The best unsecured commercial loans

Your business has won recently and suddenly you find a great opportunity to expand quickly. Maybe the competitors are just in a strait, their main retail space is available, or you have the opportunity to acquire a smaller company that will double your market share overnight. You need cash, you need cash now, but your credit is solid and you won’t tie up your equipment or property as collateral. This is when unsecured corporate loans come in handy by seizing those moments of success or failure.

To ensure you are always ready to take advantage of valuable growth opportunities, you should know which capital options and which capital is suitable for your company’s unique operations.

This guide will help you make your decision.

What is an unsecured commercial loan?

An unsecured commercial loan is a loan that does not involve collateral. If the borrower fails to repay, the collateral is a secure form of the lender; usually, it includes real estate, equipment and receivables, etc.

Unlike secured loans, lenders focus more on the company’s financial status, such as its credibility and historical revenue performance, as primary qualifications.

This is because unsecured loans are more risky than mortgages because they are not supported by collateral. Without collateral, the lender will not recover any losses from the borrower’s default. As a result, unsecured financing usually has higher interest rates than secured loans or government-backed loans.

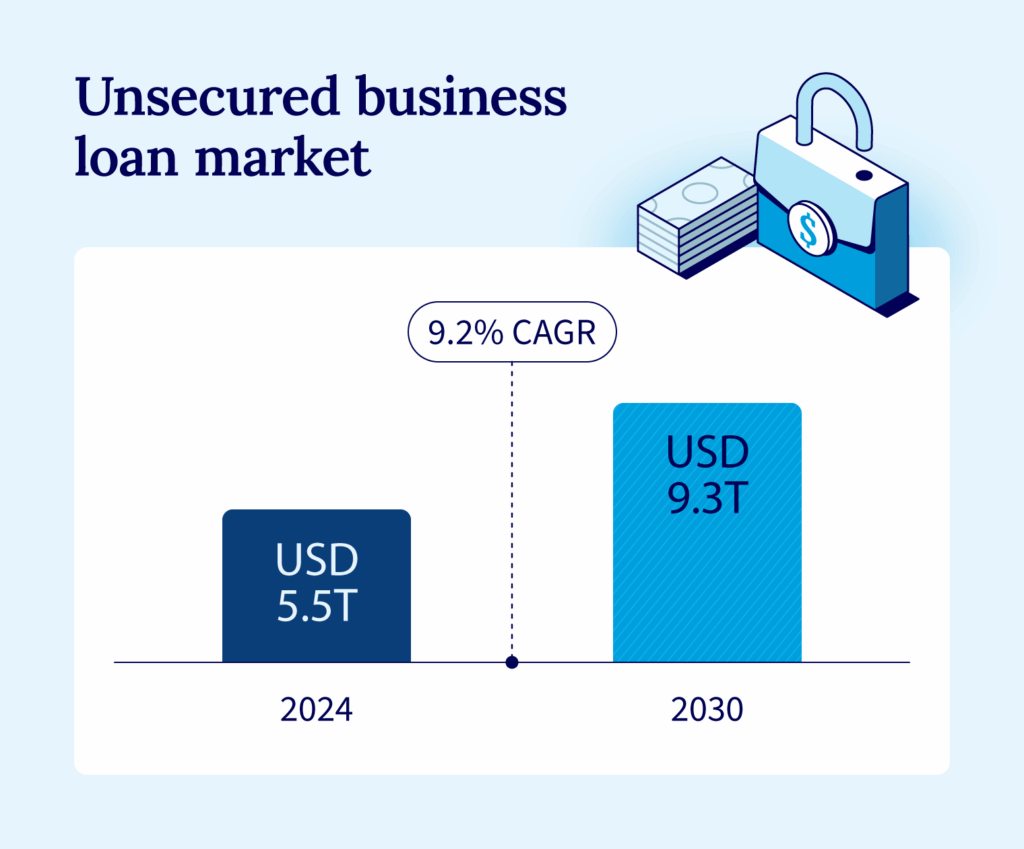

Growing market for unsecured commercial loans

For companies looking to scale up, especially those who are reluctant to commit to companies like property or equipment, unsecured commercial loans are becoming increasingly popular.

