How it works and how it qualifies

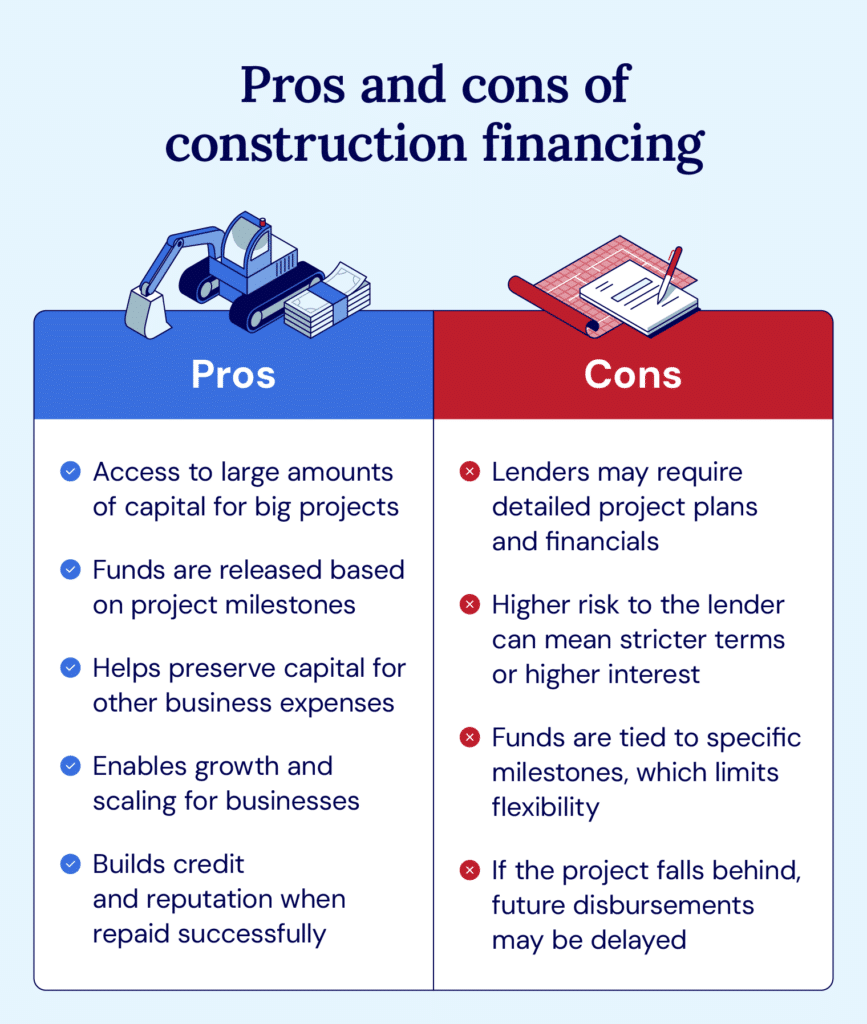

There is no doubt that commercial real estate may be volatile in terms of supply and demand, and few industries have to go as far as construction companies are concerned. Construction financing is a useful way for these companies to withstand this unpredictability and ensure reliable growth and flexibility, regardless of market conditions.

Construction funds can help companies maintain cash flows, and can also help companies expand, reach new markets, and ultimately build successful long-term businesses. In this article, we will look at the ins and outs of this type of financing, the potential benefits of building loans, and how to help your construction business survive and thrive.

Key Points

- Construction financing provides flexible funding for equipment, materials and operating costs.

- Decline payments are usually between 20-30%.

- Available options include credit lines and equipment financing.

What is construction financing?

Construction financing is an easy way for construction companies to get the funds they need. Some uses may include:

- Expand contract labor

- Obtain the required permission

- Purchase equipment

- Building materials

This is just a short list of ways you can take advantage of building financing. Like any other type of financing option, you need to meet certain requirements to obtain a construction loan.

How does construction financing work?

Suppose your construction business will have a huge job next year. You have done this kind of work before, but this particular project is of different size. You need more equipment, and a lot of equipment. In this case, you may strongly consider getting temporary financing for new equipment.

