365-day currency challenge, new year or any time

The history of challenges

There was a woman who said she liked the concept of a 52-week currency challenge, but she couldn’t do it. She explained that she would panic when she needed to put the money on hold that week.

The first few months were OK because the dollar count was low, but as they started to grow, the weekend turned into a horror period because she knew she needed to take money she didn’t have. She eventually gave up because the pressure caused by the challenge exceeded value. She asked me if there were different challenges that could help her.

It’s clear what she needs. She likes the concept, but when she is going to put the money away, she is scared because there is no money at the end of the week. What she needs is a challenge that forces her to save money before it goes away. She also needs to save a smaller dollar amount. Doing this will help so that she will not panic. The 365-day currency challenge was born.

How the 365-day money challenge works

The concept of challenge is simple. There are 365 days in a year. You need to pay first before going out every day. This step is crucial. The woman panicked because she had no money every weekend. What she needs to do is pay first.

How to incorporate 365-day currency challenges into your life

The best way is to old-fashioned – actually print out the challenge graph. Once you print out the challenge sheet, you need to place it where you will see each morning – somewhere on the mirror in the bathroom. It needs to be visible where you see every day, so it’s unlikely you’ll forget it.

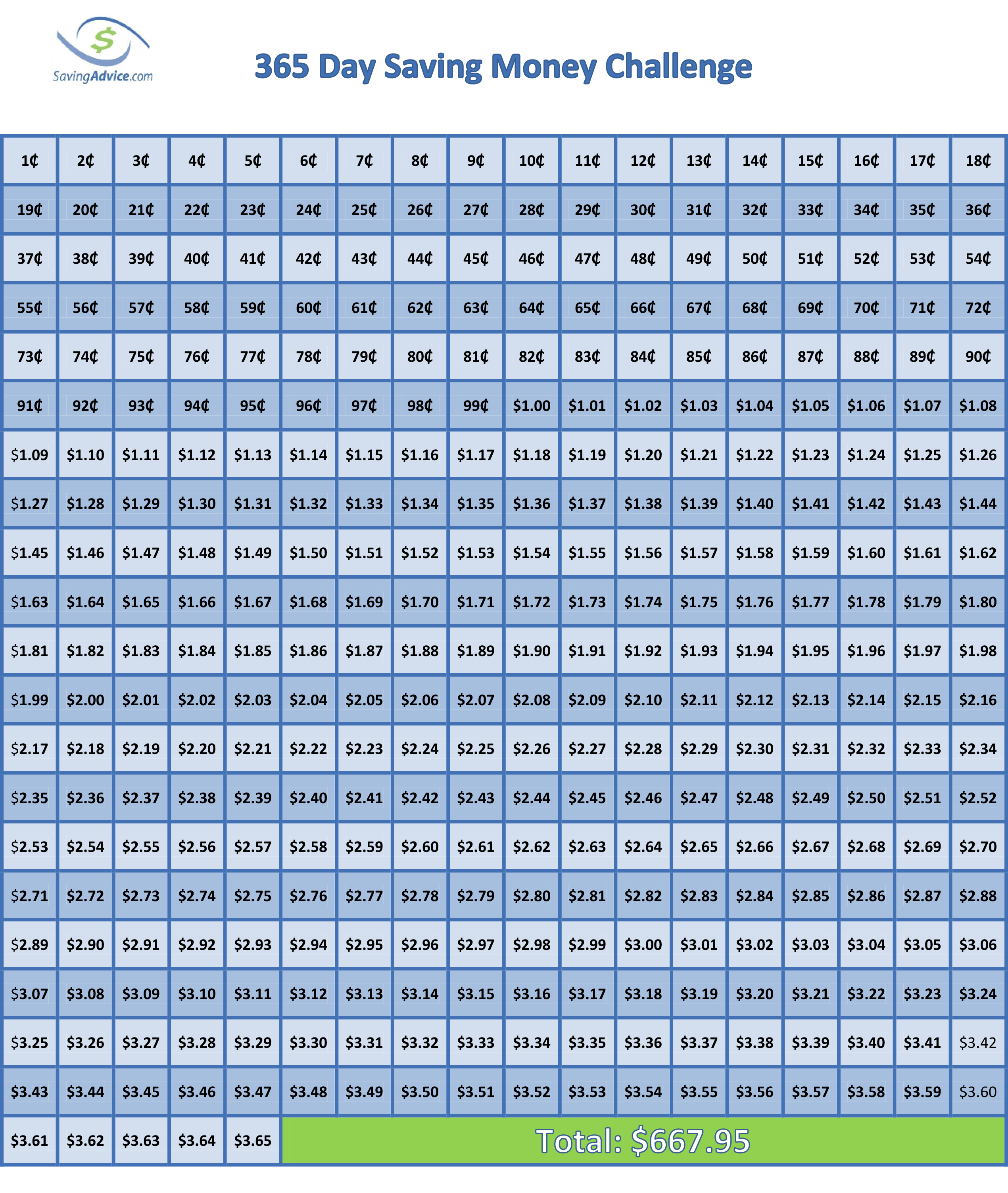

Every morning when you wake up, you have to pay some other fees before doing something else. Payments can range from one cent to $3.65. Once you pay yourself, you will have the “x” box on the chart. Your next payment can be the remaining amount on the table the next morning. You continue to do this every day throughout the year. Once done, you will save $667.95. Even better, you will form the basic financial habit of paying first, which will be an asset for the rest of your life.

365-day currency challenge

Flexibility is key

Some people are having trouble with money challenges because every week you have to save on the increased amount. By December, you pay more in the challenge than any other month. Unfortunately, this is also when you are most expensive due to the holiday. In the 365-day currency challenge, you can choose how much you want to put every day. If February is the bright moon of the bill, choose a higher daily total savings. Then, in December, when the swing room is smaller in budget, you can save a smaller amount.

Develop the habit of paying for yourself

Research shows that forming a habit can take as little as three weeks or 254 days. Therefore, it is important to save as easily as possible. Paying yourself or transferring funds for one year can meet all the requirements for developing habits. Continuing this habit will help you build wealth as your income grows. By the end of this year, saving money will be a natural part of your day.

Advantages of Challenge

This savings challenge has some advantages.

For any budget, the savings are possible

