President Trump should combine tax cuts with repairing social security – Retirement Research Center

It would be a good fiscal policy, I bet good politics.

This is the plan. The president has linked two budget projects, which may be a good idea. He wants to expand his 2017 Tax Cuts and Jobs Act and offer some other tax breaks that we need to address. The link between tax cuts and social security exists because a proposal in President Trump’s new proposal would exempt social security benefits under federal income tax. Since welfare taxes now account for 4% of Social Security income, tax exemptions will worsen the financial situation of the program and increase pressure to quickly resolve the problem.

My plan is to combine the president’s tax cut proposal with a package to eliminate the 75-year social security deficit. The program cannot solve all the problems in the world, but it will avoid making our financial situation more terrifying than it is now.

According to the Congressional Budget Office, the government currently plans to make up 6.2% of GDP in 2025. Without corrective measures, a deficit of approximately this size will continue throughout the forecast period of the CBO (see Figure 1).

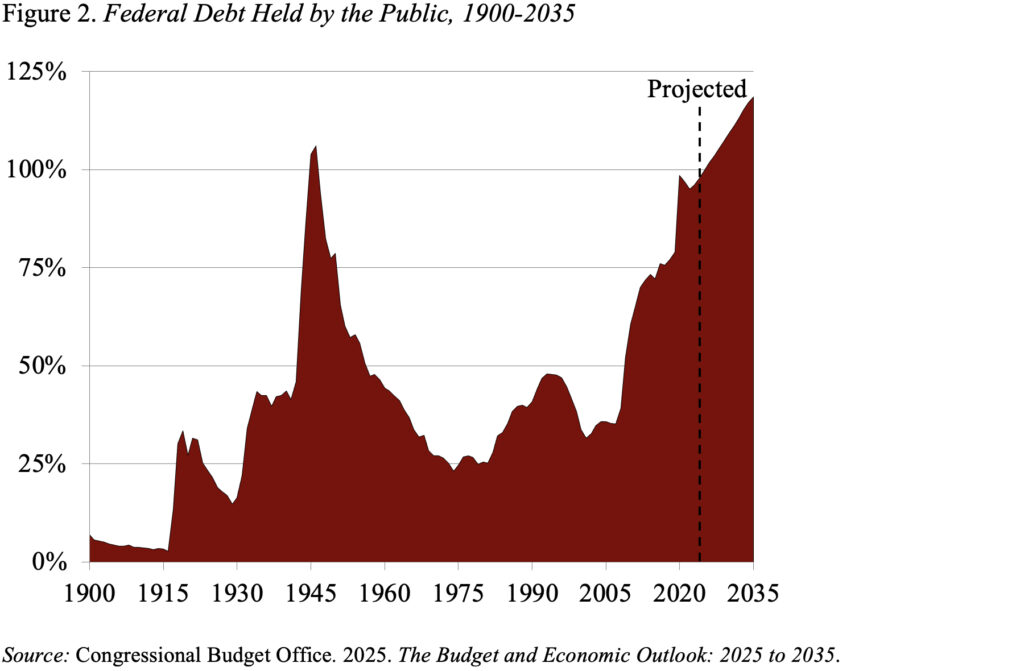

Debt inflation due to these ongoing deficits. Federal debt control has risen from 100% of GDP this year to 118% of GDP in 2035, which is greater than any moment in our country’s history (see Figure 2).

Now this is an important point. These CBO forecasts assume that “management of taxes and expenditures usually remains the same” law. The assumption means that most of the tax cuts under the 2017 Tax Cuts and Employment Act expired at the end of 2025. If not 1.2% higher And debt will surge further. The CBO forecast also assumes that no measures have been taken to address Social Security. If Congress does enact a package to eliminate the 75-year social security deficit, then the budget deficit will 1.2% of the lower GDP.

Just make it clear – expand tax cuts in 2017 Alone It will make the fiscal situation worse than the current forecast; expanding these tax cuts and addressing Social Security will not cause any harm. In other words, software packages addressing Social Security can be seen as “salary” for expanding tax cuts – no deficit is expected to increase.

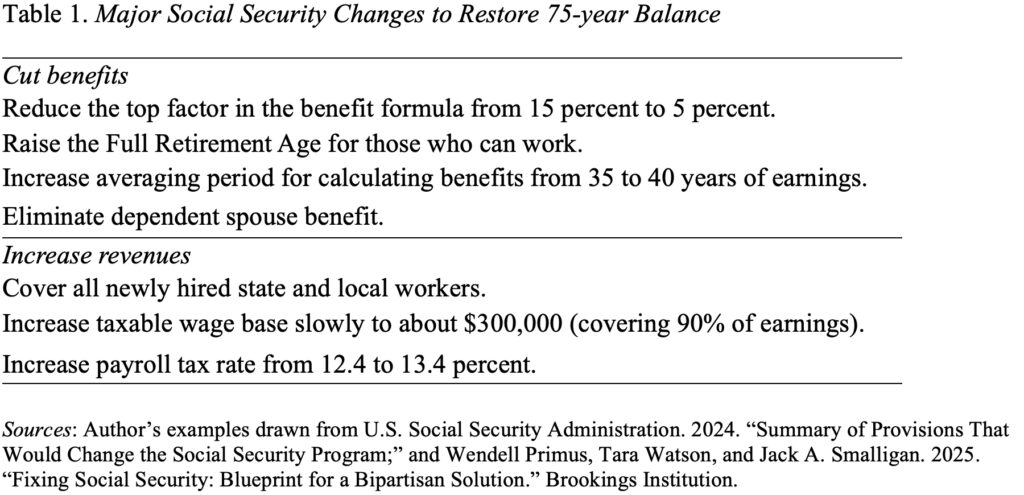

Since the president seems to be eager to change taxes through Congress, here are some fairly simple and scrutinized changes that can restore the balance of social security – roughly equally distributed between welfare cuts and income increases (see Table 1). The only new item on the list is the highest factor in reducing the benefits formula, which will reduce benefits slightly for higher earners, as they no longer need to pay income tax on their benefits. Otherwise, this list is a very standard fare.

I’m really old when it comes to federal budgets. I actually think we should pay for any proposal and offset changes in income or expenditure and keep the deficit to a minimum. Apparently, both sides got rid of this simple framework. The proposal here does not address this fundamental failure. All it does is avoid making the situation worse. It also has a nice ring – while tax cuts mainly benefit the rich, restoring social security will help everyone.

Source link