Let me introduce you to the investment pyramid. Understanding this pyramid is a game-changer for me.

Decades ago, a wealthy family friend urged me to invest in limited partnershipscalling it “an exciting opportunity.”

I don’t know that limited partnerships are liquid Even if I watched the company go bankrupt, I couldn’t sell my own stock.

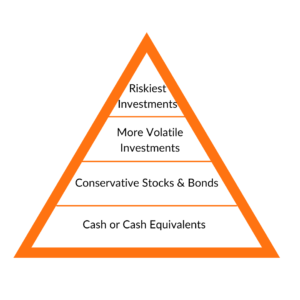

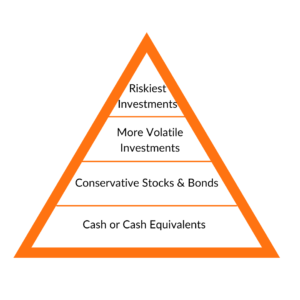

When I told my accountant this story, he drew a triangledivide it into 4 levels, explaining that this represents the entire investment world. My error starts at the top.

Then he reversed the triangle and leaned against its trembling tip. “Look at what happens when you start from the top,” he explained. “Isn’t your portfolio very stable?”

My accountant just gave me the secret to investing wisely: Start at the bottom and then gradually rise by level.

Level 1: Cash or cash equivalents (CD, Treasury bonds, money market funds, basic bank accounts). This is Your safety net. You have cash to pay for unexpected situations without falling into debt. There is almost no volatility, so you are less likely to lose sleep worry. Risk: Inflation.

Your safety net. You have cash to pay for unexpected situations without falling into debt. There is almost no volatility, so you are less likely to lose sleep worry. Risk: Inflation.

Level 2: Conservative Stocks and Bonds (Solid corporate, senior bonds, funds with a good track record.) This level of fluctuation is not just the treasury, but it is very liquid and the returns are enough to offset inflation. Risk: Need to be sold on a downward market

Level 3: More volatile investments (Emerging markets, foreign funds, junk bonds). It’s a small part of your portfolio, as price volatility can be extreme, but it can certainly improve your earnings. However, you need a strong stomach and a longer time frame. Risk: Severe fluctuations

Level 4: The Riskest Investment (Limited partnerships, venture capital, hedge funds, options, commodities). The gains here may be huge, but losses can also lead to huge fate or sudden bankruptcy. Risk: Extremely high.

Entrepreneur, guess where your business is suitable? On top. When women tell me that the biggest, sometimes the only investment is in their own company, I worry.

I urge everyone to make sure they have a reliable cash base and a healthy retirement fund in the bank forward They invest their capital in their own companies.

How do you accumulate investment? Are you on a stable ground or do you need to re-evaluate? Share your thoughts in the comments below.

Barbara Huson is the leading authority on women, wealth and power. As a bestselling author, financial therapist, teacher and wealth coach, Barbara helps millions take charge of their finances and lives. Barbara’s business background, years as a journalist, her master’s degree in counseling psychology, extensive research, and her personal experience in money give her a unique perspective and makes her the most important expert in empowering women to fulfill their financial and personal potential.

Barbara is the author of the latest book on Rewire for Wealth, published in 2021.

Your safety net. You have cash to pay for unexpected situations without falling into debt. There is almost no volatility, so you are less likely to lose sleep worry. Risk: Inflation.

Your safety net. You have cash to pay for unexpected situations without falling into debt. There is almost no volatility, so you are less likely to lose sleep worry. Risk: Inflation.