The first is that you start with a small amount, and anyone, regardless of their current financial situation, can participate. If all you can do is pay the absolute minimum amount per day in the first month, the 30-day price is just $4.65.

You ended up with an excellent introductory emergency fund for a year

Additionally, $668 is a great start to the emergency fund. More important than this, you will be able to save more money on your next few years. If you save money in a high interest savings account, you will get a higher balance of compound interest.

Other challenges you might want to try

If you want more challenges, add daily value. If you want to try another alternative, here are some challenging articles that might be better:

They were all written in 2013, but all of them are for everyone today.

Find cash for 365 days of currency challenge

The first few days of the challenge were easy. You only save a few conveniences every day. However, as the challenge progresses, you need to save a lot of money. To do this, you may need to find extra money. If this is your case, here are some new ideas to get you started.

- Sell your personal data: The regulatory landscape has changed since the 2000s. Your data can now be sold online and compensated. Typically, data brokers need things like your purchase history, web browsing history, and demographic information. This is usually for sale by large companies that use it for advertising. Good companies worth considering are: Nelson’s rewards for opinions and smart connections. You get $2 to $4 per month from each month, but that’s passive.

- Conduct investigation: This is a slow way to make money, but it works. This may be a viable strategy if you have limited time, but hopefully there are a few dollars to meet your savings challenge goals. The absolute best survey application is 1q. Each question is paid 25 cents, there is a brief questionnaire, and paid immediately after the question is answered. Worth registering.

- Sell your backup internet bandwidth: You may have more internet bandwidth than you use. Try selling it. Good apps are earned with apps and honey.

The internet is full of money-making activities, so I won’t say more here. Instead, read the following link:

Savings Advice Forums have excellent classic clues on how to make money.

Adam Froy has a list of interesting contemporary ways to make money online – this is no longer your mother’s internet.

Finally, if you need to find cash in a 365-day currency challenge, don’t forget good old ergonomics. Spend less than you earn, comparative shopping and using coupons are great ways to make money.

The final thought

You may have decided not to participate in the money challenge because at the end of the challenge, the amount is too high. However, this is not the case with the 365-day Currency Challenge. No matter your budget, you should meet this challenge. By the end of this year, you will develop a saving habit and you will have a great introductory emergency fund.

Read more

Back to the one you love! Dollardig.com is the most reliable cash folding website on the Internet. Simply sign up, click, shop and get all cashiersk!

Jeffrey Strain is a freelancer whose work appears on Street.com, seekingalpha.com. In addition to writing thousands of articles, Jeffrey is a former resident of Japan, a former owner of saving advice.com and a professional digital nomad.