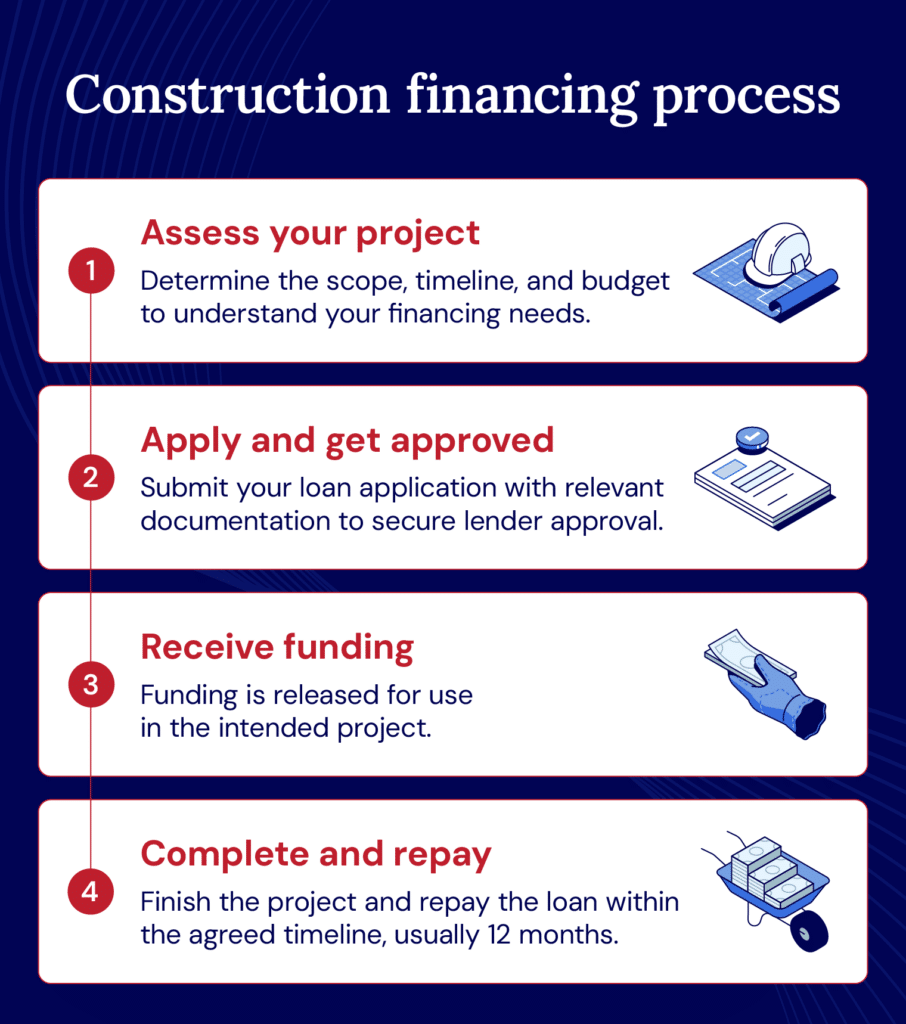

The next article is learning how to get funding for a construction company, which is first to get approval. Once your business has received construction financing, you will have to complete the construction process and repay the loan before your term. The lender will need detailed information about the project to secure the funds.

To qualify, you need to be a licensed and experienced construction business with a strong credit and financial record. This is mainly because the bank believes that the amount of capital involved in these types of loans and the potential for unfinished construction projects, so the bank does not have any collateral.

How can contractors be eligible for construction financing?

As we mentioned, the financing of a construction company requires the company to provide detailed information. Some examples include:

- Positive financial records: When building loans and other financing options are offered, lenders take risks. Your credibility helps offset this. You will need a good credit score of at least 680 and prove enough income to justify the loan.

- Completed building plan: The lender will need detailed information about the program before he can release the financing.

- License and experience proof: Most lenders will only deal with licensed contractors who have experience making money and repaying loans.

Be sure to ask your lender about all construction financing requirements you need to meet before applying. They may also offer a simpler alternative to the construction financing process.

Types of construction financing for contractors

When it comes to construction financing, contractors have a variety of options. Some people may make more sense to your business than others, so research to find the best loan options. Here are some common examples.

Cash flow financing

This is usually a short-term loan that provides immediate unsecured funds. Cash flow financing can be used in emergencies, such as payroll needs to be met. This financing option has higher interest rates due to the lack of collateral.

Credit limit

The credit line is the same as any other business line of credit. It has flexibility because it can only earn money when needed. The better your credibility, the more funds you can use. This financing option is a revolving line of credit, which means you can repay the loan and then borrow. You must pay interest on the actual capital you borrowed.

Equipment financing

Equipment financing is an excellent option to fund the purchase of construction equipment, such as machinery, vehicles or other tangible assets required for commercial operations. It is intended to be used specifically for this purpose, and the device itself is often used as collateral.

Find construction financing options that suit your needs

Contractors and construction companies are like any other business that relies on cash flow, sustained profits, and stable business development and thriving. Construction financing can help these businesses better control cash flow management, bridge short-term gaps and build development for the future.

If you are not quite sure if construction financing is suitable for your business, National Enterprise Capital can guide you through the process, from a quick start to consult to completing a financing application. You can contact us anytime today.

Frequently Asked Questions

The interest rate for construction financing depends on factors such as the credibility of the contractor, market conditions and loan type. Typically, they range from 4% to 12%.

For construction financing, collateral usually includes the construction project itself or other real estate assets. The lender can also consider the equipment, business assets or personal assets of the business owner.

The repayment terms for construction financing usually range from the short term (12-24 months) of smaller projects to the longer term of larger projects. Payments may only pay interest during construction, while principal is paid upon completion.

Businesses can use construction financing to pay for land, construction labor, construction equipment and materials, and required permits.