Fog’s Decision: Mid-Year Capital Report (2025)

In a typical cycle, the script is easier to read. The boom and obstacle cycles provide a clarity. In a boom period, motivation can reward quick action. If you miss it, there is usually another chance. During downturns, it is usually appropriate to maintain. Buffering damage is a drama of schedule.

But 2025 was not given to us either.

It gave us FOG – Uncertainty, volatility.

Opportunities won’t disappear in the fog, it’s just hard to find.

In 2025, companies that have taken bold moves are not hovering on the headlines. They are responding to moments unique to their situation. For a moment, they remained alert and they could see enough to be harder to hit on gasoline.

For consultants and partners who work with these companies, this is not as good as promoting urgency, but rather helping clients explain the foggy imprint with clarity and care.

In the middle market mentality…

In May 2025, we asked over 500 business owners from construction to education, from manufacturing to retail to transportation: How they view the current economy and how this perception shapes behavior.

The results show an astonishing but not surprising gap:

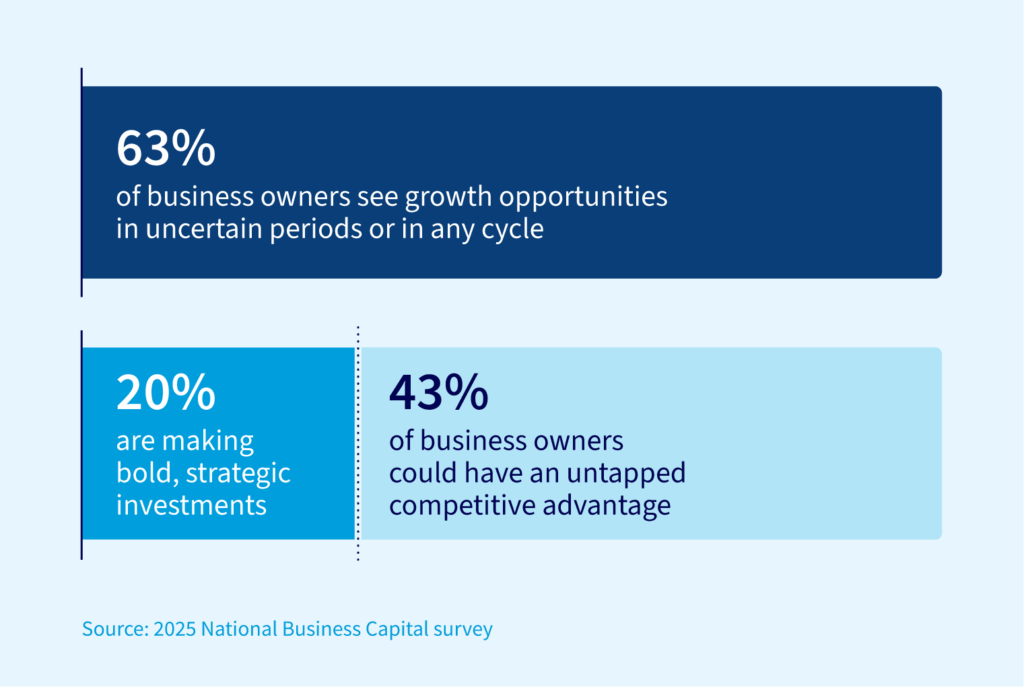

- 63% of business owners believe that growth is possible even under turbulence or uncertainty.

- But, in reality, only 20% are taking bold strategic moves to pursue this growth.

It’s not just a gap of hesitation. This is 43 points Opportunity gap Clustered between faith and action.

Strategic vulnerability is covered in the fog, where beliefs are held, but visibility is not.

Many of these business owners still believe in the possibility of growth but lack the visibility of saying “yes” with confidence. There is no clear status on the ROI window. or The certainty of the stall strategy is implemented around the growth situation. Beliefs remain, but actions cannot translate into initiatives, investments or operations expansion.

Opportunities may call. The desire for growth may be sincere. But without the basic relationships of teams, consultants, partners, and even suppliers, it is difficult for any business leader to tell which risks will pay off as they expand… and the risk of potential fire.

When action requires orientation, it is not just faith…

While many businesses are waiting for news headline predictions to be “all clear”, smaller (highly strategic) are already responding to specific opportunities that require decisive capital deployment.

