Do stock holdings reflect increased personal risk appetite or use of target-date funds? – Center for Retirement Research

I suspect most financial assets are in 401(k) plans and most 401(k) holdings are managed by target-date funds, but the data tells a somewhat different story.

When trying to understand people’s risk appetite by looking at the share of stocks in a financial portfolio, I wonder to what extent in the world of 401(k)s that share is all determined by the target-date model of funds. Frankly, my previous view was that, except for the very wealthy, most household financial assets were in 401(k) plans, and most 401(k) assets were in target-date funds. However, it’s always useful to look at some data. As it turns out, my scenario isn’t exactly where we are now, but it probably describes where we’re heading.

The idea isn’t crazy, since the 2020s represent the first time workers can live out their entire careers under the protection of a 401(k) plan. In fact, only about 16% of households approaching retirement in 2022 rely primarily on defined benefit plans (see Figure 1). This evolution suggests that most retirement savings may now be held in a 401(k) or individual retirement account (IRA).

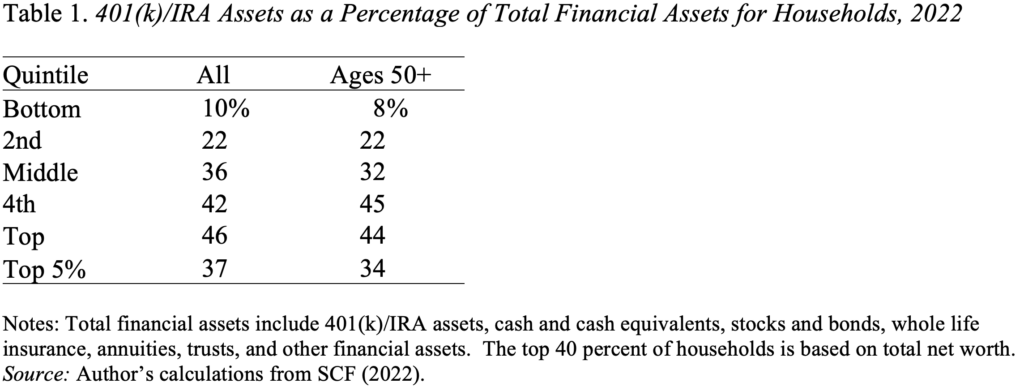

So, the question is, what is the 401(k)/IRA balance as a percentage of financial assets? Percentage breakdown by net worth quintile in 2022 shows that for the top two quintiles (the top 40% holding the majority of 401(k) assets), retirement assets represent approximately 45% of total financial assets (See Table 1). The top 5% reduce the share of the entire top quintile because they hold large amounts of non-retirement assets. However, this percentage is much lower than I assumed.

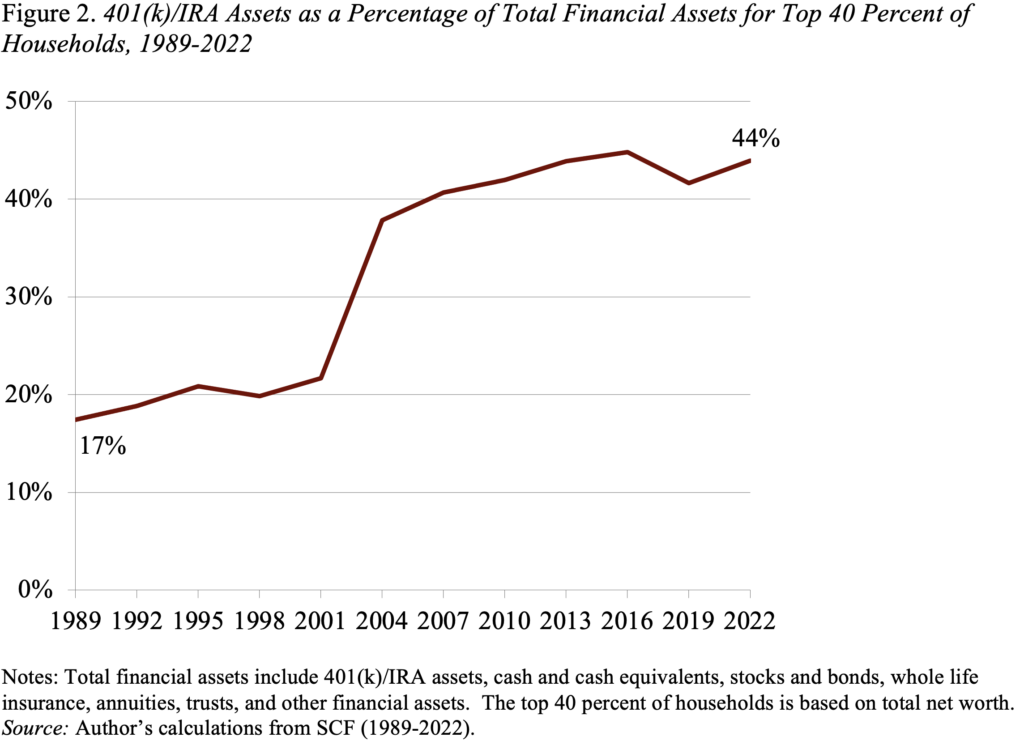

If it’s not exactly what I thought it was, are we at least moving in that direction? In fact, this percentage has increased dramatically over time, although it is not yet clear which direction it is going (see Figure 2).

