This trend is of great significance to the complete retirement age of social security – Retirement Research Center

New data show a strong relationship between income and life expectancy.

As part of a review of the recent proposal, Social Security Actuaries provide another contribution to the broad evidence over time. This model is crucial when considering the gradual rate of the Social Security program and any proposals to increase the full retirement age of the program.

The figures released by Social Security are based on records of all workers, rather than sampling the population like most other studies, but are not as spectacular as the results reported by other researchers for several reasons. First, these calculations exclude all workers who receive benefits under the disability insurance plan – a low-income population with lower life expectancy, and they will reduce their estimates by more than one-fifth. Second, unlike early studies, these figures are related to life expectancy at 62 years. Eliminating those who die between the ages of 50 and 62 will generally create healthier groups. Despite these positive biases, the pattern was retained (see Table 1). Life expectancy increases systematically with income, and the gap is widening.

This model is of great significance to the gradual nature of the social security system. A key goal of the program is to redistribute income from high-income people to low-income people by gradually replacing the higher percentage of low-income percentages. The life expectancy gap has undermined this effort, as low-income earners receive 10 years less benefits than higher-income earners.

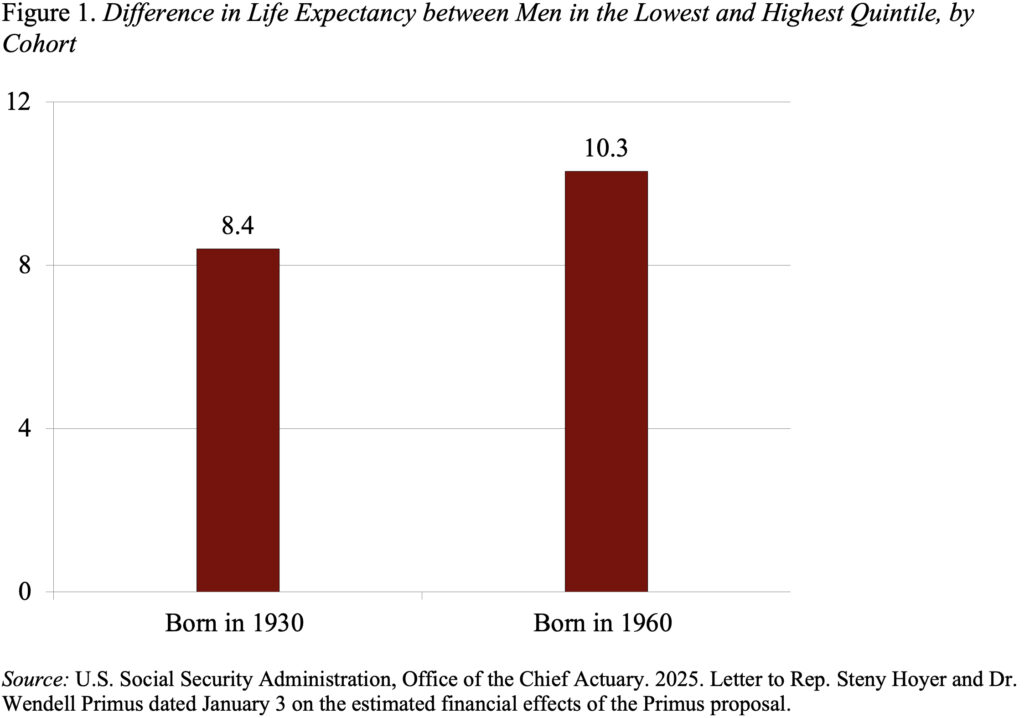

The relationship between life expectancy and benefits is also of great significance to the proposed proposal to increase the entire retirement age in response to the overall growth of overall life expectancy. Yes, the overall life expectancy has risen overall, from 18.1 years of men born in 1930 to 1960. However, the top 20% grew more than twice as much as the lowest 20% men. These two groups have increased so that the highest male is now 10 years longer than the male at the bottom (see Figure 1). That is to say, the bottom-level men in the distribution of income are expected to live about 77 years, while the top-level men are expected to live in 88.

Due to this huge difference in life expectancy, I really like Wendell Primus’ proposal to raise the full retirement age only for those who can really work longer. According to the actuary’s score, only the top 20% of each cohort had their retirement age increased to 70, gradually phased over time. Those who earn less than 60% will not change. For those who earn between 60% and 80%, there will be an increase.

This wise change will not only eliminate 16% of the 75-year deficit, but it can also restore some powers to the progressive welfare formula by helping balance the period when low-income earners get benefits.

The problem that still exists in my mind is related to the mechanism. People need to warn them of age at which they can claim full benefit. If the expected lifetime income calculation is completed at the age of 50, will this provide an accurate projection? Would it be better to be 55? Which type of workers may have been misled? The proposal requires some effort, but hopefully.

Source link