AI Underwriting: Beyond the Hype | Insurance Blog

We have Regular investigations On Underwriting for More than 15 years Understand the status of functions and the status of technology–or no–Help it grow. In our recent Report Rewrite coveragewe ask How much does the underwriter spend on non-core tasks. this time,,,,, We’ve seen some incremental improvements Year–Exceed–Year Comparative To us 2021 Survey But there are more Compare third of Underwriter’s Time spent Non-core Activities such as data collection or management activities.

But more than that, our 2024 survey generally expresses hope for the future, that new automation and AI technologies can help change the role of underwriting and truly reduce the time spent on non-core tasks.

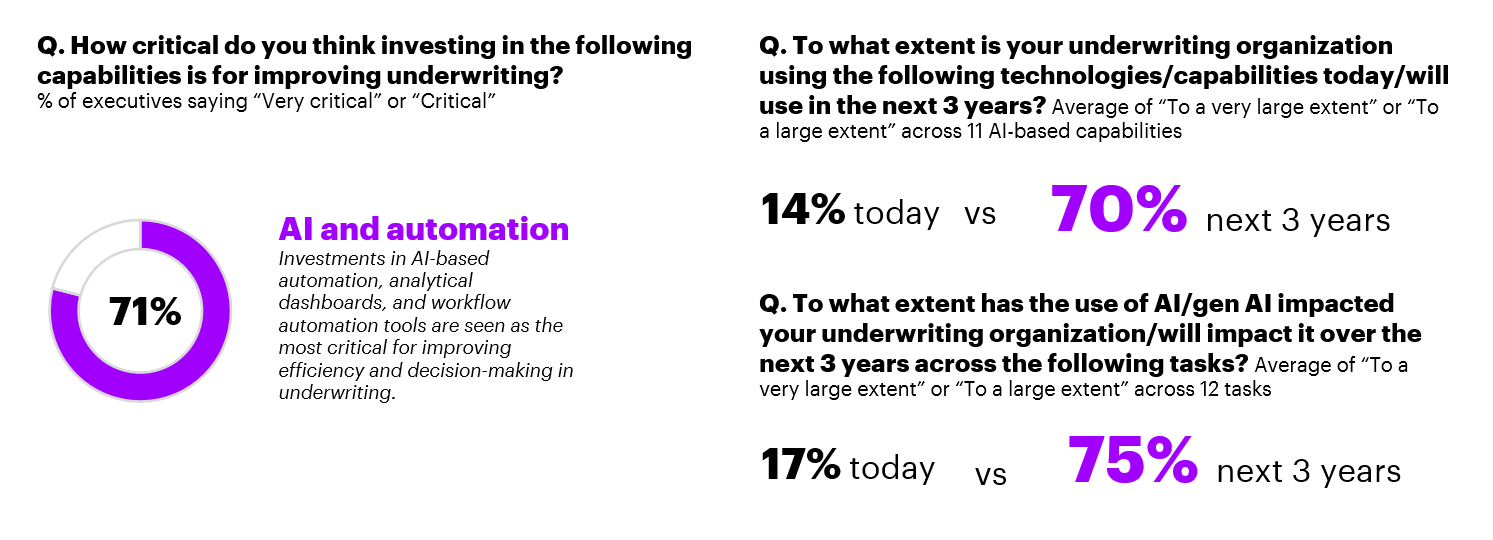

I’ve been walking long enough to remember other new ideas and waves of technologies such as knowledge management, IoT and analytics. While everyone has found a place in the overall insurance industry and technology ecosystem, one might say that no one has really changed the underwriting capabilities. But all the time we’ve been doing industry surveys in my 30-year career, I personally have never seen a number like this:

Embrace automation and AI

According to the above data, the percentage of time spent on non-core tasks is set not just as AI and automation gradually decreases. Throughout life, group, individual and commercial insurance, insurance executives are convinced that AI and automation tools will change significantly and will change it relatively quickly.

Over the past three years, operators have been trying these technologies – for example, pilots for data collection, data synthesis and underwriting advice. While not all of these pilots are likely to be successful, the overall conclusion seems to be that this time it is optimistic justification for solving the share of non-core actuarial tasks. In fact, if you haven’t adopted some kind of AI underwriting-driven strategy, you may be lagging behind based on our survey.

Here are some key data from our recent underwriting execution survey:

- 81% of underwriting executives surveyed believe that AI and AI will create new roles in a large or “largely” way.

- 65% of executives believe their workforce will need to improve their skills as AI becomes an integral part of creating new roles and enhancing existing roles.

- 42% of executives believe they need access to an external talent pool to capitalize on the potential of technology

Authorized AI-LED Underwriters

Combined with modern automation tools and advanced data intake capabilities, AI is perhaps the most transformative force in modern underwriting, balancing efficiency and complexity within controlled areas. It enables natural language processing to interact with clients and brokers to resolve issues and understand requests so that it can be routed to the right solution to be automated. Advanced decision elements and pattern recognition also allow for a wider range of self-service requests to be processed without direct intervention. Additionally, AI can coordinate automation to provide a complete self-service solution.

Let’s be clear: the underwriting role is not gone, but as each operator’s chart is the best way to fuse human plus machine decisions to improve the speed and efficiency of underwriting results, it will be converted.

Your next step as AI enhances your workforce

To succeed in any AI journey, from my point of view, operators need to think through three things:

- AI-led strategies articulate plans to leverage these new tools in existing environments. It needs to be based on a strong digital core. As AI technology evolves into more agents, underwriters can even further increase their productivity by breaking down their workflows and delegating tasks to these AI agents.

- A reimagined talent strategy is redesigning workflows to prepare management teams and underwriting organizations to take advantage of the new capabilities these solutions offer. A skill-based approach will be key, while insurers will need to align AI integration with process reinvention and ensure compliance with responsible AI principles.

- A culture that can explore and experiment while protecting core decisions. Insurers may need bottom-up, rather than top-down AI adoption approaches, leveraging employees’ wishes and desire to experiment with AI.

If you want to learn more about Accenture Insurance Underwriting Execution Survey, please Rewrite coverage Or you can contact me directly.