What is a term loan? Complete Guide (2025)

Ensure that the right financing can create or disrupt business. Whether you are buying equipment, expanding operations or managing cash flow, term loans offer a structured way to borrow and repay over time.

For businesses that require a one-time payment, term loans provide clear funding channels. But how do they work, and what should you consider before applying?

This guide breaks down the essentials – the type of business loan, repayment structure, qualification factors and how to choose the right choice for your business.

Table of contents

What is a term loan for a business?

Term loans provide businesses with one-time capital and repaid interest over a fixed period. Companies often use this type of financing for one-time one-time expenditures. It plays a crucial role in growing businesses, capital investment and improving operational capabilities.

This loan structure is also referred to as a “term” simply, allowing businesses to make regular payments within a predetermined time frame. Predictable repayment schedules make it a popular choice for companies looking to do Manage cash flow At the same time, fund growth.

Under this loan structure, the borrower will receive funds in advance and pay in installments. bank, Private lenderand other financial institutions based on credit, loan size and Commercial loan interest rate.

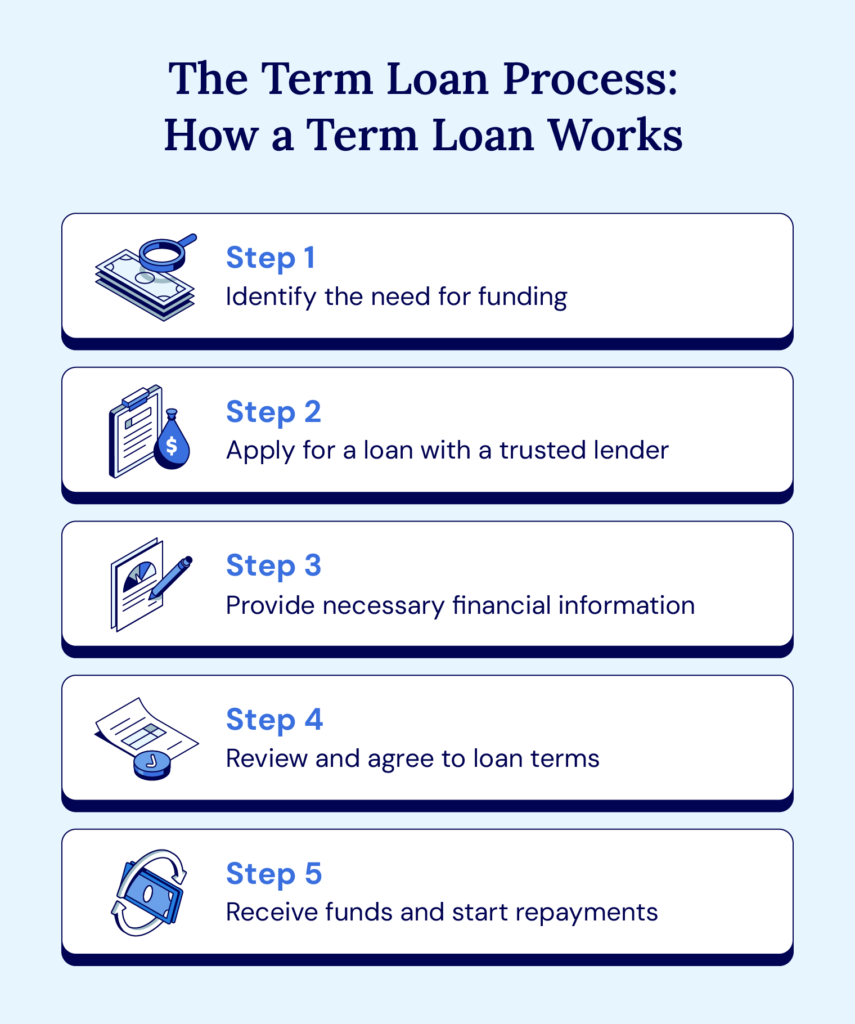

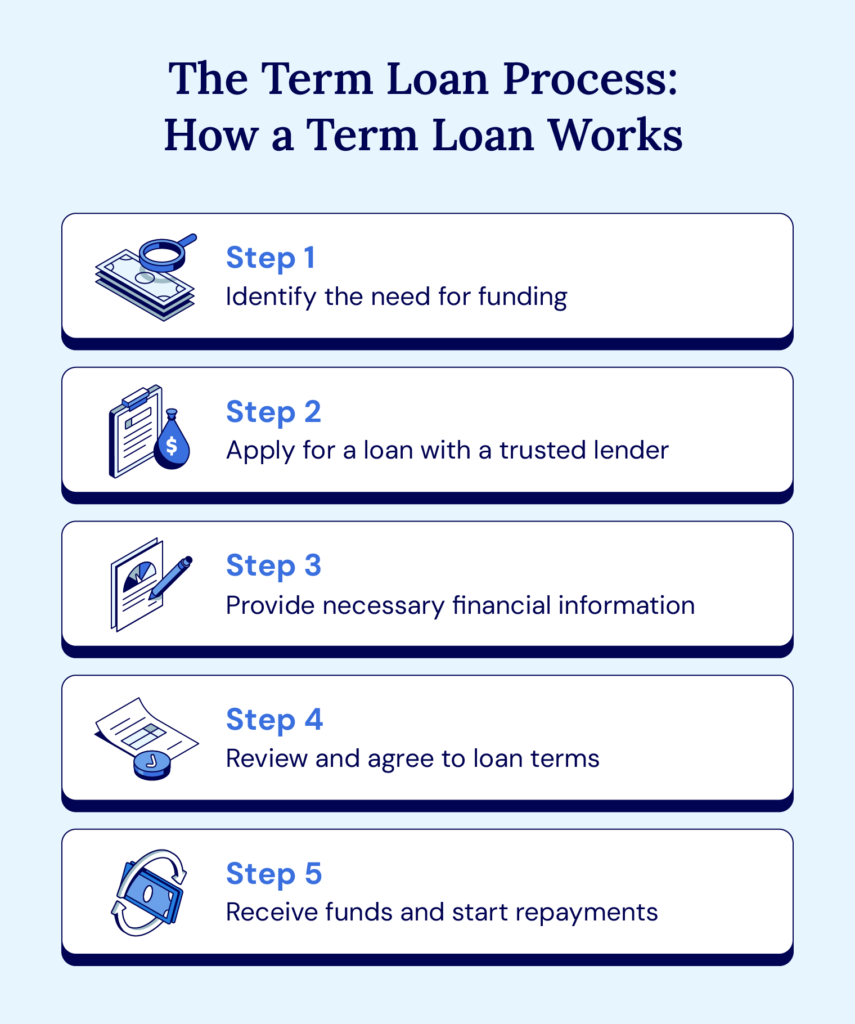

How does term loan work?

Term loans provide a one-time capital for the business that repays it in fixed installments over a set period, including interest.

To obtain a term loan, a business must first determine its funding needs and then apply through a bank, credit union, or private credit lender. The application process requires detailed information such as the purpose of the loan, the amount required, and financial records. The lender uses this information and a credit check to assess risk before approving the loan. However, many lenders make soft credit approval applications. It is crucial to ask questions about credit checks in advance to avoid being surprised by the credit inquiries you don’t expect.

