Policies, workflows, documentation and CRM are all in one platform

This post is part of a series sponsored by expert insurers.

MGA and wholesale insurance operations are very complex – mobile works scattered in disconnected tools, email inboxes and outdated software. From intake and underwriting to record processing and broker communications, teams have historically been forced to piece together temporary workflows to get the job done. This pieced together method can lead to inefficiency, chaos and risk at every turn.

Changes in expert insurance. By integrating policy management, workflow automation, document processing, and CRM into a modern platform, we reimagine how insurance teams work. Submissions, documents, and broker interactions all live in an intuitive system, simplifying operations from beginning to end.

Policy and workflow management, seamless connection

Expert Insurance first turns complex processes into clean visual workflows. Each submission, quote, and strategy follows a well-defined path (divided into intuitive stages), so your team always knows where they are and what they are next.

Figure 1: The status bar shows the submission life cycle from license to issuance.

During the submission process, the user can immediately view the stage where the file is located – whether it is waiting for clearing, references, or ready for binding. This visual layout allows onboarding and eliminates the second guess.

![]()

Figure 2: User-specific work queues display active items.

Each user sees their personalized work queue, showing exactly what submissions or policies they are responsible for, and the stages each stage is in. Need to reassign work? Simply move the project to another user’s queue and get a complete understanding of who has something and location in the workflow.

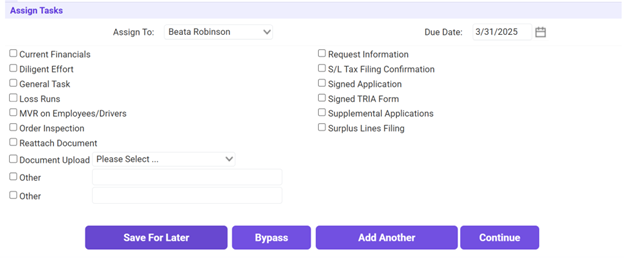

Figure 3: The task interface allows users to assign team responsibilities.

In addition to standard workflow tasks, expert insurers support flexible tasks. Regardless of whether someone “has” a submission or policy, they can be assigned specific follow-up actions, questions or approvals without breaking down process integrity.

Files, embedded in the place where you work

Documents are at the heart of every insurance transaction, but in most systems they are considered as afterthoughts. Stored in shared drives, buried in email threads, or inconsistently named across folders, they are often difficult to find and manage. By embedding document management directly into expert insurance changes in the policy lifecycle, everything is stored, organized and accessible, exactly where and when it is needed.

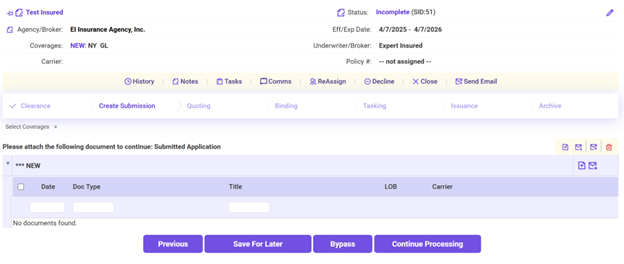

Figure 4: The required application documents must be uploaded during submission.

Whether you are collecting applications, signed quotes, or supporting documents, everything can be uploaded directly to the system by drag and drop. You can tag documents with custom tags such as “Loss Run”, “Signed Adhesive”, or “Broker Submit” to keep all structured and searchable content. These files have been attached to policies or submissions, so there is no risk of their loss on a shared drive or someone’s inbox.

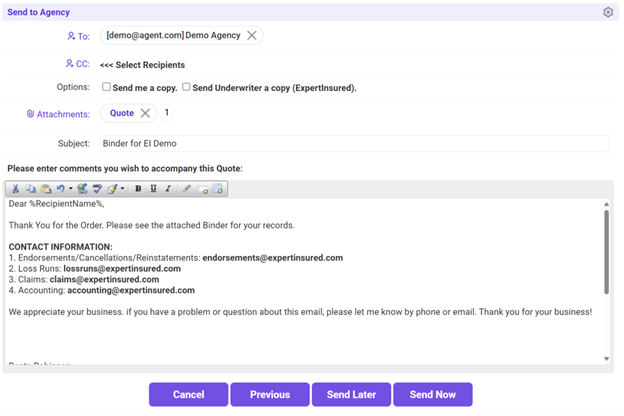

Figure 5: Documents are emailed to brokers without leaving the system.

Expert insurance also makes it easy share The same is true for files. Need to send a quote letter or request a lost item? You can send emails directly from the system without downloading or switching to Outlook or Gmail.

It works, too. Since the expert insurer connects directly to your email, you can easily extract attachments from Straight Email Enter Just click (no need to save, rename or upload) the system. Found the broker’s submission package in your inbox? Simply select email and place the document directly in the workflow.

With a full version of history, embedded templates for document generation, and seamless communication, Expert Insurance’s document management is more than just an add-on – it’s part of the full integration of your underwriting and repair process. Organized, ready, and always where you expect.

CRM that works like you

Relationships power wholesale insurance business, but traditional CRMs are often disconnected from the policy systems they should support. Expert insurers bring CRM functionality directly into your daily workflow, so each interaction is based on actual business activities.

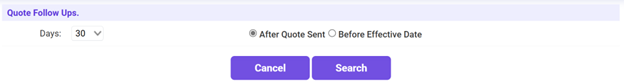

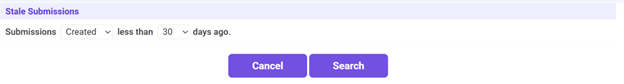

Figure 6: Quickly search for outdated submissions and send targeted follow-ups from within the system.

Track all submissions, quotes and conversations with your producer in one place. You can set up follow-up reminders, search for inactive submissions, and then email them directly by sending them an email without switching tools.

Since CRM is within the same platform as your policy data, your insights are always accurate, actionable and in context. You not only need to record contact information – you will actively strengthen broker relationships and drive revenue.

Conclusion: The power of true integration

Experts insured are not just a cleaner UI, it’s a transformation in how and should insurance operations work. With policy workflows, document management and CRM both live on the same platform, teams move faster, collaborate better and serve brokers more effectively.

This level of integration eliminates friction, improves clarity and supports growth without the overhead of multiple systems. For MGAs and wholesalers who want to expand smartly and be confident, what Experts insured is the system that ultimately brings all of this together.