Commercial Invoice Factoring Guide (2023)

Do you want you to be able to leverage the value of incoming invoices to support your growth plan? You can break down through invoices, and doing so can help you avoid interruptions in cash flow that affects your business.

approximately 60% of business owners At some point experiencing cash flow issues, invoice factoring can help businesses mitigate these disruptions. When used to boost growth, invoice factoring can help you gain the resources you need to make strategic investments and maintain your organization’s cash flow.

Let’s take a look at the guarantee of invoices, how it works, and how to choose the best factoring company for your needs.

Table of contents

How does invoice factoring work?

Invoice factoring is Accounts receivable financing This allows you to sell existing invoices to third-party factors at a discounted price. This is a way to access unpaid invoices without waiting for the customer to pay the capital they owed. Typically, factors will make 80% to 90% of the invoice value minus any applicable expenses.

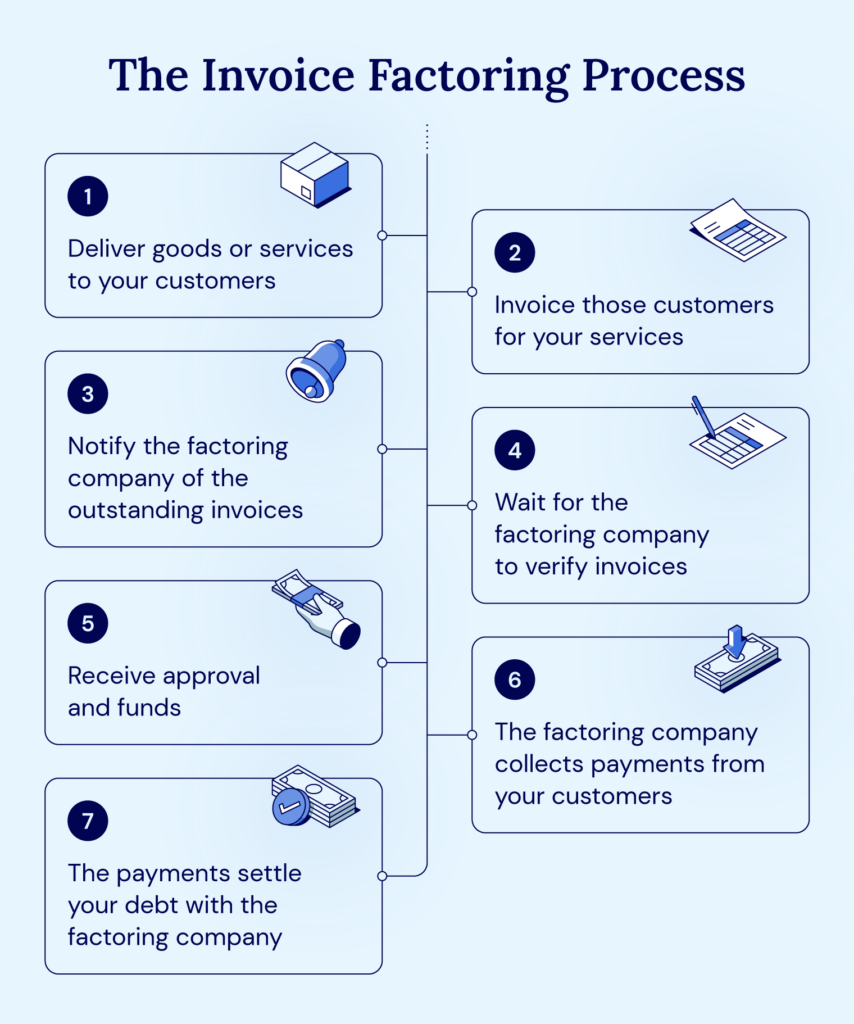

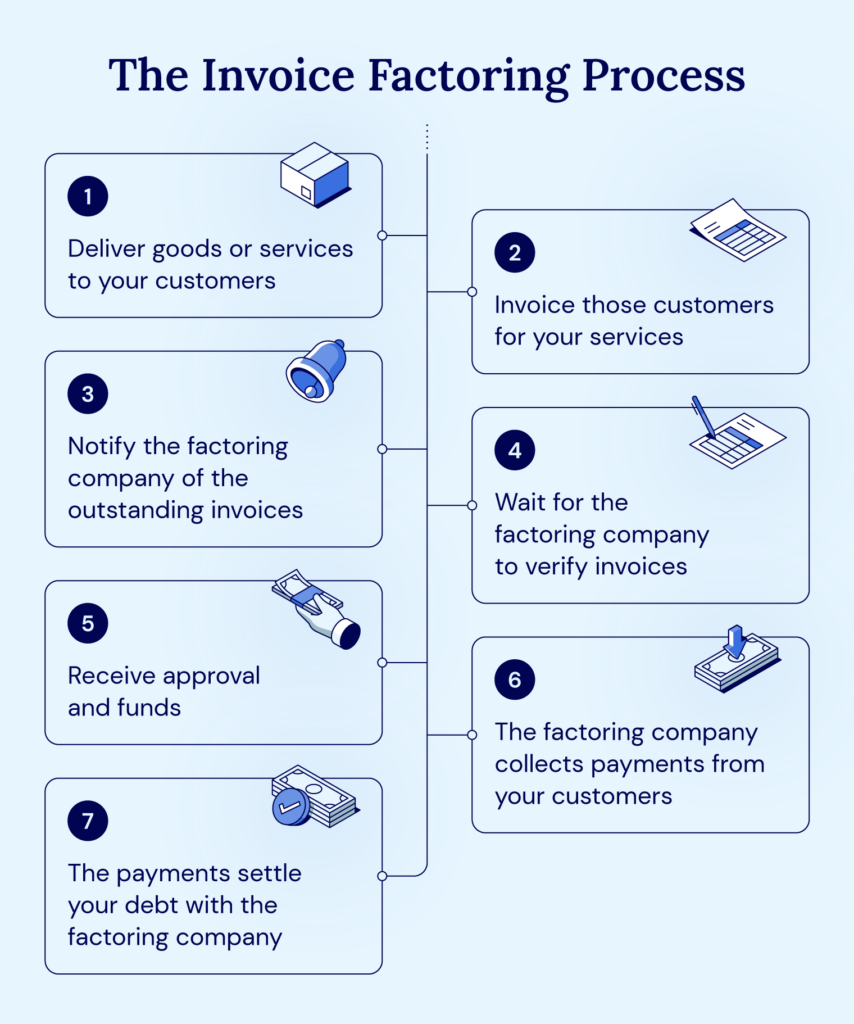

Invoice breakdown usually follows this process:

- Step 1: The business contacted a factoring company to sell invoices for its instant capital.

- Step 2: The business establishes an account with the factoring company and drafts it Covered Agreements contract Range, amount and cost.

- Step 3: Factoring companies conduct due diligence on invoices, bill Effectiveness and customer’ Payment ability.

- Step 4: Factoring company Provide a copy of the final reason agreement for the business, stating that they will purchase the invoice you specified and provide you with a specified percentage of its value minus the factoring fees paid to the factoring company.

- Step 5: Factoring company After the two parties sign the agreement, commercial capital will be given.

- Step 6: tHis consideration company is responsible for collecting invoice payments Notification of tasks (NOA).

- Step 7: The company’s clients pay the factoring company what they owe to the company to settle the company’s debt.

This process gives you access to capital tied into an invoice so that you can pay for your expenses and grow your business without waiting for payments for the invoice.

Remember that some factoring companies may notify your clients that they are now legally charged invoice payments. If you are worried that your client knows you are selling their invoices, you may want to consider working with other factoring companies.

Some offer non-notification factoring to keep transactions cautious. If it is important to keep this information confidential, please ask potential lenders about their notification policies before signing the agreement.

Types of small business invoices

Companies can choose from several major types of business invoice factoring to obtain capital. While the type of you are pursuing depends on your business needs, you need to fully understand your choices before starting to find the factor companies you work with.

This is the most common factoring type:

- Spot decomposition: This enables businesses to selectively consider single invoices, making them ideal for covering occasional slow periods.