According to a recent Global Insights report, more than 70% of unsecured commercial loans in the United States are used in small and medium-sized businesses. This suggests that smaller companies are using unsecured loans as a fast, flexible financing tool.

Trends have accelerated only globally. Research and Markets Unsecured Business Loans Global Strategic Business Report Project Projects The total unsecured loan market will grow at a CAGR of 9.2% to reach USD 9.3 trillion globally by 2030.

This overall market growth suggests increased lender confidence and high demand from borrowers, especially entrepreneurs who prioritize speed and flexibility over mortgage structures. For start-ups and expanding small and medium-sized businesses, unsecured loans quickly become a mainstream financing strategy, not just a backup plan.

The best unsecured commercial loan at a glance

When preparing for your next big move, you have a lot of capital options to choose from. Here is an overview of the top lenders in the United States

| Loan | Maximum loan amount | Minimum credit score | Term length | The best |

|---|---|---|---|---|

| National Commercial Capital | $10 million | 620 | Up to 2 years | Flexible consulting services |

| Bank of America | $100k | 700 | Up to 5 years | Long-term loans |

| Bank of America | $50K | Not disclosed | Up to 4 years | Fast funding |

| Wells Fargo | $150K | 680 | Up to 5 years | Credit limit |

| Ondeck | $100,000 credit limit | 625 | Up to 2 years | Lower credit score |

| blue | $500K | 625 | Up to 2 years | Larger loan amount |

| Fundbox | $250K | 600 | Up to 6 months | Short term loans |

National Commercial Capital

Best for flexible consulting services

- Maximum loan amount: $10 million

- Minimum credit score: 620

- Term length: Up to 2 years

National Commercial Capital provides fast and flexible funds, with some of the industry’s largest loan amounts, up to $10 million. The team is known for its excellent service, with expert business consultants working 1:1 with clients and assisting throughout and after the funding process.

| advantage | shortcoming |

|---|---|

| Trained Advisorshigh Loan Amount | Income requirements for shorter loan term |

Bank of America

Best for long-term loans

- Maximum loan amount: $100k

- Minimum credit score: 700

- Term length: Up to 5 years

As one of the oldest banks in the United States, the small amount of loans offered by Bank of America is offered from $100K. However, banks need higher credit scores to get funds, with a maximum loan amount of just $100,000.

| advantage | shortcoming |

|---|---|

| •The term is up to 5 years • Small loan amount available |

•Higher credit score requirements •Maximum funding reduction |

Bank of America

Best for fast money

- Maximum loan amount: $50K

- Minimum credit score: Not disclosed

- Term length: Up to 4 years

As one of the country’s largest commercial banks, Bank of America offers unsecured loans with a capital amount of between $50 million and $50,000, which is lower than most competitors. However, they do provide quick funding with their “fast loan” option, which is available online.

| advantage | shortcoming |

|---|---|

| • “Fast Loan” option available online •Funding up to $5K |

•Not disclosed credit score requirements •The maximum loan amount is low |

Wells Fargo

Best for credit limit

- Maximum loan amount: $150K

- Minimum credit score: 680

- Term length: Up to 5 years

Although Wells Fargo does not offer unsecured term loans, it does offer unsafe credit lines, which is slightly different from term loans. Although its credit requirements are stricter than other lenders, it does offer reasonable maximum funding restrictions and longer limits.

| advantage | shortcoming |

|---|---|

| •Longer repayment terms available •Includes rewards programs |

•Higher credit score requirements •No semester loans are provided |

Ondeck

Best for lower credit scores

- Maximum loan amount: $100k

- Minimum credit score: 625

- Term length: Up to 2 years

Ondeck is an online lender that does not offer unsecured term loans but provides unsafe business lines of credit, usually funded on the same day. These credit lines tend to have a lower maximum fund than other lenders.