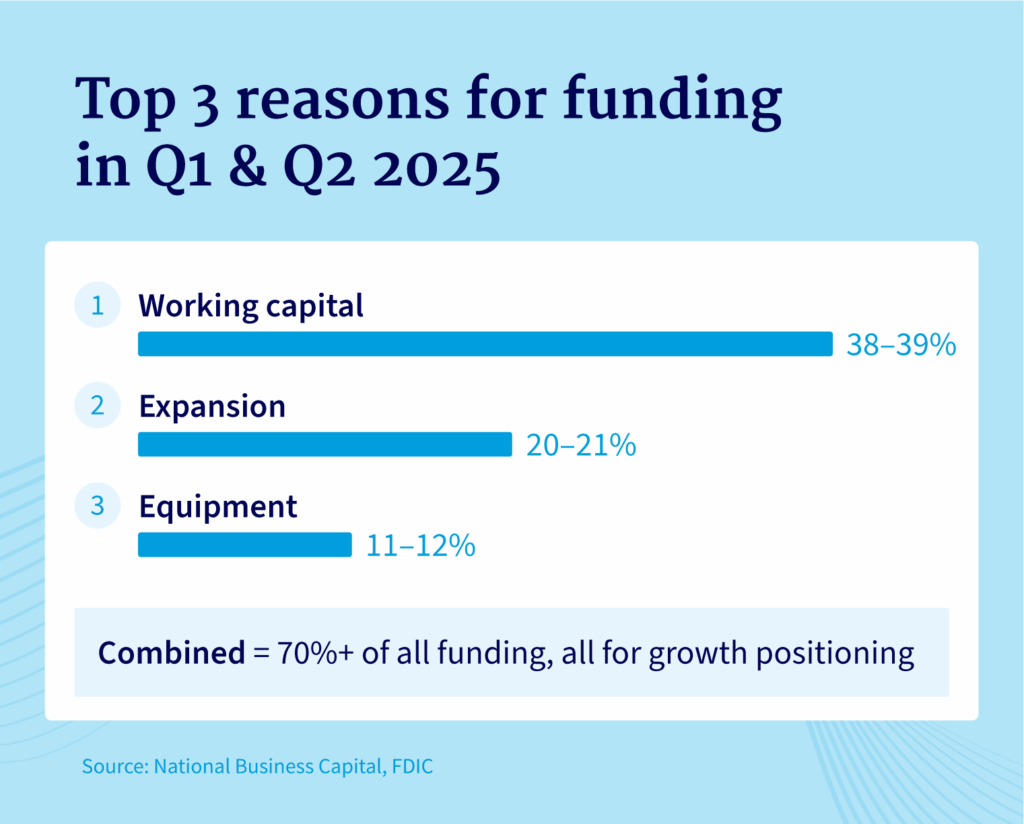

Nationals’ own first quarter-2nd quarter 2025 funding data can support this.

In Q1 2025, we saw:

- Funding demand increased by 94.5%

- Average loan size requirement soars by 114.8%

- The first 3 use cases: Working capital, expansion and equipment it’s over 70% Deploy total capital

These are not defensive actions. them Targeted growth plans Use precise actions, clear prediction of ROI windows and contingency plans.

The second quarter of 2025 brought about geopolitical tensions, with rising tariffs and changes in international policies triggering market declines. However, even with such a background, the momentum on the street has not stopped. Funding demand increased by another 40% compared to the second quarter in our 2024 data.

Yes, yes, yes, but there is no reversal.

This model tells us something important: companies are not only preparing for the next step. Even if the path is not completely visible, they will develop in the future.

As our CEO Joe Camberato said:

“On the streets, power is being built. Business owners are leaning towards growing and moving with clarity, speed and confidence.”

This is especially clear in high-value funds. In transactions over $650,000 or above, the main use cases are about expansion rather than emergency cash, but capital for new locations, capacity increases or long-term equipment purchases.

Even if market hesitation continues, growth is taking root.

Although our data reflects the High Street (i.e., the medium-term market industrial company that did not report its earnings), the Q2 2025 S&P earnings Insights Report (Factset, July 18) shows small signs of growth. Deleting the “Magnificent 7”, the report shows how the experiences of different sectors have experienced the current economy.

In some of the businesses we offer (industry, logistics, construction and manufacturing), the growth model is too quiet for the title, but powerful and easy to read for the mid-market pulse.

Key department data

On our balance sheet, Construction leaders’ funding requirements increased by 40%.

Meanwhile, on Wall Street, industrial companies have an average net profit margin of 10.6%, higher than the five-year average of 8.6%.

→Only 44% Industrialists expanded their profits this quarter; 54% of people experience compression.

the difference? Usually, strategic capital deployment.

Some businesses are using capital to expand and position to gain a long-term advantage.

Others face the same uncertainty, still, feeling the edge squeeze.

The industry likes Healthcare, energy and consumer staple food With the continuous compression flashing red, the business we work with quietly outperforms.

On Wall Street, while technology and finance make headlines, highlights and low lights, Our customers continue to build. They do not dominate the news cycle. They simply fill the package with delivery, welding frames and orders. The economic fog may continue during the H2 period or may be lifted in the coming months. Either way, the business won’t slow down. Our customers and partners are advancing growth plans, and so are we.