- Selective invoice factoring: This method allows businesses to select several invoices at a time.

- Recourse decomposition: If the business assumes the responsibility of collecting payments from clients and repaying factoring companies, it can be considered. If they fail to collect payments, the business must repay the factoring company at the expense of unpaid factors.

- Non-recovery factoring: This method makes the factoring company responsible for collecting payment invoices. If the client is unable to pay, the factoring company will bear the loss.

- Contract Factoring: This approach allows businesses to reach an agreement with factoring companies so they can consider the minimum number of invoices per month.

The factoring method you choose depends largely on the company’s needs and doubts about cash flow.

Invoice factoring example

Let’s take a look at how invoice factoring works in practice. Suppose Company A sold ten pieces of equipment, totaling $1 million. The clause states that these units should be paid 30 days after delivery.

We assume that Company A has sent orders that exceeded expectations. They need to buy inventory to meet demand quickly, but cash flow is tight after initial purchase. They are looking for ways to generate immediate cash flow to keep the business running.

To free up working capital, Company A decided to consider invoices:

- Company A contacts a factoring company Invoices for sale of instant capital worth $1 million.

- Company A establishes an account with factoring company and drafted an agreement outlining the scope and amount of the contract and any fees associated with the contract.

- Factoring company conducts due diligence Enter the invoice of Company A and provide the company with a copy of its final agreement to purchase its invoices, with a total of $980,000 of a fee of $200,000 and agree to pay the company 90% of the total invoice amount. That’s $702,000.

- Both parties sign an agreement The factoring company offered the company $624,000 for a one-time payment.

- tHe considers the company and then collects payment Used for excellent invoices.

Each case is different, but this example should give you an idea of what you would expect if you consider an invoice.

Pros and cons of invoice decomposition

Like any business activity, invoice factoring comes with quite a number of advantages and disadvantages. Let’s explore some of the advantages and potential disadvantages of this type of financing.

| advantage | shortcoming |

| Quickly enter capital: You can get approval and be paid in just 24 hours. | Potentially high fees: Factoring can become expensive, with fees ranging from 1% to 5% of the value of each invoice. |

| Minimum risk: Factoring does not require you to use assets or property as Collateral. | Potential for retaining bad debt liability: Factoring companies will expect you to manage unpaid invoices and bad debts. |

| Ability to focus on operations: You can spend more time in your business than chasing unpaid invoices. | Potential customer relationship damage: Some factoring companies may notify your customers, which may damage consumers’ confidence in your brand. |

| Pay the fee in a slow time: Breakdown allows you to create cash flows to bridge the gap until the business recovers. | You can lock your contract: Some factoring companies require you to agree to consider a certain number of invoices per month for a set time. |

Before signing on the dotted line, review any possible factoring agreements and consider how the benefits and disadvantages affect your business.

What is the cost of invoice decomposition?

Contrary to many Invoice factoring myththis financing method does not have to be very expensive. Although different factoring companies can set different terms, most monthly fees are based on percentages of invoice values.

The fee is usually from 1% to 5% of the invoice value every 30 days. For example, if you take a $10,000 invoice and a 2% time-based shipping fee, you may pay $200 per month until the customer pays the invoice in full. If your customers pay invoices quickly, the fees you pay can be very low.

Be sure to compare the fees for each breakdown company before you agree to the terms. This way, you will know how much you will be responsible for before signing the contract.

When to consider business invoice breakdown

Invoice factoring can help your business improve its cash flow quickly and can be an excellent choice for traditional loans and lines of credit. However, this is not the perfect solution to meet every business requirement. Let’s take a look at some of the situations in which invoice factoring can help you solve:

- You want to accelerate your business expansion, but your cash flow is tight: Invoice factoring can provide pre-provided capital, making it easy to take advantage of growth opportunities even if cash flows are tight.

- You received a large order request: Invoice factoring can help you if a customer places a large order and you don’t buy cash upfront to buy new inventory to suit their requests. You can take advantage of excellent invoices to get the money you need to adapt to their orders.

- You want to negotiate better rates with suppliers and suppliers: If you pay your invoice quickly, suppliers and suppliers may be willing to offer you better rates. By using invoice factoring, you will gain access to upfront capital, which you can use to quickly repay suppliers and possibly negotiate higher rates on future orders.