| advantage | shortcoming |

|---|---|

| •Low credit score requirements •The credit line of funds on the day |

•Short repayment requirements •No unsecured term loan option |

blue

Best for larger loan amounts

- Maximum loan amount: $500K

- Minimum credit score: 624

- Term length: Up to 2 years

Bluevine is a fintech company that provides banking solutions for small businesses, including corporate loans, through its lender network. The company offers some of the highest amounts of funds available, as well as lower credit score requirements.

| advantage | shortcoming |

|---|---|

| • High loan amounts available through loan partners •Low credit score requirements |

•No loans provided through blue • Terms and requirements may vary widely based on loan partners |

Fundbox

Best for short-term loans

- Maximum loan amount: $250K

- Minimum credit score: 600

- Term length: Up to 6 months

Founded in 2013, Fundbox is quite new in the small business loan industry. The lender asks much less – three months of business, with an annual revenue of at least $30,000 and a credit score of $600. Fundbox, on the other hand, has a maximum repayment rate of six months.

| advantage | shortcoming |

|---|---|

| • Higher loan amount •Ideal for start-ups and low-income businesses |

• Very short repayment terms • Limited loan options |

Factors to consider when choosing an unsecured loan

There are a lot of variables you will need to consider when you review business unsecured loan options. Some of the most important factors to consider are:

- interest rate: Since collateral is not involved, unsecured loans have higher interest rates.

- Repayment Terms: Repayment can be as low as six months and up to five years. While longer terms will reduce your monthly payments, you will also pay more interest throughout the loan period.

- Funding speed: Depending on the lender, you can get funds on the same day, or it may take up to several weeks. If you need capital quickly, keep this in mind.

- Credit Score: Credit score requirements vary from lenders; some may need as low as 600, while others may require stricter scores, such as 700. Remember that a lower credit score may lead to higher loan terms rates.

- Lender reputation: It’s easy to study a lender’s reputation online, whether through TrustPilot, Better Business Bureau (BBB), or Google Review.

Researching multiple financing types can help you better understand your capital accumulation needs.

How to Get Unsecured Commercial Loans

There are a few things you need to consider before applying for an unsecured commercial loan. This is a general process:

- Consider the type of loan you need. If you need a one-time specific investment (such as a device or extension), choose a term loan as it offers predictable monthly payments. If you need flexibility to access ongoing fees or seasonal cash flow differences, choose a line of credit because you only need to pay the interest you used to use.

- Consider how much money you need. Borrowing too much may overscaling your company, while borrowing too little may require you to submit another loan application. Solve this problem strategically and make decisions based on what best suits your business and its goals.

- Check your credit. Credit score requirements may vary according to the lender, so you need to have a clear understanding of your location before applying.

- Compare the lender. As mentioned earlier, terms and requirements may vary widely depending on the lender you choose. Do your research and choose a lender that makes sense for your business.

- Apply for your unsecured commercial loan. Once you have researched and have the correct information, apply for your loan and make sure to ask any unresolved questions to a representative of your preferred lender.

Pros and cons of unsecured commercial loans

Any type of loan has a share of its benefits and disadvantages, and unsecured loans are no different. Take the time to weigh these pros and cons before applying for an unsecured loan.

| advantage | shortcoming |

|---|---|

| •No mortgage involved means less risk • Faster funding due to the colorless process •Fixed payment • Interest rate is lower than credit card |

• Higher interest rates than guaranteed loans •Stricter qualification requirements •The maximum loan amount is low • Credit may be risky |

Use state commercial capital to find the right unsecured loan

Figuring out how to get a business loan is not always straightforward. The best lenders are financial planning partners that can help you evaluate your choices and choose the one that best suits your goals. National Commercial Capital has many years of experience to help clients find financing that suits their goals and provides 2.5b+ funding to companies across the United States. Our team of expert business consultants will help you throughout the application process when you find the loan that best suits your business needs. Apply now to start and take your business growth to the next level.