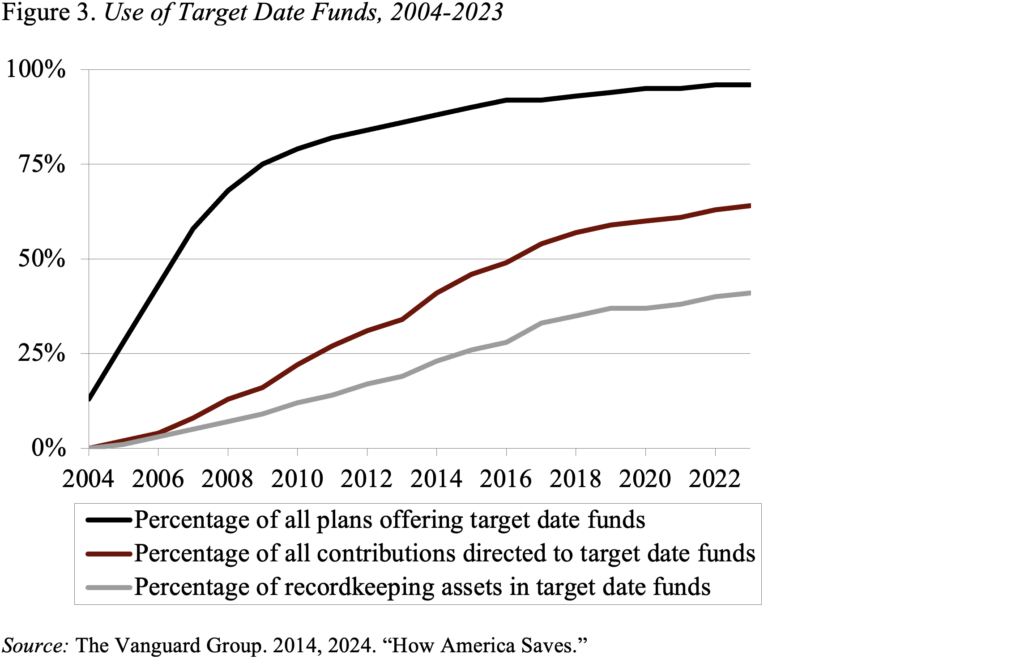

I also seem to be a little ahead of the curve when it comes to the role of target-date funds (TDFs) within a 401(k) (funds that automatically reduce equity holdings as participants age). This significant change is not surprising given that the Pension Protection Act of 2006 allows plan sponsors to automatically enroll employees using TDFs as preset investments. Since then, the percentage offered by plans, the percentage of directed contributions, and the percentage of assets in TDFs have all grown rapidly (see Figure 3).

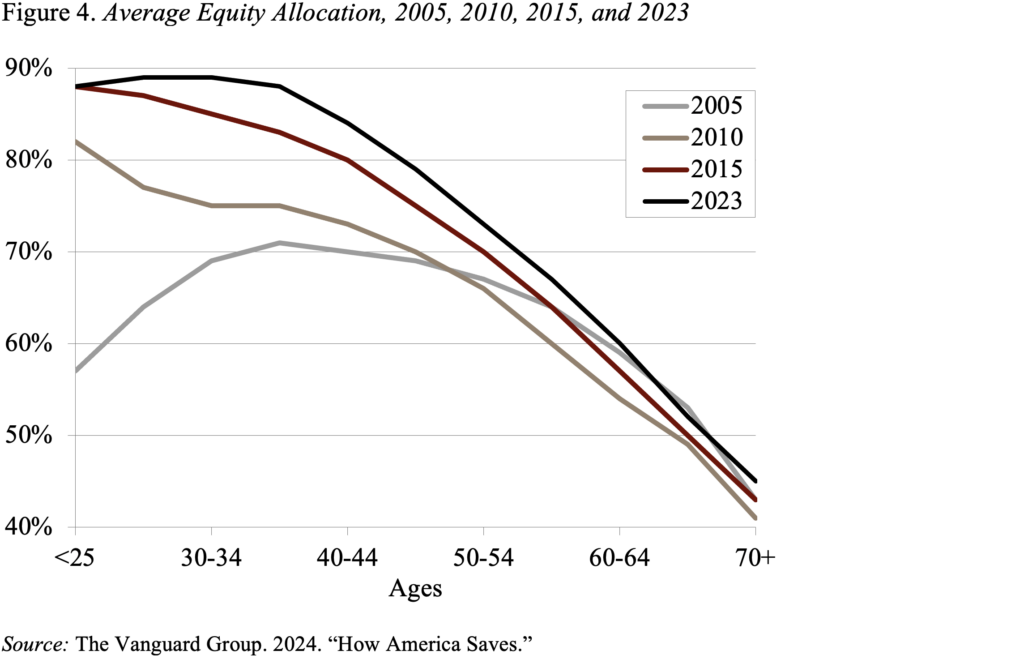

TDF investing changes asset allocation and increases stock holdings (see Figure 4). In 2005, stock allocations were in the shape of a hump; younger participants were more conservative, middle-aged participants held the most stocks, and older participants reduced their holdings significantly. In 2023, the shareholding allocation for participants decreases by age, starting at 88% for younger workers, falling to 73% for those aged 50-54, and then to 45% for workers over 70. Not only are the patterns vastly different, but the share of 401(k) assets in stocks has also increased significantly.

So, the story is not as clear as I thought. For those in the top 40% of the wealth distribution, retirement assets only account for about 45% of total assets, and this ratio appears to be stable. The importance of target date funding in a 401(k) plan has increased over time and may become even more important in the future. On the other hand, people tend to move assets from a 401(k) plan into an IRA and possibly change their distributions. So I guess people exercise more discretion over the stocks they own than I thought.

Source link