Why residential commercial real estate looks attractive in 2025

In this episode of the Financial Samurai Podcast, I talk to Ben Miller, Fund rises On his outlook for residential and commercial real estate in 2025.

Click the play button below or head to the episode on Apple or Spotify to listen to my conversation with Ben.

Reasons to be optimistic about residential commercial real estate in 2025

In my post, How would I invest $250,000 today?I talked about why I believe residential commercial real estate offers a compelling investment opportunity in 2025.

Of course, I’m glad to hear Ben’s optimistic take on the subject. As discussed in the podcast, summarized below are four key reasons why Ben is bullish on residential commercial real estate in 2025.

you will notice some skepticism This is how my voice sounded when I questioned certain points in his argument. Since there are no guarantees when investing in risky assets, it’s always wise to identify any potential blind spots.

1) Valuation Differences Between Stocks and Real Estate too wide

The S&P 500’s forward price-to-earnings ratio is about 22 times, well above the historical average forward price-to-earnings ratio of 17 times. Historically, investing in stocks with such high valuations has often resulted in poor returns.

Meanwhile, commercial real estate prices have fallen by more than 20% in the past two years, but the stock market has soared by more than 50%. This wide valuation gap seems unsustainable, especially if mortgage rates start to edge lower.

The chart below caught my attention because it highlights how apartment values have fallen to levels similar to those seen during the global financial crisis. However, the economy and household balance sheets show strength today. This disconnect has me optimistic about residential commercial real estate, as prices have rebounded significantly following the global financial crisis.

Back in 2010, I distinctly remember wanting to start a fund to buy up all the residential real estate in Vallejo, a city 29 miles north of San Francisco that had declared bankruptcy. However, I lacked the funds and connections to make this happen. Today, I can simply invest in a residential commercial real estate fund and receive real estate investments at a significant discount.

2) Inconsistent performance correlations

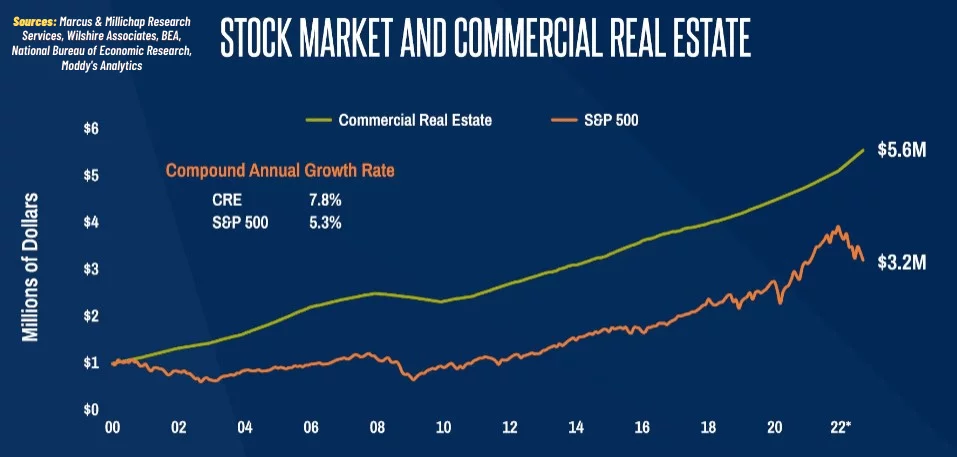

Stocks and commercial real estate have historically been highly correlated because both reflect the broader economy. From 2012 to 2022, their performance has developed in tandem. A healthy economy is good for both asset classes.

However, since 2022, this correlation has been broken, creating opportunities for those who believe in mean reversion. Additionally, real estate could outperform stocks in a potential recession as investors shift to more stable assets.

3) Insufficient housing supply in the future

Rising interest rates since 2022 have caused a significant slowdown in new construction, even in builder-friendly cities like Austin and Houston. Costar said housing starts in Houston are down 97%. Years of stagnant development are setting the stage for a housing undersupply.

Ben, who has a large residential and commercial real estate portfolio, believes the oversupply created by the 2021 construction boom will be absorbed by the end of 2025, if not by mid-2025, faster than many expect. As a result, he expects rents and residential commercial real estate prices to start rising again in late 2025 and beyond. Their portfolio has seen rental growth return.

In the interview, I also laid out my argument that a return to offices will boost commercial real estate in major cities such as New York, San Francisco, Boston, Seattle and Los Angeles, where it is more challenging to build new developments. Ben, however, remains skeptical and points to technological advances as a counterpoint.

4) The risk of accelerated inflation is low

There are widespread concerns that a second Trump term could bring severe inflation. However, the economy was much stronger in 2015, 2016 and 2017 than it is now. However, despite Trump’s strong growth and eventual tax cuts after taking office on January 20, 2017, inflation remained relatively low before the outbreak.

Additionally, Trump pledged to fight inflation during his campaign, suggesting he is unlikely to pursue policies that could exacerbate inflation.

Demographics also point to a long-term deflationary trend. As U.S. birth rates decline, slower population growth could put downward pressure on inflation.

Long-term investment in commercial real estate

As a value investor, I’m always looking for a disconnect between historical performance and valuation. Many personal finance enthusiasts may share this mindset, as we tend to be more frugal and cost-conscious.

Through 2025, I would prefer to allocate more new investment dollars to undervalued residential commercial real estate rather than expensive stocks. After the S&P 500’s strong performances in 2023 and 2024, it’s hard to imagine the index delivering big returns again in 2025.

So far I have invested about $300,000 Fund risesa trusted partner and long-term sponsor of Financial Samurai. With a minimum investment of just $10, dollar-cost averaging in commercial real estate has never been easier.

To accelerate your journey to financial freedom, join over 60,000 others and subscribe Free Financial Samurai Newsletter. Founded in 2009, Financial Samurai is one of the largest independent personal finance websites.