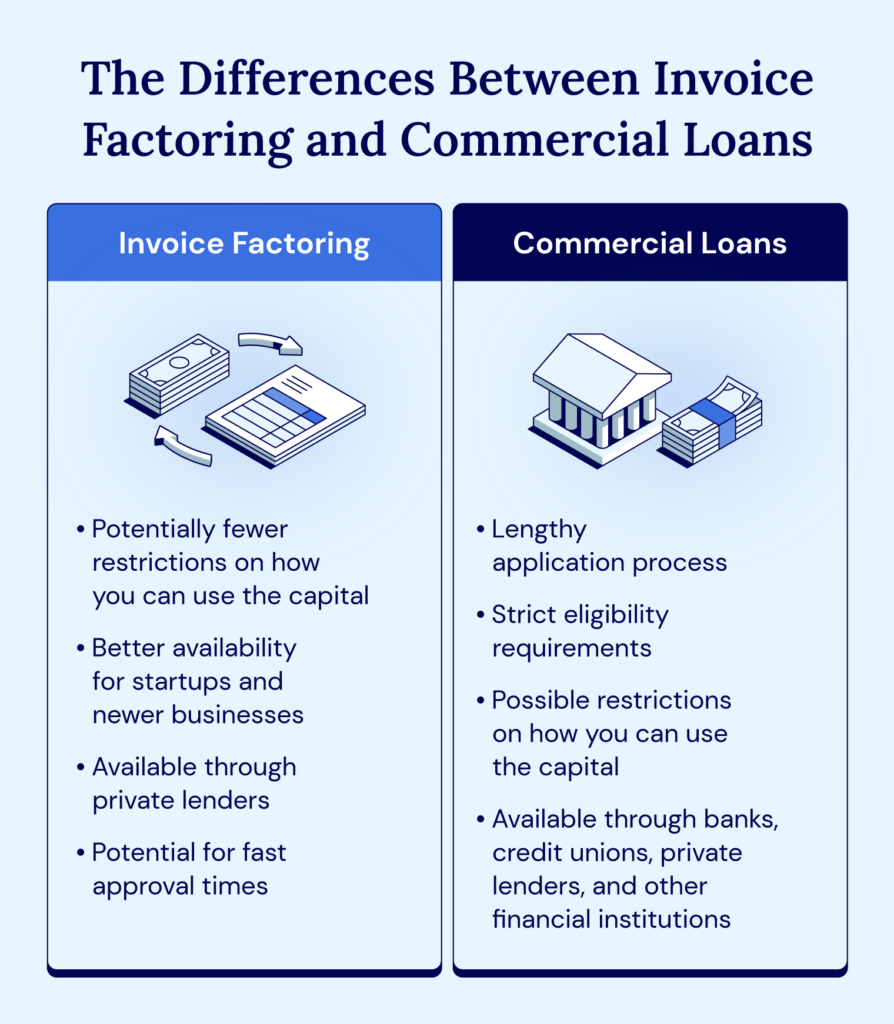

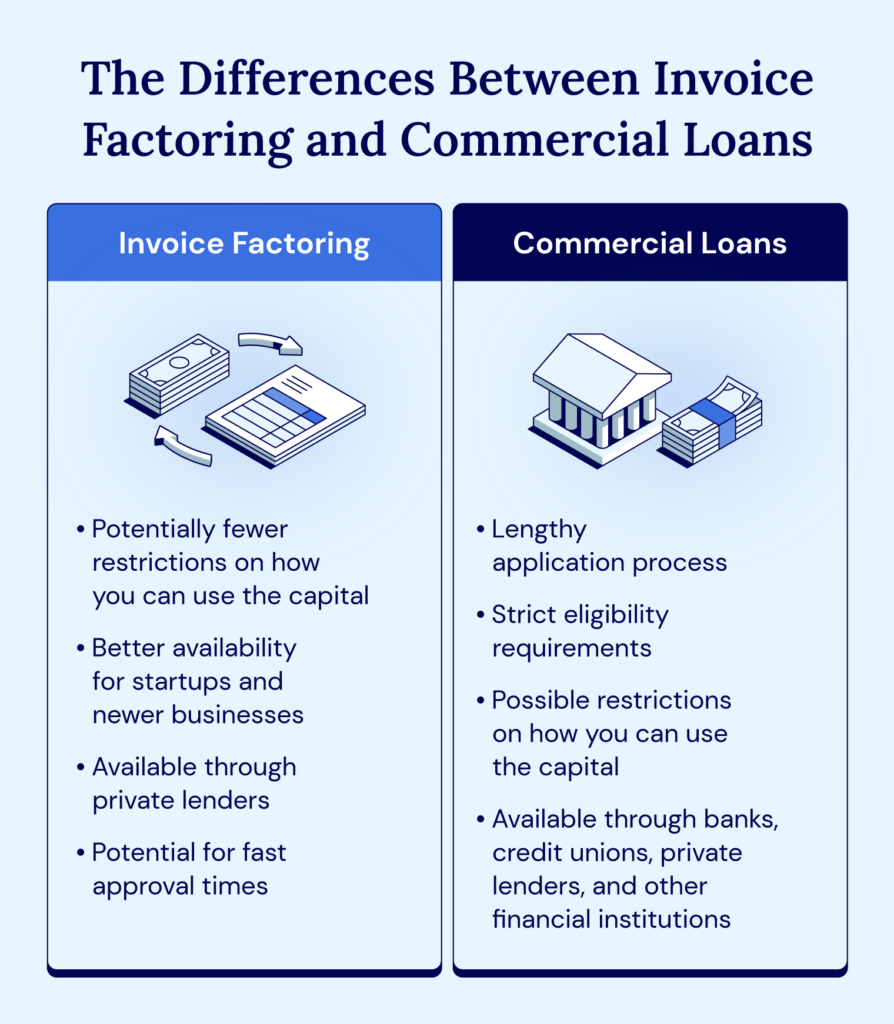

Factoring is a flexible way to inject your business into the capital it needs to thrive. However, getting a business loan may be a better option, especially if you need access to a lot of capital.

How to choose the best invoice factoring company

The factoring company may consider whether to purchase an invoice. You have the right to choose which factoring company to work with. Each company works slightly differently, but there are a few things you need to consider when looking for a factoring partner:

- Company knowledge about your business model: Choose a factoring company with experienced industry experts Work with businesses like you. In this way, they will Have a better understanding of how financing terms flow in your business model.

- Company fees: Please note that you are considering the fees for each fee-based agency that charges their services. Compare the factoring firms that offer the lowest fees if possible.

- Company’s responsiveness: The best factoring companies should be able to respond quickly to your concerns and help you get the funds you need as soon as possible. When you start searching and prioritizing people who respond quickly, be aware of the company’s responsiveness.

- Company flexibility with terms: Some freight companies require you to sign a contract and set a minimum number of invoices they are willing to consider. Consider the terms of each company and choose a company with terms that meet your needs.

Try to pay attention to how each breakdown company’s services will be integrated into your business. If a company feels too restrictive, responds too slowly, or does not have experience working with a business like you, choose another company.

Alternatives to invoice breakdown

Invoice factoring is not your only option when you get access to capital. There are several alternatives you may want to consider:

- Commercial loans: Commercial loans is a form of financing that provides opportunities for capital access through external lenders. You can use them for most business expenses.

- Small Business Loans: SBA Loan is a financing option supported by the Small Business Administration and is designed to help small businesses with potential credit and corporate history Eligible for financing.

- Credit limit: These Credit limit Allows you to borrow money from your lender for business purposes. They function similarly to credit cards and allow you to borrow your credit limit and repay content that you borrowed multiple times. You only need to pay interest on the amount used.

Talk to your lender to see which options are best for your business needs based on your goals and current financial situation.

Invoice factoring is just an option

Invoice breakdown enables your business to Borrow your accounts receivable No Spend weeks of applying with a lender and negotiation the term. Once invoices are taken into account, you will get the capital you need with a one-time payment to help you invest in your business immediately.