“Update” instead of retirement – Retirement Research Center

In a recent podcast, co-columnist Helen Dennis talked to me about her “renewal” plan, rather than retirement. Dennis and her program co-founder Bernice Bratter, specifically targeting retired or retired working women, have called over 40 groups of women to work together to find satisfaction in their post-work life.

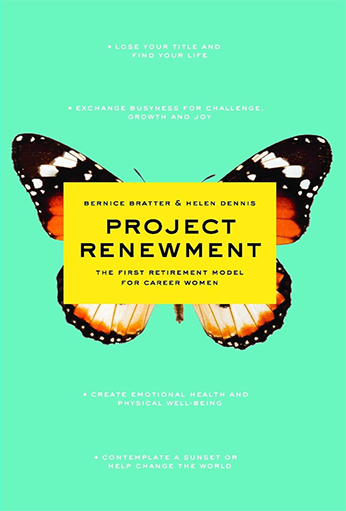

These groups of eight to ten women meet regularly, sometimes for decades to discuss the problems they encountered in their later years. Although each group is autonomous, they are guided by Dennis and Blatt’s books as their guide “Project Update: The First Retirement Model for Professional Women.” It provides tips for discussion, such as:

- I don’t have a business card Who am I?

- What does productivity mean?

- What if my partner retires first?

- What if I’m alone?

New retirement

Dennis explained to me that things have changed a lot in recent decades about retirement. This is the first time we have retired so many women with careers. In addition, the increased life span changes the lives of men and women after work.

“Forty years ago, wishes were different, life expectancy was short. Now, with life expectancy increasing and improving health, people are asking, “What would make me wake up in the morning? “This becomes a moment of personal exploration. “Who will I become in the next 20 or 30 years?” “transparent

Dennis said one of the excellent unexpected consequences of the layoff group is the creation of the community. They do a lot to combat loneliness, which is an epidemic in the United States, especially among the elderly.

Financial security

While all women in all renewal groups have occupations, they are not financially in the same position. Women’s occupations are often less consistent than those of men because they often leave the labor force when raising families. As a result, they may make less money than men and save less money now.

While the group didn’t talk about the unwaveringness of money, they did discuss the implications of financial security. This is the cornerstone of renewal. “If you can hardly survive, can’t meet rent or pay for medications, you won’t really consider what exactly will be.”

Finances will also arise when discussing the costs of health care and long-term care, and who will be there to serve them when they need care.

Dennis commented that retirement wasn’t affordable either 40 years ago, in large part due to rising costs, especially healthcare. Now we live longer and most people don’t have traditional pension plans. They are worried about running out of money.

Many participants continue to work to some extent for economic reasons and purposes. Some are working but not paid.

Racial Difference

I asked Helen if she saw any racial differences in retirement. She is indeed largely due to financial differences. “Black American workers [tend to] Financial retirement security is low. “The opportunity for renewal is not necessarily provided by all Americans. “Economic pressure can easily become a top priority. You are worried that you can’t give what your grandchildren want to give. “But she also sees many non-white retirees taking care of their grandchildren, which does have benefits in providing goals and combating loneliness.

suggestion

I ask policy makers and individuals about their advice from all guests. Helen said that in terms of policy, nearly 7 million Americans suffer from Alzheimer’s disease, and we also need funds outside of Medicaid to support families to hire caregivers.

“Three-thirds of Americans aged 85 and older have Alzheimer’s disease. More than 85 cohorts are the fastest growing part of the population. No mathematical genius is needed to see the needs of families for health care. There is no way to pay for home health care. If there is a way to partially fund it, it can make a big difference in addition to Medicaid.”

For individuals who are retired or near retirement, Helen recommends “Assuming your financial situation is well organized, consider retirement as an opportunity to be your best self and be more fulfilled. We have more opportunities than ever before. We just need to Open your heart, look around, be resourceful and take the initiative. Take initiative, take risks, and discover that this may be a time of opportunity.”

Check out project updates here.

For more information about Harry Margolis, check out his risk in Senior Blog and Podcast in the United States. He also answers consumer real estate planning questions at Askharry.info. To stay up to date on the Squared Blog, join our free email list. You will only receive one email per week.

Source link