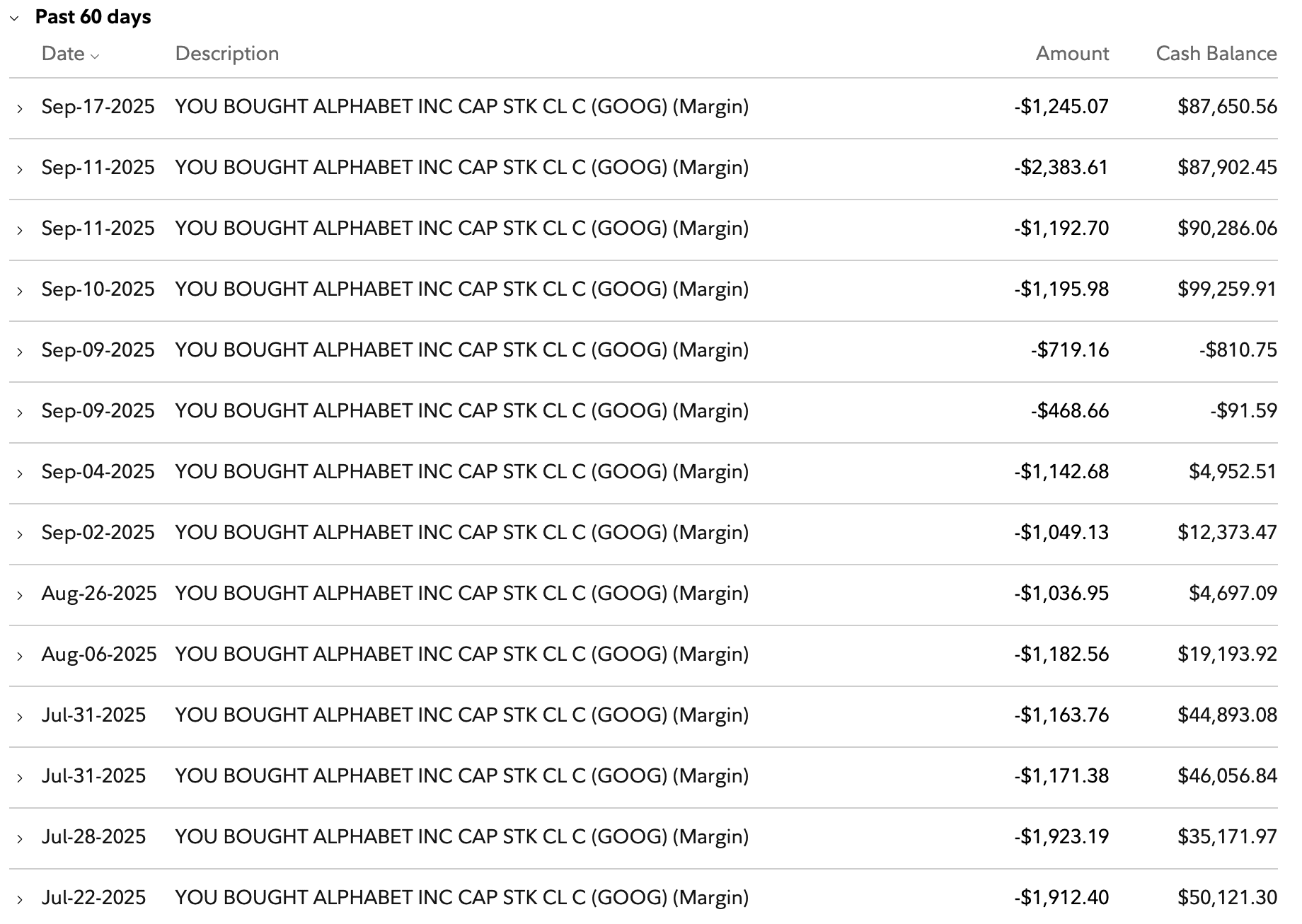

That’s why I like to build Concentrated exposure Choose monopoly and oligopoly in your portfolio. These companies may generate the most consistent profits, have the greatest pricing power, and provide the highest returns over time. When these companies are inevitably right, I will buy more.

Yes, complain about injustice if needed. Yes, worry about inequality. But at the end of the day, if legal and profitable, rational investors will join the winner. Because if you can’t beat them, you might as well invest in them.

That’s not cynicism. That is survival.

Reader, are you investing in monopoly and oligopoly as part of your strategy? Or maybe a startup that might be acquired by them one day? I would love to hear your point of view – why do you think the government and the courts are breaking the initiative of these giants for the sake of consumers?

Subscribe to Financial Warriors

Pick up a copy of my National Bestseller in the United States Today, Millionaire Milestone: Simple Steps to Seven Numbers. I have distilled over 30 years of financial experience to help you build wealth than 94% of the population and take a free break soon.

Listen and subscribe to the Financial Samurai Podcast apple or Spotify. I interviewed experts in my respective fields and discussed the most interesting topics on this website. Thank you for your stocks, ratings and reviews.

To speed up your financial freedom journey, join more than 60,000 people and subscribe Free Financial Samurai Newsletter. You can also get my posts in your email inbox. Register here. Financial Samurai is one of the largest independent personal finance websites established in 2009. Everything is written based on first-hand experience and expertise.