Once approved, the lender issued a loan agreement outlining the key terms, including repayment schedule, interest rates and fees. Once signed, the borrower will receive funds and start making the scheduled payment.

How long does it take to get a semester loan?

Depending on the repayment period, term loans can be short-term, medium- or long-term:

- short term Business loans usually last less than a year.

- Medium term Commercial loans take between one and five years.

- long Business loans were extended for five years.

From covering cash flow gaps to massive expansion in financing, each option can meet different business needs.

learn Different types of term loans Help the business make the right decision.

What are the examples of term loans?

A powerful Example of litigation term loan It is a resort company that received $1.1 million to solve a common infrastructure problem.

Each winter, a key bridge to its property destroys and limits access to the active space, with over $100,000 in annual maintenance. This ongoing fee creates cash flow challenges and limits growth opportunities.

The resort cannot provide traditional lenders asking for collateral, but they received funds in just two weeks Alternative financing. Loans allow them to permanently rebuild bridges, eliminate repair costs and open up new revenue streams.

This case study illustrates how term loans provide capital to businesses to overcome financial barriers and facilitate long-term success.

Why term loans are right for your business

Term loans can be a strategic solution for businesses that want to fund major spending while maintaining cash flow stability.

Whether you need capital to invest in new equipment, expand operations or pay unforeseen costs, business offers structured financing term loans, predictable payments – making budgets easier and growth more achievable.

With flexible terms, a team of expert business consultants, and a simplified approval process, it is not complicated to obtain term loans from state commercial capital.

Start your Application for a term loan Today, explore tailor-made financing options.