How to build your credit profile

Every successful business owner knows that growth requires strategic financial planning and the right tools to seize opportunities. Whether you are expanding operations, investing in new equipment, or leveraging market opportunities, having strong business credit opens the door to possibilities.

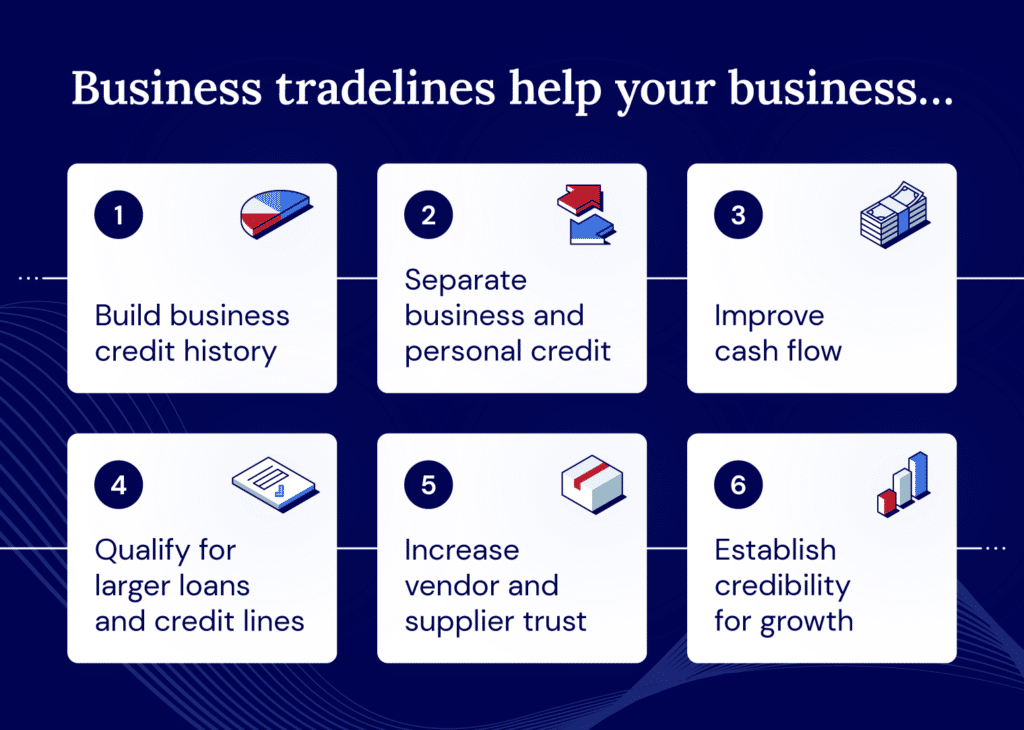

Commercial trade channels provide enhanced cash flow and sustainable growth. With established trade credit, companies have obtained better financing terms and the financial basis required for confident scale. The trading line is both a growth accelerator and a safety net to ensure you are ready for any opportunity or challenge you have. We will explore how they work and whether they are suitable for your growth goals.

What is business?

A business transaction line is a credit account that your business has established with a supplier that reports it back to a major credit bureau. A similar account, but not always the same, is a Net-30 account that is a provider that is limited to 30-day repayment period.

Since business is a form of credit, it is reported to major credit bureaus such as Experian and Equifax. Not only does the transaction line help build credit in your business, it can also help the company get immediate cash flow funds. Remember that the credit line will reflect the reputation and history of your company and is not related to your own personal credit information.

Why is business important?

Commercial commerce is important because they provide companies with instant access to goods and services without prepaid cash, which significantly improves cash flow management and operational flexibility. These established trade accounts with suppliers and suppliers allow businesses to purchase inventory, equipment or materials on favorable payment terms, thereby freeing up working capital for other key growth-focused investments such as marketing, recruitment or expansion.

By expanding payment cycles and creating predictable cash outflows, Tradelines allows businesses to better align their spending with their revenue cycles and maintain optimal cash reserves. This enhanced liquidity management means that companies can respond faster to unexpected opportunities or challenges without exhausting their cash reserves or seeking emergency financing.

For growing businesses, business creates a financial buffer that enables strategic decision making rather than reactive scrambles, enabling companies to capitalize on market opportunities, manage seasonal volatility and maintain stable operations, even during temporary cash flow challenges.

Key information about business

Like any other type of financing, such as credit lines, there is no lack of some kind of risk. Before you decide to get a trading line for your company, you need to know what you are entering.

Here are some pros and cons worth considering:

advantage

- Rapidly improve cash flow

- Easier to qualify than traditional small business loans

- Reduce interest rates

- An easy way to build credit history and score

shortcoming

- Small credit limit initiated

- Loan fees are part of the transaction

- Short repayment terms

- Can lead to a continuous cycle of debt without the need for active repayment

How do you get a business transaction line?

If you weigh the pros and cons of commercial credit and think it’s for you, you need to get one.

- Open a credit account with at least one company that reports to the major credit bureau.

- Make sure you meet the company’s credit requirements, which most likely involves your credit score, credit history and business hours.

- Be prepared to provide relevant information such as your employee identification number (EIN), commercial bank account, business registration and license.

Once you have established a revolving business line of credit, you should get the next line of credit more easily.

How many businesses should you have?

If you want to establish a credit score in a shorter time, then there are at least two suppliers of items (if not more, a bad idea). Keeping these accounts active and semi-regulated will help build your credibility. More types of these types of transactions you record, your score will slowly increase, and lenders will be more willing to offer new commercial transactions in the future.

| It is important to remember: |

| Maintaining multiple open transactions requires careful management. Excessive expansion in excess credit accounts will damage your ability to meet your payment obligations and your damage relationship with your major supplier.

Additionally, juggling numerous transaction payments can create complexity of cash flow and increase the risk of missing payments, which can lead to lower credit limits, lower terms, and even damage your business’s account. |

How to build business industry activities

Once you have a business credit business foundation, you can start building activities and improving your credit. Make sure you manage your account in a smart way to maintain a good reputation with your lenders and credit bureaus.

The best ways to do this include keeping balances low, paying on time, conducting regular activities such as simple, small purchases, and other forms of credit agility you use. If you open too many accounts at once, this could be a red flag for creditors.

One easy way to maintain credit is through credit monitoring services. These services will regularly update your credit score, monitor your credit activity, and alert you about actions that may affect your score or overall profile. These services are very affordable and remove a lot of the pressure associated with tracking your own credit.

Use national commercial capital to ensure credit

Promoting your credit profile, building capital, and moving towards growth plans are key advantages of business business. If you think commercial credit is a great solution for you, then National Commercial Capital has expert business consultants who can help you understand your options.

If you still have questions, we can walk you through the application process so you can feel comfortable before making a final decision.

Frequently Asked Questions

Yes, business is legal. Some controversial buying and selling methods that usually frown in the credit industry.

Yes, you can buy commercial business, but credit bureaus usually discourage it. This involves paying third parties to add you to a credit account, essentially allowing you to “carry” their good credit use to help you build your own credit. The bureau believes that buying a transaction line is an attempt to misrepresent your credit history, and some people ban the sale of commercial goods altogether.

To get a delivery in your business credit report, you just need to establish a credit account with another business or supplier that reports it back to one of the major credit bureaus. Repaying your credit line on time will also help build your credit and help you gain more capital in the future.